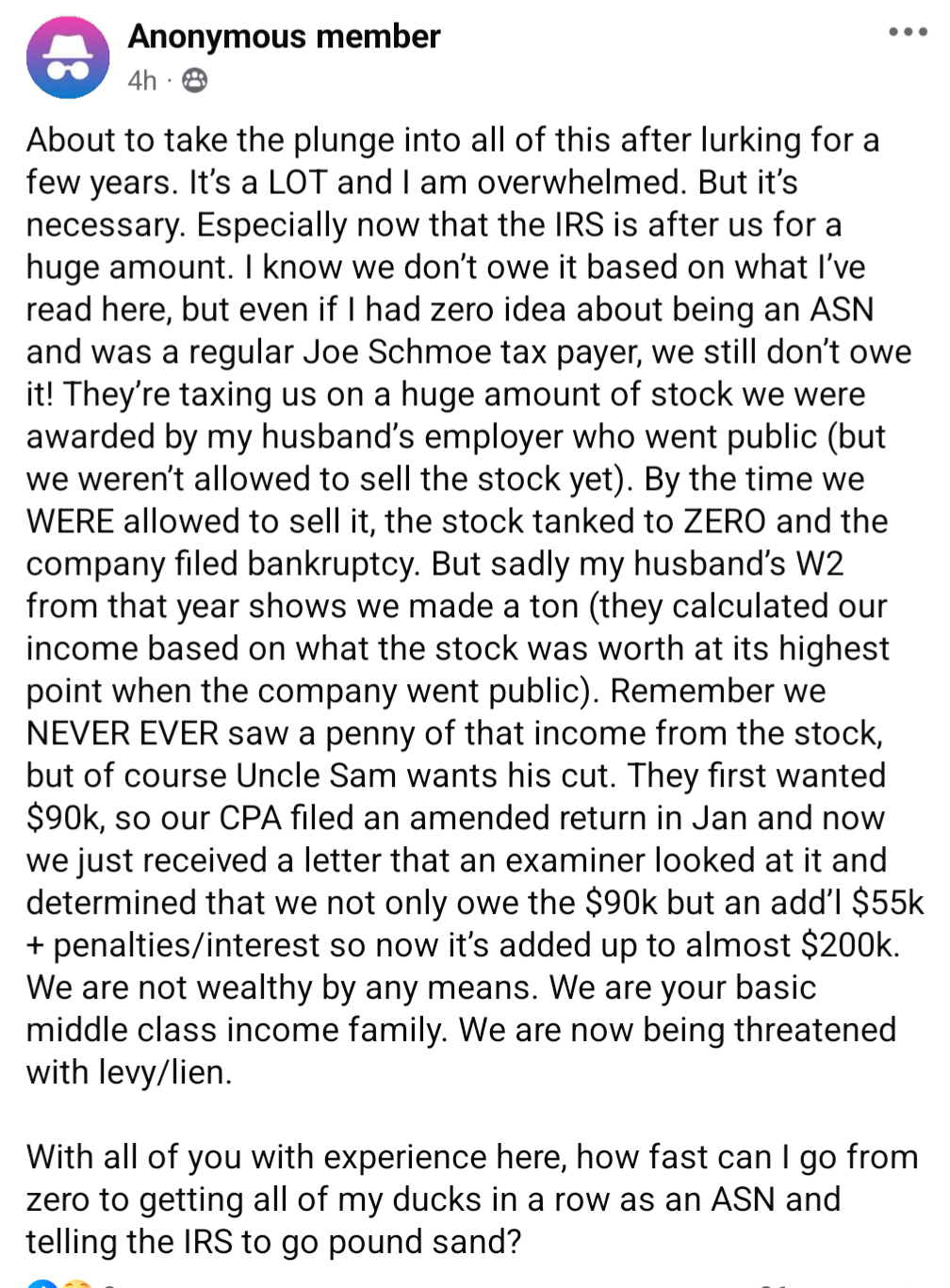

It is my understanding that awarded stocks are taxed as direct income at the time the stocks vest because that is essentially what it is. It's money they gave you, but bought stocks with it on your behalf. If it is vested and public, it is yours to do with as you will, including selling immediately and just collecting your money straight up (no capital gains because no growth, all principal). If you hold it until it becomes worthless, that is no different then buying any other stock and holding it. Your tax burden should be partially offset by the capital losses, though.

They say that they could not sell it. That either means that it wasn't yet vested (there is often a period, like a year, before the awarded stocks from your employer vests), in which case they are correct that they shouldn't owe income tax on it until it vests. OR, and I suspect this is the case, they either misunderstood or were lied to by their employer about what they could do with that stock. If it was vested, they owe income tax on it. If they were lied to, there may be civil recourse they could take against the employer. But if they just misunderstood and sat on stock until it was worthless, that's just their fault.