this post was submitted on 07 Mar 2024

994 points (91.3% liked)

General Discussion

12088 readers

1 users here now

Welcome to Lemmy.World General!

This is a community for general discussion where you can get your bearings in the fediverse. Discuss topics & ask questions that don't seem to fit in any other community, or don't have an active community yet.

🪆 About Lemmy World

🧭 Finding Communities

Feel free to ask here or over in: [email protected]!

Also keep an eye on:

For more involved tools to find communities to join: check out Lemmyverse!

💬 Additional Discussion Focused Communities:

- [email protected] - Note this is for more serious discussions.

- [email protected] - The opposite of the above, for more laidback chat!

- [email protected] - Into video games? Here's a place to discuss them!

- [email protected] - Watched a movie and wanna talk to others about it? Here's a place to do so!

- [email protected] - Want to talk politics apart from political news? Here's a community for that!

Rules

Remember, Lemmy World rules also apply here.

0. See: Rules for Users.

- No bigotry: including racism, sexism, homophobia, transphobia, or xenophobia.

- Be respectful. Everyone should feel welcome here.

- Be thoughtful and helpful: even with ‘silly’ questions. The world won’t be made better by dismissive comments to others on Lemmy.

- Link posts should include some context/opinion in the body text when the title is unaltered, or be titled to encourage discussion.

- Posts concerning other instances' activity/decisions are better suited to [email protected] or [email protected] communities.

- No Ads/Spamming.

- No NSFW content.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

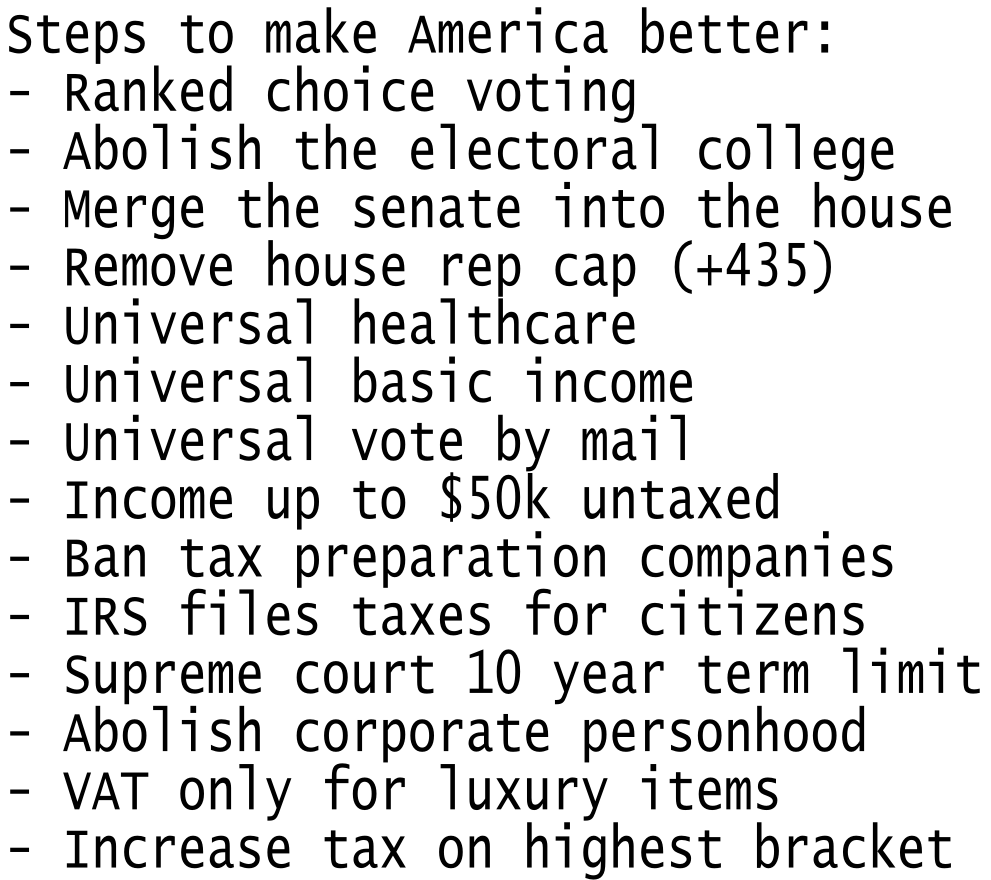

From an outsider perspective. Two houses/chambers are better than one. But the second should be a review chamber that sends amendments back to the first. If those amendments are rejected by the first then so be it.

Something like PAYE would be better than having your government work out the tax. It places the expanse on the companies rather than the government or the individual.

With a less convoluted tax system and businesses working it out you probably wouldn't need to ban those tax companies as market forces would make them no longer viable.

VAT should be on luxury goods, and ones that the government wants to discourage the use of for public health (500% vat on tobacco products, 300% VAT on vaping etc).