If its "technically a ... check", and it has account number and routing numbers on it, and you're passing it off as a check, and its not a check, that's call Check Fraud and the Federal Trade Commission will be interested in you very soon.

InsanePeopleFacebook

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

Also, they are not required to accept a non-standard check (at least in America where this SovCit probably is) and have not had to for decades. People have done things like carve a check to the IRS into a boulder and the U.S. government got sick and tired of it.

Well, I think the US Government has to accept those weird checks, as do banks. There's 7 or 8 check components. Technically, I don't think your name or the bank's name is necessary. The routing number and account number will probably find you.

https://www.nerdwallet.com/article/banking/understanding-the-parts-of-a-check

That doesn't mean the bank won't close your account after you deposit your rock or potato or whatever.

MICR refers to the formulation of magnetic toner or ink used to print the special font at the bottom of checks. Different from regular ink or laser toner, MICR ink and toner contain magnetic iron oxide, a requirement of the Federal Reserve, making check-clearing a more efficient process.

...

According to the Federal Reserve and the Accredited Standards Committee, X9 Inc. for financial industry standards, a check must contain MICR for it to be treated as a cash item.

If your business is currently printing its own checks, you must use proper MICR toner or ink to ensure they are compliant with the processing procedures of the banking system.

https://www.sourcetech.com/blog/why-micr-line-required-checks

It's not required to have special ink. You can just print checks at home. You are posting something from a company that sells the special printers. Banks accept checks with regular ink (from cheap companies) all the time.

Do I need to use magnetic ink or toner when printing checks?

To process checks, banks' automated check sorting equipment relies on numeric information that appears at the bottom of checks and is printed in magnetic ink. This information is known as the check's magnetic ink character recognition line, or MICR line, and contains information such as the routing number of the bank on which the check is drawn, the account number on which the check is drawn, and the check serial number. Generally applicable industry standards for original checks long have required the MICR line to be printed in magnetic ink; the need for magnetic ink on original checks is not the result of the Check 21 Act. Only the MICR line of a check must be printed in magnetic ink. The rest of the information on the check, such as the date, the payee name, and the amount, can be printed in regular, non-magnetic ink.

If you make payments by printing checks at home and the checks you use have pre-printed MICR lines, then the rest of the information that you print on the checks need not be in magnetic ink. By contrast, if you must print a check's MICR line because it is not preprinted on the check, you should print the MICR line in magnetic ink.

https://www.federalreserve.gov/paymentsystems/regcc-faq-check21.htm

Yeah, I know about that. I'm just saying that banks will still take the regular ink checks. They just type the numbers in manually when they deposit it. The check reader can't read non-magnetic ink.

They might, but they don't have to. If you bring in a boulder with a checked carved into it and expect them to cash it, they have every right to tell you no.

If that were indeed the case then how come so many banks now take online check deposits with just photos of checks? Just this afternoon I deposited a check via my banks smartphone app. I endorsed the check, took photos of both the front & back, and the app sent them to the bank. In a few days I’ll get an email confirmation that the check was deposited.

You'd have to ask the Federal Reserve. I don't make their rules.

Slacker

I never heard of this! Interesting

Dishonorable, you say?

That's what I was coming in to say. Where do they think they are, the Klingon Empire?

Glad to see I wasn't the only one with that thought. Qapla' !

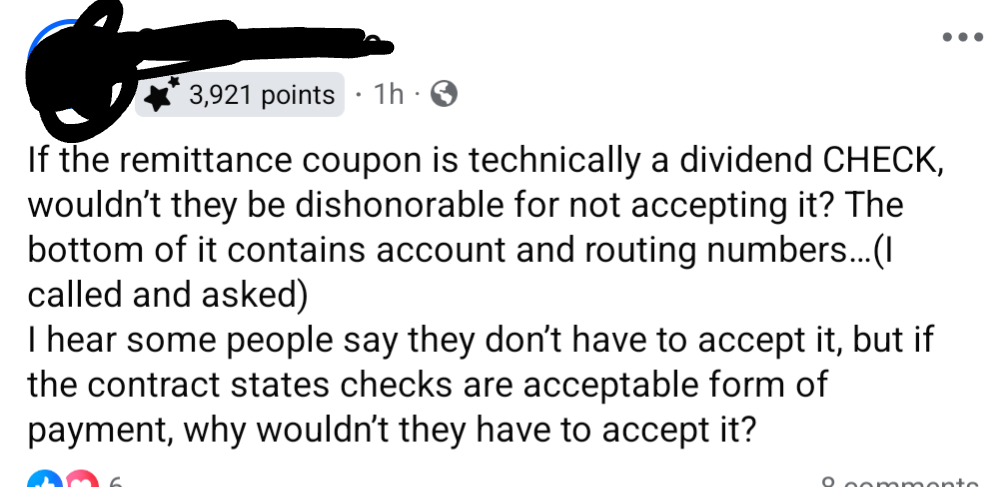

The convoluted logic to get from “this is how much money I owe” to “actually, that’s how much they owe ME” is so wild.

It's like a grown adult who still seriously believes that Santa Claus is real, and genuinely plans their budget around the idea that they'll just ask him to pay all of their bills at the end of the year lol

You mean Christians???? Lol

The world may never know.

...what this guy is talking about.

I think none of them are actually insane. They all know they are attempting a scam and hoping it works. The reason is that absolutely none of them would take a remittance coupon if they were selling something.