this post was submitted on 08 Jul 2024

671 points (96.9% liked)

2meirl4meirl

1196 readers

257 users here now

Memes that are too meirl for /c/meirl.

Rules:

-

Respect the community. If you're not into self-deprecating/dark/suicidal humor then this place isn't for you. Kindly just block and move on. This is just how some of us cope.

-

Respect one another.

-

All titles must begin with 2meirl4meirl. This is for multiple reasons. One is just so you can be lazy with titles but another is so people who aren't into this kind of humor can avoid it.

-

Otherwise just the general no bigotry, no dickishness, no spam, no malice, etc stuff.

Sidebar will be updated when I feel like and considering I'm Sadboi extraordinaire we'll see when that will be.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

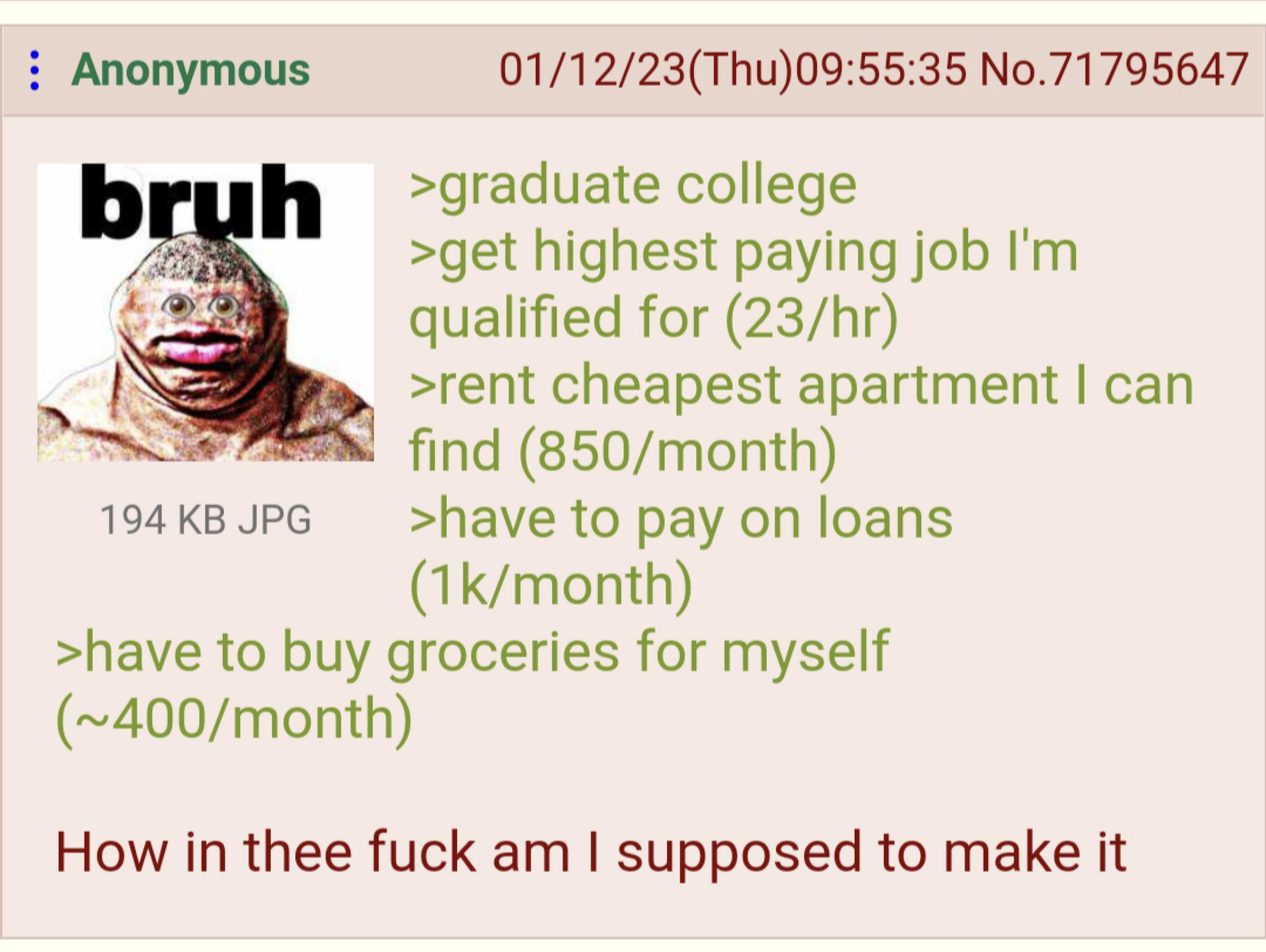

Talk with the student loan provider. Get on income based repayment plans, you end up paying more in the long run, but less each month (or none at all) so you can at least eat.

Is $1k/month student loan repayments in America usual?

This was nearly 20 years ago, but when I dropped out (two years in college, so don't even have a degree), it was all spread across 4 loans (something weird, I dunno, I was a kid, but it was like a new loan for each semester? That didn't even count the parent loans my mom took out for my schooling - thank god they just wrote those off entirely when she died). The repayment ticket book I received was $55 per week for each loan. That was $880 a month they wanted. For about a total of $50k of debt. With the sharp increase in tuition costs since I was in school, I wouldn't be surprised if $1000 total per month is on the low end if you just pay what they ask you to. They don't really tell you that you are taking out multiple loans by going to school, not just one big one.

I did as the above comment said and got on an IDR (Income Driven Repayment) plan, it basically refinanced my 4 loans into 1 and my monthly bill was now $57 a month, and it adjusts each year around tax time based on the previous year's income. I'm currently paying about $80 a month.

That sounds like it sucks, especially to take on when you still don't know what you are doing in life. I am glad you have since sorted it to be lower.

Do you get the same situation over there where interest increases the size of the loan more than you can pay it off with the lower amount now? In the UK most students expect to never pay theirs of before it gets cancelled around retirement age.

Yeah, I don't know about their loan specifically but that's a situation that happens here too.

We've killed the retirement industry and it just hasn't hit yet.

Uhhh... In theory, if you are on one of the IDR plans, it is supposed to work that anything you have not paid off after 10 years gets "forgiven"... But I don't even know if these plans existed 10 years ago, I think the one I am on was an Obama era program. I know there are a lot of government programs that are supposed to "forgive" some amount of the loan, or the entire loan, after a certain amount of time for people working in certain sectors (like teachers or other civil servants) that just aren't actually working. I didn't get on the program right away (I just let them ruin my credit for a decade...), so I'm not 10 years in yet (also because everything was on "pause" during covid from mid 2020 until late 2023, so those 3 years didn't count toward the 10).

There have been news stories of people whose loans were supposed to be forgiven under one of those "civil servant" programs (because apparently we know they are horribly under-paid but instead of fixing that, we just made a program to forgive their massive student debt?) that just didn't. The departments that handle the forgiveness play the "we are short staffed and too backed up, we will get to you eventually" card and they keep receiving bills every month, or they say their records don't agree that they qualify anymore (blah blah whoopsy poopsy, you know how bad the gov't is at keeping records, right?). And since the plans are usually dependent on not missing payments, you have to keep paying or risk losing the status needed for the forgiveness in the first place and/or they absolutely won't forget to ruin your credit and fast.

It is a fucking nightmare all around to be honest. But at least it isn't constantly ruining my credit anymore and I can afford to pay what they want each month without giving up on food or rent.

That's much higher than normal. A quick google suggests between $200-$500 is more in line with a normal student loan monthly payment, which is still a burden on someone just starting out.

Only speaking from my own experience, but that sounds in-line with what the monthly payment is for each loan, but when I came out I had 4 separate loans that they came collecting on.

The IBR plans are aggregated against all your federal loans. So, unless there are some weird private loans in there, that’s the upper limit in sum total based on the income we’re discussing here.

They aren't on an income based repayment currently (or there is no evidence stating they are or aren't I guess), so he would be dealing with all the separate loans sending him bills currently. Definitely needs to get on one though, it would help a lot, more than likely.

If you have any hope at all of keeping the interest from ballooning the principal beyond the original loan amount, yes.

:(

Or do what my cousin did.

Have uncle take out loan entirely under his name.

Make minimum payment on it.

When he dies, the debt dies with him.

How are they taking out education loans in someone else's name? Sounds like fraud.

In the United States, there's a federal loan option called Parent Plus loans that can allow parents to take out loans for their children's education. Private loans could be taken out by just about anyone to pay for a student's education, depending on the institution.

Parent loans are a thing. The parent of the kid takes out the loan, not the kid themselves. And yes, thankfully, they just go away if the parent dies and don't get passed on to the estate.

The educated kind of fraud 🧐

A regular work day for corporations.

mine is like 280/mo, and my wife's is like 175/mo. i think 1k/mo is very unusual

edit Didn't mean to double post the same comment - internet at work sucks :(

My daughter went to one fucking semester and is paying $900/mo for two years. We tried to talk her out of it but she wouldn't hear reason. She's going to go back to school a little wiser next year.

If you pay that much what is the sum of the loan? How much is a semester?

I got through college with no loans. But I had a scholarship for a few years that paid 75% tuition. I ended up taking 7 years to graduate because when the scholarship ran out, I cut back on my class load to work full time as a bookkeeper to pay for my living expenses and tuition. I could've done a lot better if I had gone to a community college for at least the first two years but I got duped by university "prestige". Being in the workforce now, I know employers don't care what school you attended.