this post was submitted on 29 Apr 2024

1124 points (98.4% liked)

Political Memes

6239 readers

3995 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

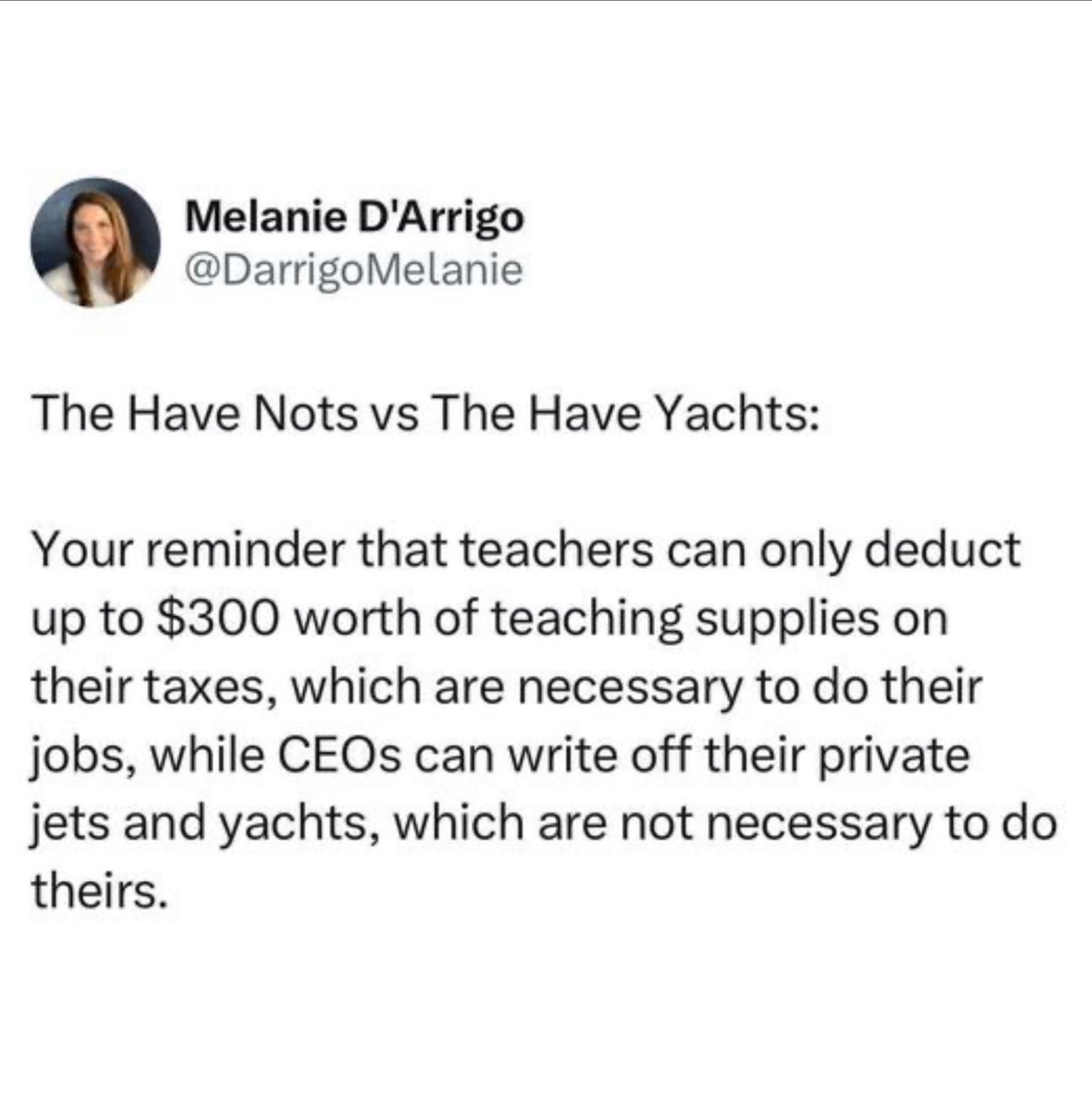

There are complicated parts of accounting, but basic expense tracking is simple and businesses would do it even if it didn't affect their tax treatment.

If businesses couldn't write off expenses, it would be nearly equivalent to treating the corporate income tax as a universal sales tax. This would be incredibly damaging to small businesses and benefit behemoth vertically integrated companies, which is probably the exact opposite of what you want.

If you get rid of expenses, you need to get rid of corporate income tax and either replace it with VAT or combine it with increases to personal income tax like taxing capital gains as ordinary income.

Mmmm that's a great point about vertical integration, I forgot about that.