We "print" money so time. It's called "cryptocurrency".

Curated Tumblr

For preserving the least toxic and most culturally relevant Tumblr heritage posts.

The best transcribed post each week will be pinned and receive a random bitmap of a trophy superimposed with the author's username and a personalized message. Here are some OCR tools to assist you in your endeavors:

-

FOSS Android Recs per u/[email protected]: 1 , 2

Don't be mean. I promise to do my best to judge that fairly.

I mean...

We could just... Eat. The. Rich.

The US has such a huge pool of people using the dollar that when they do seigniorage they're essentially taxing the world instead of only their citizens. It's kind of obscene and why the imperialists are very hostile to BRICs.

Price of gold goes Brrrrrrrrrrrrrrrtrtrtttrtrtttrrtrrtrtrttrr

She's not totally wrong

If we gave every American 1 billion dollars the current billionaires would lose massive amounts of power and it would help fix wealth inequality.

It would do nothing to wealth inequality. The assets the current billionaires own would just become valued at a trillion dollars, or even a quadrillion depending on how badly devalued the dollar became.

If they had their money scrooge mcduck style. But the assets they own will explode in value almost proportionally to the value of the dollar

Oh yeah they would also need to be forcibly stripped of their assets

I thought that went without saying

Hah, well I'll go to this strip club.

That wouldn't work because the bilionaires don't have money, they have assets, AKA capital.

Do that and get ready for 100,000 dollars for a dozen eggs cause the market will charge what it knows the customer can pay.

That's the point.

The poorer groups will pay the same amount of their wealth proportionally for things, but the proportional wealth of the rich will be dimished.

this could be one of those bell curve memes where the low end and high end are the moron/jedi guys saying “just print more money” and the middle of curve has a freshman Econ student trying to explain macroeconomics.

Very good observation. On the high end of that bell curve, there's Modern Monetary Theory (MMT): https://en.wikipedia.org/wiki/Modern_monetary_theory

Yeah, exactly what I was thinking. Like, it isn't quite as simple as "print $1m for everyone and they can all go out and buy Ferraris." But, there are plenty of situations where the government can just print the money and it won't cause inflation or any other harmful effects.

There's a line from (I think) a Tyler Perry movie that goes "The only thing reparations will do is make Cadillac the best selling car in the country."

The funny irony is that because money is mostly made up bullshit anyway, we kinda could just decide to print more money and keep its value. Granted, it would take the unanimous agreement of basically everyone on this silly little planet, so the chances of this ever occurring are effectively absolute zero, but still, there is no actual rule that says we cant except for the ones we ourselves created

To be fair, Economics is half imagination and magic. It’s why something like bitcoin could even become a thing.

One of the main things I learned during my economics degree is that money is fake.

To quote Brian Brushwood, "It's just pieces of paper that we believe in."

Printing more money and using it for public works or giving it directly to the poor could be a valid form of wealth redistribution that doesn't require collecting taxes. The problem of course is capital, it's immune to this kind of inflation, though rich people who have their wealth in debt would be hurt.

though rich people who have their wealth in debt would be hurt

Aren't the big loans interest rates tied to inflation though?

Directly. Yes.

All government spending is done by "printing money", at least in monetary sovereign countries like the US, UK, and other countries issuing their own cureencies. The government is the monopoly issuer of the currency and cannot run out of it, just like the scorekeeper of a baseball match cannot run out of points. Taxes are also not for funding the government, but for removing momey from circulation, precisely to curb inflation. (Also to drive the value of the currency by making people demand it to be able to pay their taxes). Thus "printing money" isn't in itself inflationary, as long as the newly created money is spent on something where there is excess production capacity. The question for the government is never "can we afford it", but rather "are the real resources there to achieve it".

I think the problem isn’t that there is a lack of money which could be solved by printing more, but that there is a lack of money because like 6 guys have stolen most of it and piled it up under their mattresses with no intention of actually using it at any point.

Prices should be set by the king tho, the only acceptable rate of inflation is zero.

Humans do make the rules, unfortunately only some of them get the chance to so they made the rules favor themselves.

So here is how it works (in the USA):

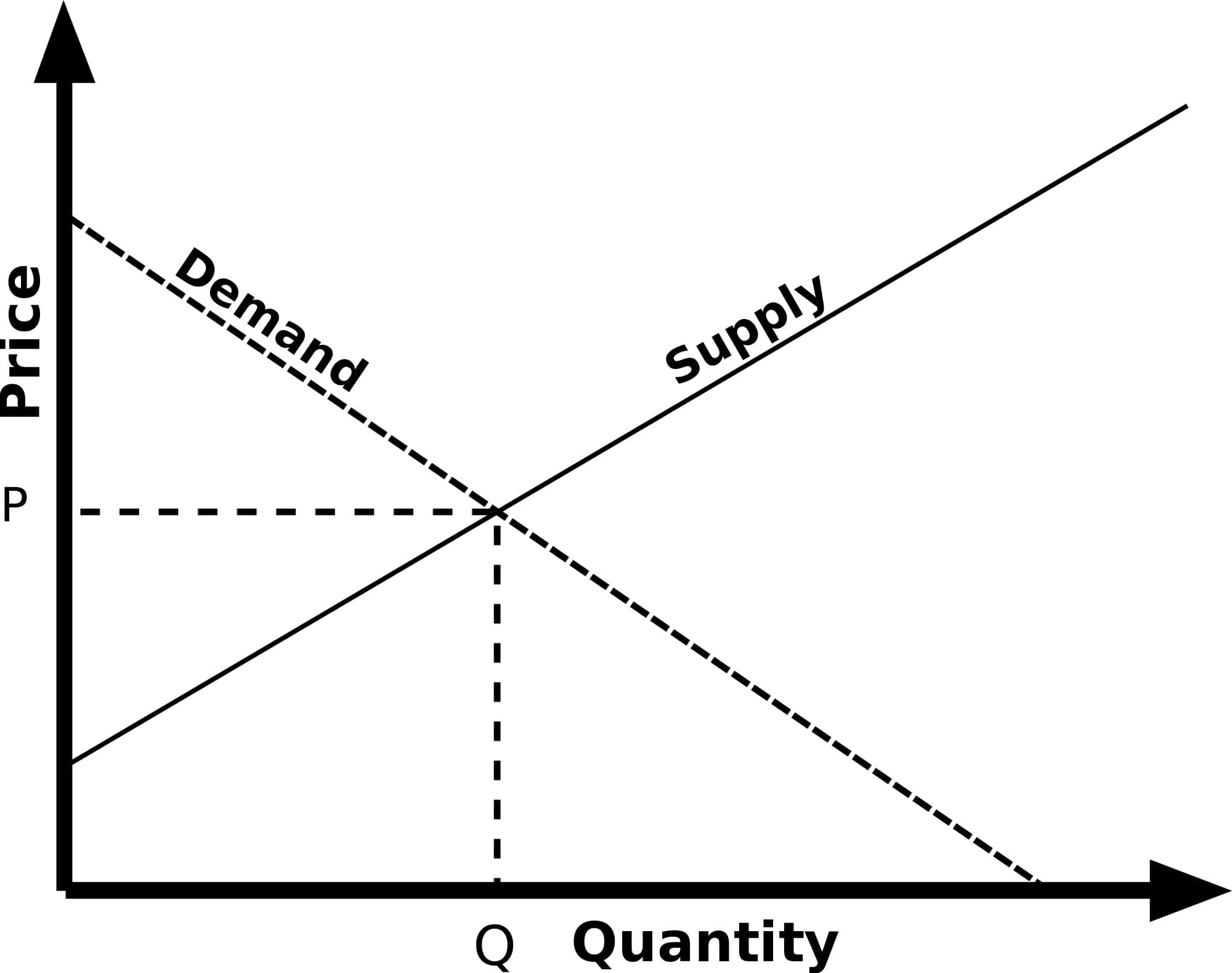

Prices of goods on a market are set by Supply:Demand Equilibrium

If a business knows they can charge more for a good or service and still sell enough to get more profit than selling them all quickly and cheaply, then they have to calculate what to sell at to optimize profits.

You can chart out the supply and the demand as a function of price with inverse correlation at varying strengths, *implying that supply will change to meet market demand so long as enough capable workforce exists to accomplish it.

Now apply this concept to Money.

If Money is plentiful and people are more willing to spend money on goods and services, then the providers of those goods and services will raise the prices to maximize the gains. In this example the regulatory bodies might use Bonds to reclaim and retire money and/or use a variety of techniques targeting loan interest rates in various ways to limit the *creation of money.

If Money is Scarce, then the prices will lower until they reach a threshold at which A) it cannot be produced for cheaper or B) somebody somewhere needs it and therefor will pay the price no matter how comparatively steep. Since these two scenarios are generally quite bad in the context of unnecessary human suffering, unprofitable goods and service industries generally receive subsidies so that regulatory bodies can keep a steady calculated amount of necessary supplies available to citizens far into the future, examples give: food, medicine, hygiene, or housing.

This also has an effect on exchange rates for trade partners. You can set a price on money. If your money is more valuable than another country's money as a result of their willingness to purchase that money as an investment, then it makes sense to trade and buy up their cheap goods. The USA's financial system is built around this concept of lending to struggling economies and providing data-heavy telecommunications services, built on the back of their decades of leading the pack for telecommunications technology and their leadership roles in many trade organizations including World Bank headquartered in Washington DC. Basically, the value of USD is dependent on investors in the EU and China owning US Treasury Bonds.

So it becomes obvious to most of us that creation of money can oftentimes be beneficial, but it also devalues savings and bonds, so it's often thought a delicate balance is needed to maintain value.

-

*implying - it's not always true that supply reflects demand in the same way that demand relies on supply, many modern economic theories revolve around the idea that Supply has much more power and therefor regulatory actions which focus on supply are more effective fiscal policies.

-

*creation of money - Loans create money. If you lend 100 dollars at 5% interest then you get back 105 dollars. While the debt is yet to be repaid, that 5 dollars exists. Debts can be traded as well. At first it doesn't seem like it would add up to much, but in fact Bonds act as Debts and also large Loans are very very very common for the USA, and this all sort of stacks year after year until it's reached the current point where the majority of USD is non-M1 M2 which is to say money that doesn't physically exist: digital money and promissory notes.

Theres a lot more but I can't be asked to teach economics.

It's not particularly difficult to fix the economy.

Make a law. This law will require the head of the IRS go to the richest person in the country, and give them the option of writing a check large enough that they are knocked out of the top 1%, or playing a round of Russian Roulette.

Repeat every month, and the problems of wealth disparity will be solved in about a year.

The problem here is that a government does not in fact have the ability to decide how much their currency is valued, they can only indirectly influence it. When they try to pretend like it's just a "rule" they can set like "here is the mandated exchange rate, we'll put you in jail if you make trades at any other price" is when things get real stupid.

just declare the leaf to be the official currency ... from one of the books in "The hitchhikers guide to the Galaxy" ... which is, you should know, the only trilogy in five books.

Have you peeps never heard of modern monetary theory (mmt)? Macroeconomics is not so simple! Most people talking about have the knowledge of a minor in business econ though