this post was submitted on 08 Jul 2024

671 points (96.9% liked)

2meirl4meirl

1108 readers

294 users here now

Memes that are too meirl for /c/meirl.

Rules:

-

Respect the community. If you're not into self-deprecating/dark/suicidal humor then this place isn't for you. Kindly just block and move on. This is just how some of us cope.

-

Respect one another.

-

All titles must begin with 2meirl4meirl. This is for multiple reasons. One is just so you can be lazy with titles but another is so people who aren't into this kind of humor can avoid it.

-

Otherwise just the general no bigotry, no dickishness, no spam, no malice, etc stuff.

Sidebar will be updated when I feel like and considering I'm Sadboi extraordinaire we'll see when that will be.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

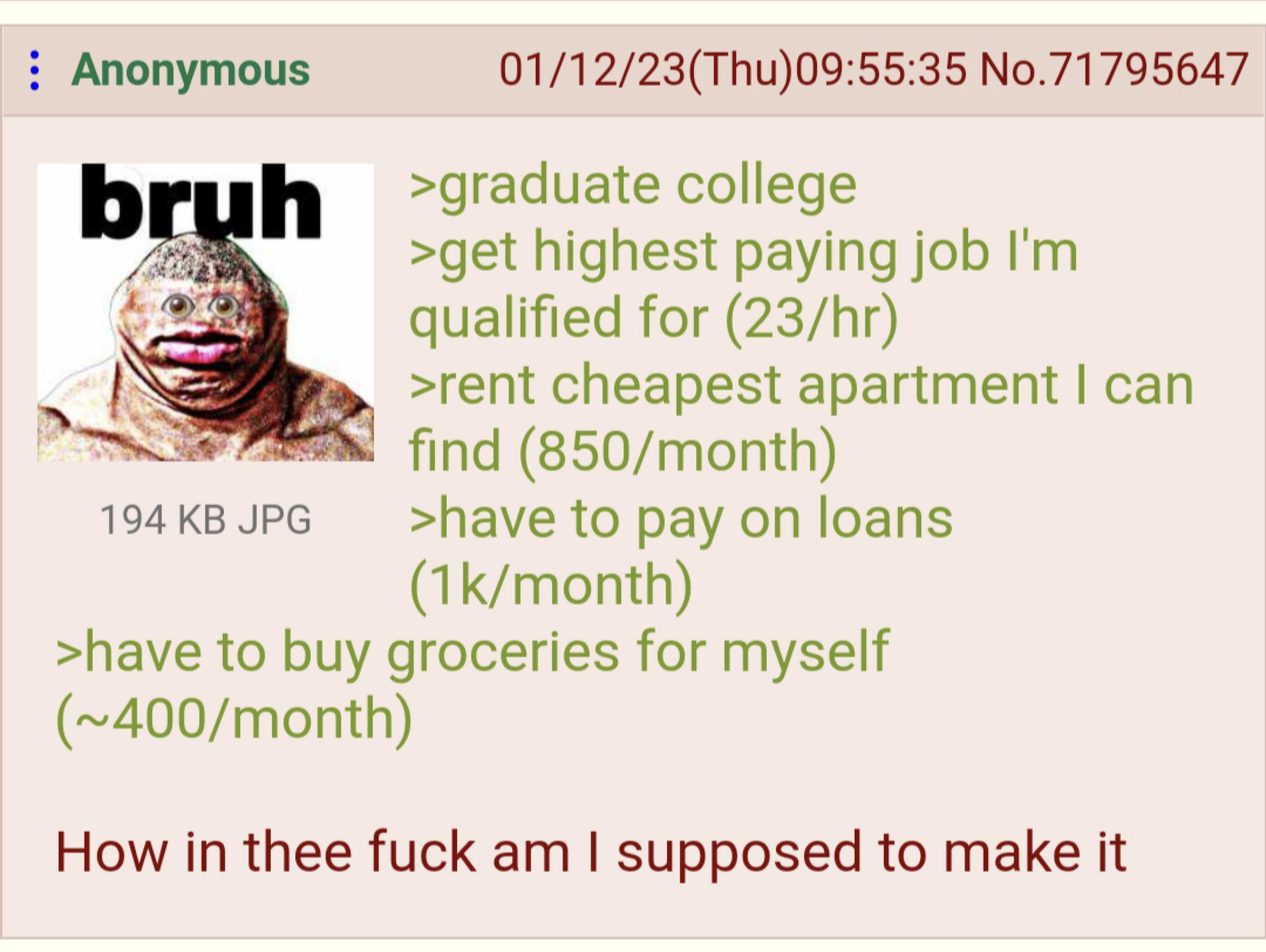

If you have any hope at all of keeping the interest from ballooning the principal beyond the original loan amount, yes.

:(

Or do what my cousin did.

Have uncle take out loan entirely under his name.

Make minimum payment on it.

When he dies, the debt dies with him.

How are they taking out education loans in someone else's name? Sounds like fraud.

In the United States, there's a federal loan option called Parent Plus loans that can allow parents to take out loans for their children's education. Private loans could be taken out by just about anyone to pay for a student's education, depending on the institution.

Parent loans are a thing. The parent of the kid takes out the loan, not the kid themselves. And yes, thankfully, they just go away if the parent dies and don't get passed on to the estate.

The educated kind of fraud 🧐

A regular work day for corporations.