this post was submitted on 03 Aug 2024

69 points (98.6% liked)

InsanePeopleFacebook

2695 readers

145 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

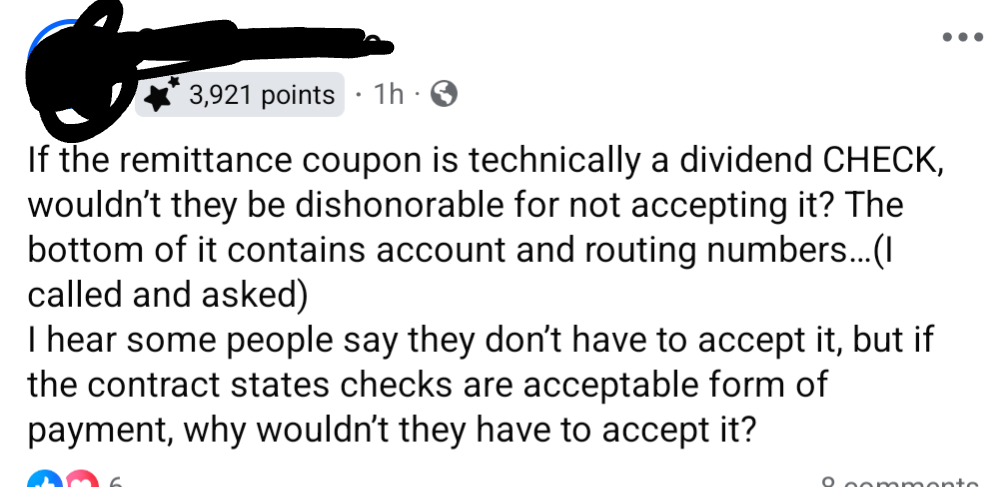

Well, I think the US Government has to accept those weird checks, as do banks. There's 7 or 8 check components. Technically, I don't think your name or the bank's name is necessary. The routing number and account number will probably find you.

https://www.nerdwallet.com/article/banking/understanding-the-parts-of-a-check

That doesn't mean the bank won't close your account after you deposit your rock or potato or whatever.

...

https://www.sourcetech.com/blog/why-micr-line-required-checks

It's not required to have special ink. You can just print checks at home. You are posting something from a company that sells the special printers. Banks accept checks with regular ink (from cheap companies) all the time.

https://www.federalreserve.gov/paymentsystems/regcc-faq-check21.htm

Yeah, I know about that. I'm just saying that banks will still take the regular ink checks. They just type the numbers in manually when they deposit it. The check reader can't read non-magnetic ink.

They might, but they don't have to. If you bring in a boulder with a checked carved into it and expect them to cash it, they have every right to tell you no.

If that were indeed the case then how come so many banks now take online check deposits with just photos of checks? Just this afternoon I deposited a check via my banks smartphone app. I endorsed the check, took photos of both the front & back, and the app sent them to the bank. In a few days I’ll get an email confirmation that the check was deposited.

You'd have to ask the Federal Reserve. I don't make their rules.

Slacker