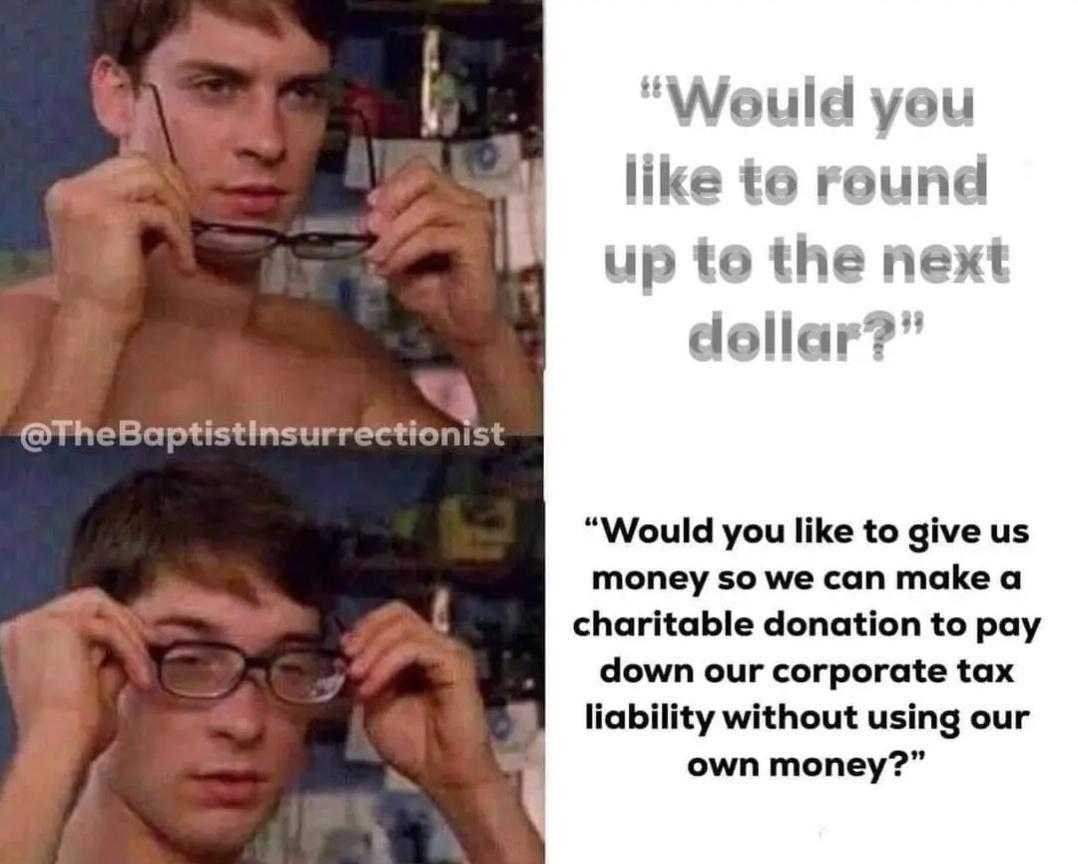

Everyone is talking about how taxes work and no one is talking about how this meme works. He doesn’t need glasses anymore! It looks blurry with his glasses!

memes

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

He's even squinting!

Fitting considering how cash register donations usually do not work the way it is described in the meme.

This is not how tax deductions for charitable donations work.

- You round up to the dollar for a 50c donation

- The business has 50c extra income

- They write off 50c as tax deductible

- They pay the exact same taxes whether or not you make a donation

Sure, but they also get to advertise that they donated X thousands of dollars to charity, while the truth is that the actual donors get no tax benefits at all. And like OP said, I'd rather use https://charitynavigator.org/ to do my own research before giving money to a corporation to donate to some organization that may be mishandling their funds.

Yup, it's not about stealing money it's about stealing goodwill.

The customers at the grocery store don't get thanked for donating $50 million to fighting awful childhood diseases, the grocery store does.

Then they can use that to argue they're good for the community, and deserve massive tax subsidies when they go to open their next store.

Unrelated, I've talked with people who work in the corporate philanthropy part of a business, and they're fine. They're just happy to get to use their position to organize charity, even though they know the point to the business is goodwill not giving.

It's other parts of the business that then milk that goodwill in incredibly scummy ways.

It's about stopping centralized programs which would actually address public needs. "We don't need universal healthcare, here's a charity that helps people with the bubonic plague!"

And in the worst cases, it's a grift for the wealthy. Where the charities exist to do scammy things like pay the founder to fly to luxury resorts to give a talk about why poverty is bad. Or to fund your family members solar manufacturing company. Or to put fuel into your church's private jet so you don't run the risk of catching demons from the public.

I don't think that's the intent behind it, but it's certainly an impact.

Charity is a stopgap to a systematic solution to addressing a lot of problems.

Your local food bank isn't bad, but it does hide the issue of food insecurity behind a solution that isn't guaranteed to be available to everyone like UBI or expanded food stamp access would.

Those cruddy charities do exist, but I think usually businesses try to avoid them because of the risk of backlash. The people running the programs usually try to do what they can to pick good charities at the least, since it's basically all the same to the business.

Not much that they can do about the CEOs spouse getting a spot on the charity board though.

Then they can use that to argue they're good for the community, and deserve massive tax subsidies when they go to open their next store.

So there is tax benefits, just with extra steps?

Yes, but not guaranteed, and usually "somewhere else".

Instead of avoiding paying $50M in federal taxes like a lot of people think, they might be forgiven $1M in taxes at the local level, pending some sustained employment level for some duration or another.

Point being, they're usually not planning to do the charity to save tax money, but to gain goodwill. They definitely intend to use that goodwill to make or save money later, and a common way is "you want us in your community, don't tax us in buying the land 🥺".

They might also just use it for advertising so people forgive 5% higher prices.

The person who paid the round up donation (i.e. you) is the person allowed to use the donation for their tax benefit. If you save receipts with round up donations, you can deduct them on your taxes, but no one does that.

It's difficult for individuals to get deductions for charitable contributions under current tax code. You've got to pretty much donate upwards of twenty thousand dollars before any benefits.

That stated number is different for every situation and is a rough estimate of average of what I see on returns.

If Trump tax sunsets in 2025, things will revert back to more easily getting benefits from donations, but that's a long way away and entirely reliant on who's running the show at that time.

Thats only because of how the standard deduction works; If you have to itemize, then any amount of charitable donations can be deducted (up to like 60% of your AGI i think). Basically anyone needs to "outweigh" the standard deduction with their own deductions, because doing otherwise is worse. Technically i think you could forgo the standard deduction and use your own, even if you don't go over the standard deduction, but why would you?

That's the point: almost nobody benefits from charitable donations because almost everybody takes the standard deduction, so "but you can get tax benefits for donating!" is a red herring in almost all cases.

That catch on current code is that they combined exemption with standard deduction. Makes it quite a bit more difficult than the before times.

I'll leave it at that as I'm generally overwhelmed with unparalleled Internet tax expertise any time the subject arises.

That's not how it works either. You're the one naking a donation, you get a receipt for your 50 cent donation that YOU can claim on your taxes.

The business getting you to make a donation doesn't get to claim your donation.

This is a pretty good example of your typical misinformation karma whore clickbait ragebait bullshit post. Glad to see these make their way over from Reddit to Lemmy. Rip.

- They show boat about how much they do for charity

- They lobby against government aid programs and increased taxes because "look, see, we are help the poors, no need for the government to get involved!"

- The charity is operated by the company, and pays fat stacks to the CEO for operating it.

It's not how Spider-Man works either.

#2 and 3 don't actually happen since it can't be recorded on the P&L.

The donation would get recorded to cash and offset to a liability account, probably something named Charitable Donations Payable likely with a subaccount for the specific programs.

Overall, the effect is essentially the same, though. Fwiw, I like to use the same comparison as you did to show to people how dumb this belief is.

The individual who donated at the register also is allowed to claim the donation when they file their taxes.

common misinformation, fact check here

Donations made by customers at checkout are not tax-deductible for the business, as the donation does not come from the company. According to TPC, the business only serves as a collector for charitable donations from its customers and has no right to claim any of the collected funds.

If you got this far in the comment, take a mental note to call this out the next time you see it. I too am very critical of the late stage capitalist hellscape we live in, but rounding up for charity is a rare instance of an unproblematic practice that is damaging to discourage as this post does. Charities do a lot of good and when you donate to them you are the one that gets the opportunity to do a writeoff.

Edit: If you are wondering why they do it then, it’s a psychological marketing technique. If you come to associate the good things that the Ronald McDonald House does with your McBurger, you are more likely to buy more tasty McBurgers. Sketchy? Sure, but it happens to be really effective at supporting charity work so it’s kind of a mutually beneficial arrangement.

I'm just instinctively averse to corporate bullshit because corporations don't do anything unless it serves them in some way.

Why do I have to round up to a dollar? I just dropped 159$ shopping at your store, you round up and give some of your profits to charity, don't guilt trip me with this nonsense as you rape me with fake sales and shrinkflation.

I'll donate to charities that I want and I'll give more than a miesely dollar.

i totally get that, and your instincts are noble, which is probably why this misconception is so pervasive. i too was in your position once, but yeah, no harm is done by donating at checkout.

I disagree. Charities should not have to exist if the government was responsible and funded services in the public interest. Charities have to spend a non-trivial amount of money on fundraising itself and sustaining their own management. Hunger, medical research, veteran care, homelessness. All these things could be alleviated through government funding.

The Revolution Will Not Be Funded: Beyond the Non-Profit Industrial Complex

Your meme is the wrong way around.

That’s not really how taxes work.

My charities are in my neighbourhood, like your friendly spiderman.

Like cooking for the less fortunate, giving kids my abandoned PC stuff, building together their new rig, supplying food packets to fams in need, like with the "to good to go" program here in the Netherlands. Supplying local food banks.

I have been homeless for a long time and now I share what I consider a very fat bank account. I certainly knew how to share when I had nothing, makes one humble, makes one appreciate rain on the window, or a shower whenever you want one. I got served a patato soup and a glass of port after eating nothing walking around hungry for days by a guy who had himself nothing, engraved in my mind.

We got all we need now and then some... Why not see a problem at close and solve it right there. I am surely not giving Bob Geldof any money, fuck that guy.

I'm pretty sure that's illegal for the corpo

That said still don't do it.

The Nonprofit Industrial Complex: What Is It and How Does It Work?

This tax-exempt status has been a boon for the nonprofit sector. The code arguably encourages elites to divert money otherwise spent on taxes to private foundations where they can distribute funds as they see fit.

Your meme is backwards

Look them in the eye as you tap "no".

Cashiers don’t care, it saves them from whatever cringeworthy ’attention getter’ corporate policy like clapping or ringing a bell they’re compelled to do if you donate

That would drive me away from donating. You already took my money, so at least have the decency to leave me alone.

I will say don't give corporate any money for charity, instead donate yourself to your favourite charity & get tax benefits for this.