this post was submitted on 05 Jan 2024

1098 points (96.0% liked)

memes

12950 readers

4830 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

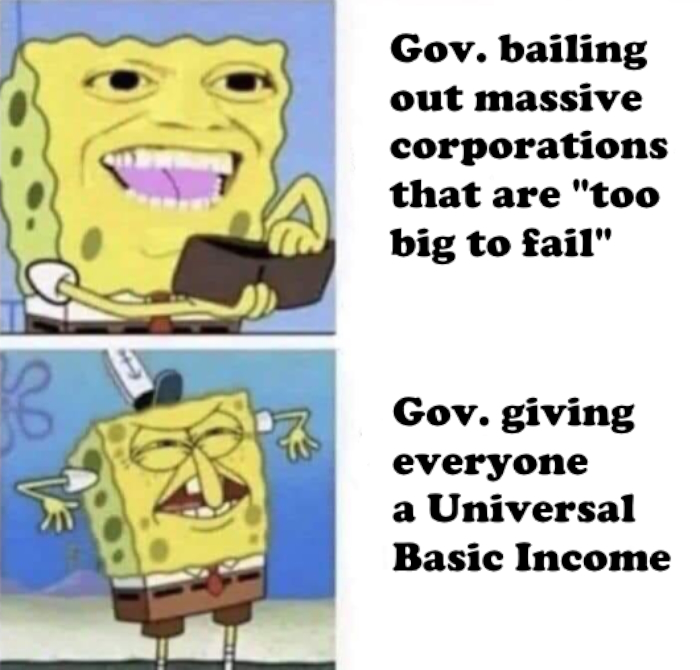

If a company is "too big to fail" the punishment should be that the government bails them out, then breaks it up into smaller parts that are free to fail or succeed naturally without government intervention

Just nationalize them. If the government has to bail them out then then the government just bought them. If a company is too big to fail then it's too big to be privately owned.

That's what they did in my country when a bunch of the big banks almost keeled over in 2008/2009. They were temporarily (partly) owned by the state and eventually bought back their rights to operate as a separate business when things were going better again.

That's actually what the US government did with at least one of our failed companies as well, General Motors.

Should've done it to all the banks and house loan companies too imo.

They also gave GM a 45 billion dollar stock swap and GM never paid it back. They paid back the loan but not the stock swap. Every time I hear people brag about how the government saved GM I wonder what amazing things any company could do with not only 45 billion to play with but the government ensuring that no one could take them down for a year.

Give me 45 billion and the full faith and credit of uncle sam, I will create so many jobs.

I don't want them to be nationalized though, I want them to be able to operate without needing government intervention, basically the exact opposite

Are you just talking about bailouts or regulations in general? Because businesses need to be regulated.

Just bailouts

Let them keep their control of the company, but give shares of the company to the American people who paid to bail them out.

Everyone gets dividends

Nationalize them and turn the former business into a 501:c3. Also fire the entire C-Suite, with cause to prevent any golden parachute payments.

But I was told that the rich leaders take risks!

…right?

Sure they do. With your pension they are bold.

What if we just give every American a portion of the company that we bailed out?

Eventually the average American would own stocks in many different banks.

Eventually the American people will have majority share, at that point we vote on the actions of the bank as if we were the board.

A sovereign fund will be easier to administer. Issuing individual shares to people directly would be an administrative nightmare.

Allow the sovereign fund to acquire the shares, and then we can vote as board members in a national vote, though we'd probably just elect a representative for the fund.

Fuck all this representative bullshit. They never actually represent us.

That sounds like a great plan to have the money squandered.

Maybe the dividend is just applied towards your tax return, that would reduce the complexity of issuing 350k shares. I don't want politicians getting their grubby hands on the money.

That's not something that really works with industries that are zero sum games. You can't have a dozen competing rail companies in a given state because there is only so many paths that a rail system can take, and you need to clear out continuous stretches of land through eminent domain.

If a company provides a vital services and fails, it should be nationalized. If a company does not provide a vital service and fails, it shouldbe allowed to fail and the employees themselves bailed out.

Maybe the government should give the money to the employees and if they feel that the company can make a come back they can invest the money in it. If not they can use the money to move on.

That seems fair. If the powers that be where I work for offered me to invest in the comoany itself I would do that. I bet I would get a better return over an index fund the way business is going. Of course they would find some way to fuck it up and corrupt it.

Not much of a "punishment" to the business to have socialized losses. Oh you've mismanaged your ginormous business and it's going to cause a huge, negative ripple effect on the economy and impact everyone else? Here's some free money, courtesy of working class taxpayers! Also we're going to break you up and place no restrictions on how big you can get so that one of your smaller entities can inevitably get enough market share to be in a position to do the same thing a decade later! Huh? Punishment? Oh... Uh... Don't do that again please, Mr. Business, sir 🥺

Hard to effectively punish entities that feel no pain and are otherwise basically immortal

Best we can really do is mow the grass periodically (which the US gov has been failing to do for a LONG time now, although we're starting to see anti-trust rumblings in the tech industry now thankfully)

It's not the best we can do, though. The best we could do would be for workers to own the means of production.

The best we can realistically do in our current time and place, then

Nah, we could definitely start taking back business thru unions and co-ops

That's what usually happens in Europe. Companies get bailed and either restructured or nationalised. But muh fridoomz!

Mh, not necessarily. After 2009, many banks were just saved and not a lot else changed. Although admittedly, banks too big to fail have special monitoring and are subject to extra harsh rules, but they weren't broken up.

Parex failed, got bailed and nationalised as Citadele. Touche.

I didn't know about that one, thank you. I guess good examples are there, and I'll keep it in mind now :)

or the government should get a significant amount of shares on the company

How do you determine when a company is in this “too big to fail” category, to get access to this program?

How do you draw the lines in that company to fractionate it? Geographically? Randomly?

If a company is about to go bankrupt and congress decides it's too important to let that happen, exactly how it happens currently

That's for business people, lawyers, and politicians to figure out, it's happened multiple times before, look into the breakup of Standard Oil or Bell