this post was submitted on 08 Jul 2024

669 points (96.9% liked)

2meirl4meirl

1068 readers

468 users here now

Memes that are too meirl for /c/meirl.

Rules:

-

Respect the community. If you're not into self-deprecating/dark/suicidal humor then this place isn't for you. Kindly just block and move on. This is just how some of us cope.

-

Respect one another.

-

All titles must begin with 2meirl4meirl. This is for multiple reasons. One is just so you can be lazy with titles but another is so people who aren't into this kind of humor can avoid it.

-

Otherwise just the general no bigotry, no dickishness, no spam, no malice, etc stuff.

Sidebar will be updated when I feel like and considering I'm Sadboi extraordinaire we'll see when that will be.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

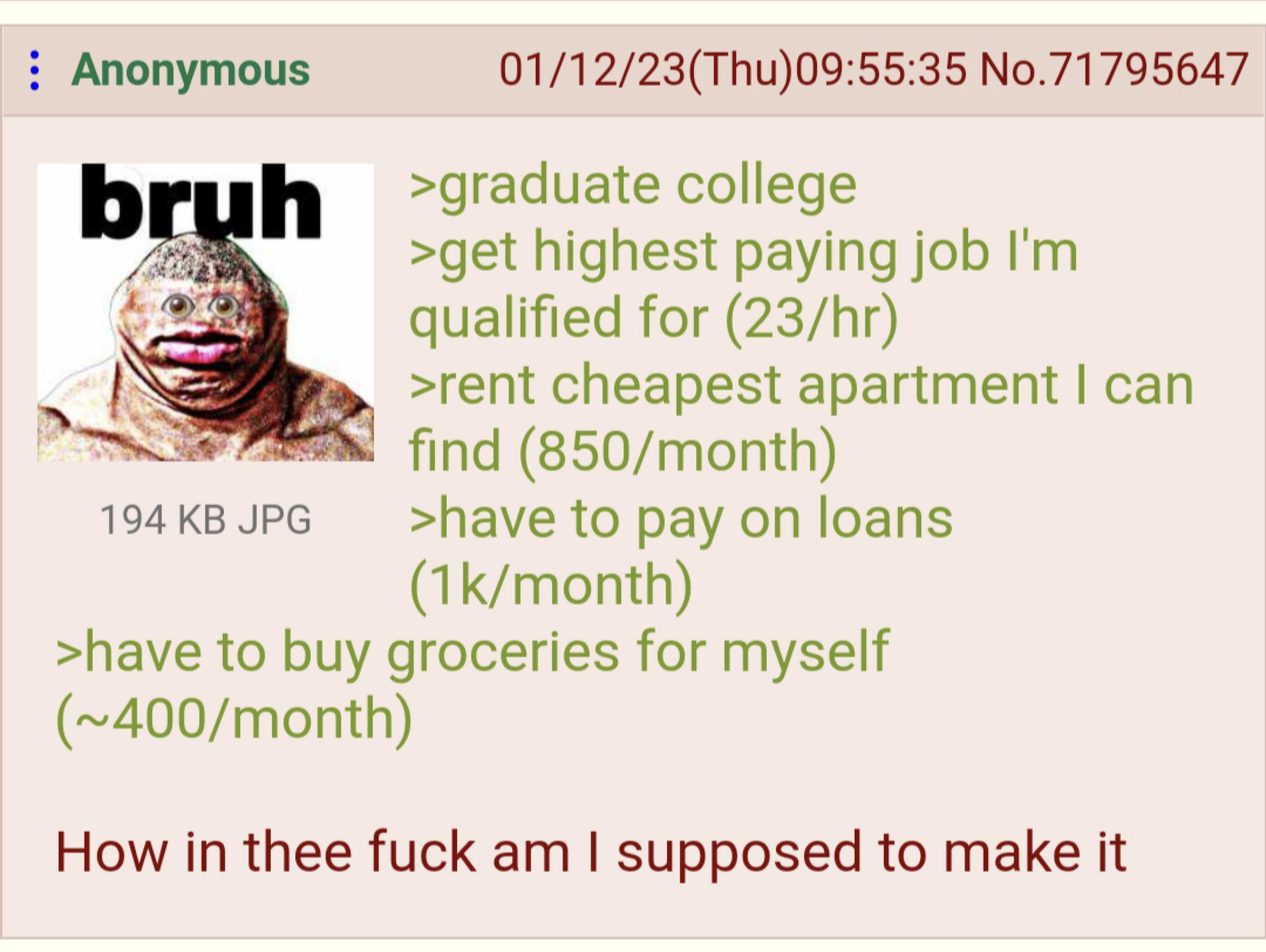

That's much higher than normal. A quick google suggests between $200-$500 is more in line with a normal student loan monthly payment, which is still a burden on someone just starting out.

Only speaking from my own experience, but that sounds in-line with what the monthly payment is for each loan, but when I came out I had 4 separate loans that they came collecting on.

The IBR plans are aggregated against all your federal loans. So, unless there are some weird private loans in there, that’s the upper limit in sum total based on the income we’re discussing here.

They aren't on an income based repayment currently (or there is no evidence stating they are or aren't I guess), so he would be dealing with all the separate loans sending him bills currently. Definitely needs to get on one though, it would help a lot, more than likely.