this post was submitted on 22 Apr 2024

119 points (76.7% liked)

Political Memes

4622 readers

3238 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

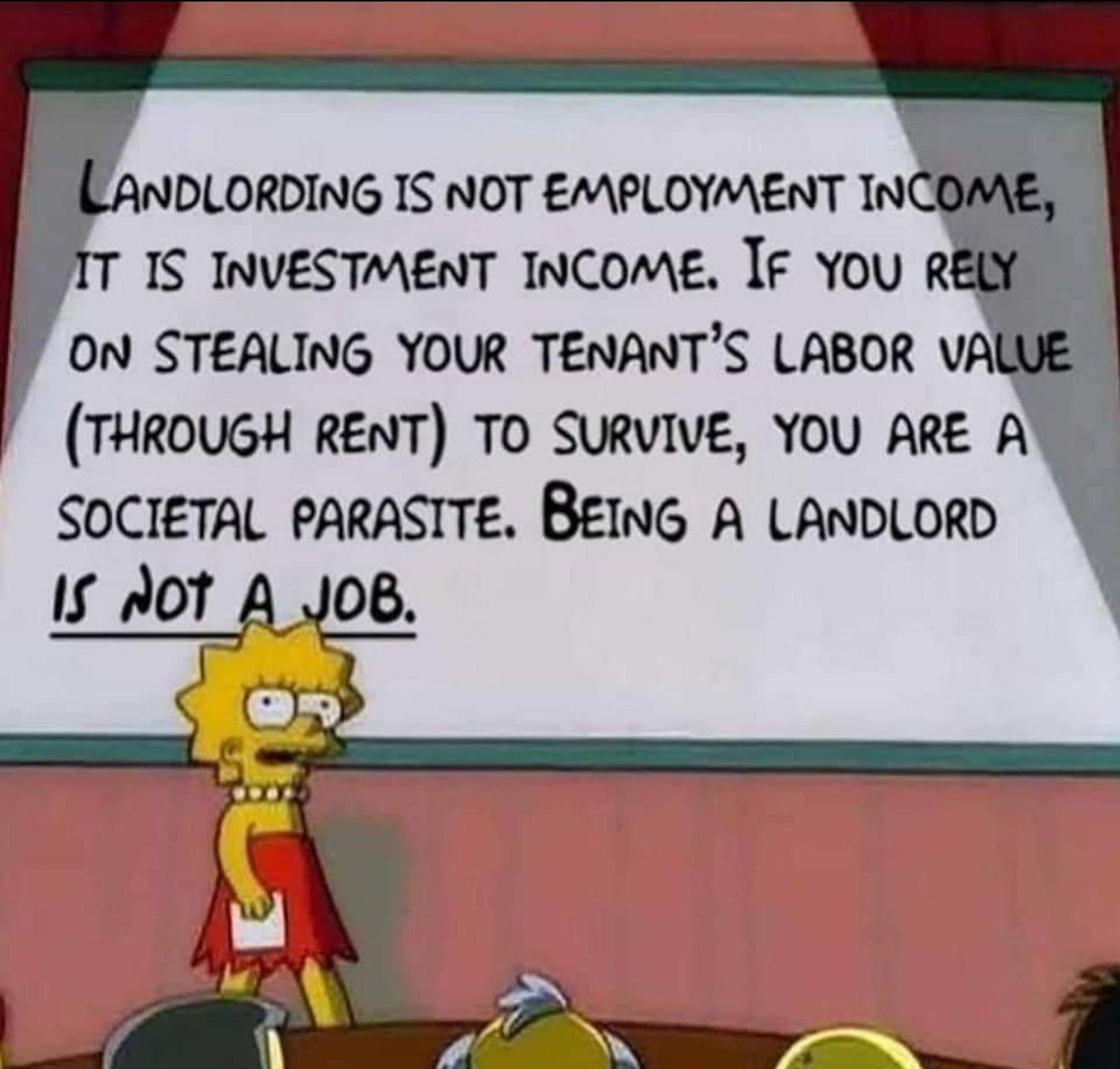

Historically, the S&P grows faster than housing prices. So if you tie up a ton of capital in a property, the reduced growth + property taxes mean it's likely losing you money (not to mention any interest paid on a mortgage). Renting it out makes it a viable investment (and obviously it depends on where you buy).

Now, whether or not investments should be allowed for things which are basic human needs is another question.

Something I always felt was missing from this argument is the leveraged amount of the mortgage. In the stocks my $100k might make 10% annually, but with a house I’ve used that $100k as a downpayment on a $1M home and I’m making the 10% (minus say 3% borrowing cost) return on a much higher number than the physical money I had.

Not to mention in the states how mortgage interest is tax deductible? I’m not American, that seems like a crazy advantage to homeowners.