this post was submitted on 15 Apr 2024

467 points (97.6% liked)

Comic Strips

13547 readers

4226 users here now

Comic Strips is a community for those who love comic stories.

The rules are simple:

- The post can be a single image, an image gallery, or a link to a specific comic hosted on another site (the author's website, for instance).

- The comic must be a complete story.

- If it is an external link, it must be to a specific story, not to the root of the site.

- You may post comics from others or your own.

- If you are posting a comic of your own, a maximum of one per week is allowed (I know, your comics are great, but this rule helps avoid spam).

- The comic can be in any language, but if it's not in English, OP must include an English translation in the post's 'body' field (note: you don't need to select a specific language when posting a comic).

- Politeness.

- Adult content is not allowed. This community aims to be fun for people of all ages.

Web of links

- [email protected]: "I use Arch btw"

- [email protected]: memes (you don't say!)

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

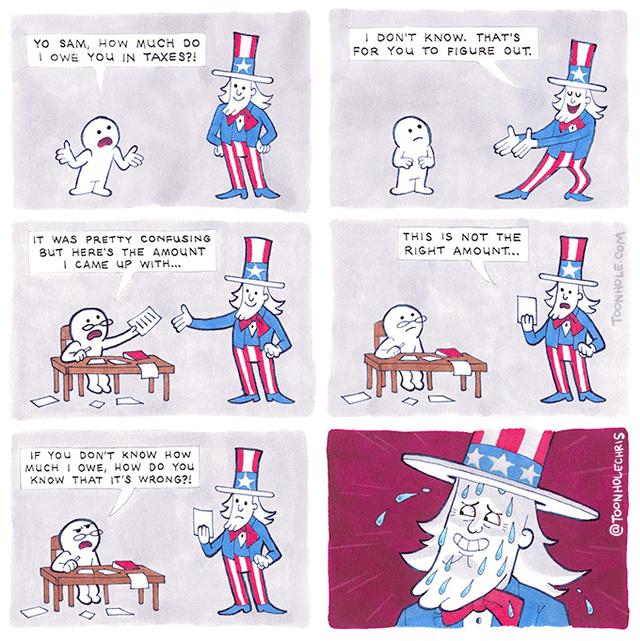

It should be super simple... We have all the math to make it happen, just take the correct amount out of people's checks and leave them the fuck alone.

Don't put your hand in my pocket 26 times in a year then come to me at the end and go "(Blush), sorry, I took too much/too little."

Take the right amount, leave me the fuck alone.

Thank companies like TurboTax and HR Block. They're the ones who make it hard.

You can thank the politicians that TurboTax and H&R Block bought. They aren't innocent here.

I can’t vote out a corrupt politician from another state, but I can vote with my dollars and Intuit will never get another dime from me.

We could consider those politicians employees of TurboTax and H&R Block just with extra steps

It's a little more complicated because of itemization.

The standard deduction should be pretty simple. For people that give a bunch of money to accountants ... you're probably better off just taking the standard deduction anyways. But eh maybe not.

In theory itemization is a good option, it does save me some money, and there's very little way for the government to know that I e.g. donated to X and that reduces my tax burden by Z. My neighbor tells me back in the day you could itemize a lot more stuff, but those days are gone.

Definitely support the IRS providing some free tax filling software at the very least. There's really no reason electronically filing should cost all the money it does to go through e.g. TurboTax and scare you with the up selling to protect you from audits or XYZ thing.

Isn't this how it works for most people with a W2? It only gets complicated when you start adding dependents or starting side businesses.

they take the appropriate amount out but they don’t “leave me the fuck alone” – you still gotta fill out all the paperwork and file your taxes

pretty much every other country in the world, come tax season, just sends out a receipt for you to sign …

Thanks TurboTax and HR Block.

Oh yea, it comes with a 14 page PDF in small print that tells you what each field contains using the most obtuse verbiage. Then with a simple click of a button it does simple arithmetic to calculate all the numbers you plug in. But you don’t have any help on deductions. Is a thrift savings plan a Roth? Depends on when the savings plan gets taxed. Is it taxed? When i put money in or pull money out, but before or after i turn retirement age, which goes up every few years. Input all the taxes you didn’t pay by buying things online. Does livelihood depend on tips for some ungodly reason? Hope you did well because the government kinda just averages a guess how much you should be tipped. For the love of god don’t add BA though BH unless something you would know when if so. And that’s the 1040ez

… sort of … we can do it for free now instead of having to pay a tax preparer but there’s still the matter of having to fill out all the paperwork – we haven’t reached the stage of the rest of the world of just signing the pre-filled tax bill

Yeah, no.

It only gets complicated when you have dependents? Like a massive percentage of all adults...

Not if you take any form of assistance, make any purchases for a business/education, get income from multiple places, work in multiple states, have health insurance, or even received tax credit from a previous year where the government took too much.