this post was submitted on 11 Feb 2024

266 points (98.2% liked)

InsanePeopleFacebook

3107 readers

122 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

So while everyone can see that this is dumb, there is actually precedent for sending bills to companies for services that weren't rendered. If you can get them to sign for it, they are legally bound. There was a guy who was financing with his bank and he basically altered the contract(that they didn't expect him to read to begin with) to give him no spending limit, 0% interest, and a bunch of other stuff, and he sent it back for them to sign it. Because they actually didn't read it but signed it anyways, when it was taken to court he did win.

Although that case is real, it did not happen in the US; I believe it was Russia or some other former Soviet Republic. Under systems of law evolved from British common law, it is generally held as necessary to inform the other party of such a change to the contract.

Sending bills for services not rendered can actually result in payment from large corporations because they are constantly receiving bills, so if it looks right there is a chance someone will just pay it. However, I believe it is also fraud if they notice and can thus get you in trouble; remember, the law is primarily there to protect companies and rich people.

Yeah, if you say you did something for them but didn't, that's fraud.

I think you can technically get away with just sending them a letter asking for money, but you have to be careful not to imply that they owe you the money or you did anything you didn't do.

I do some ordering for work and am confident if someone really wanted they could sneak something by me. You know once for a small amount of money.

It was for a credit card company and was in Europe. In the USA you would end up a convicted felon in prison for that.

That's altering a contract. If there's a dispute about added terms (that both parties signed) it's usually construed against the more sophisticated party, i.e. the bank, not the customer.

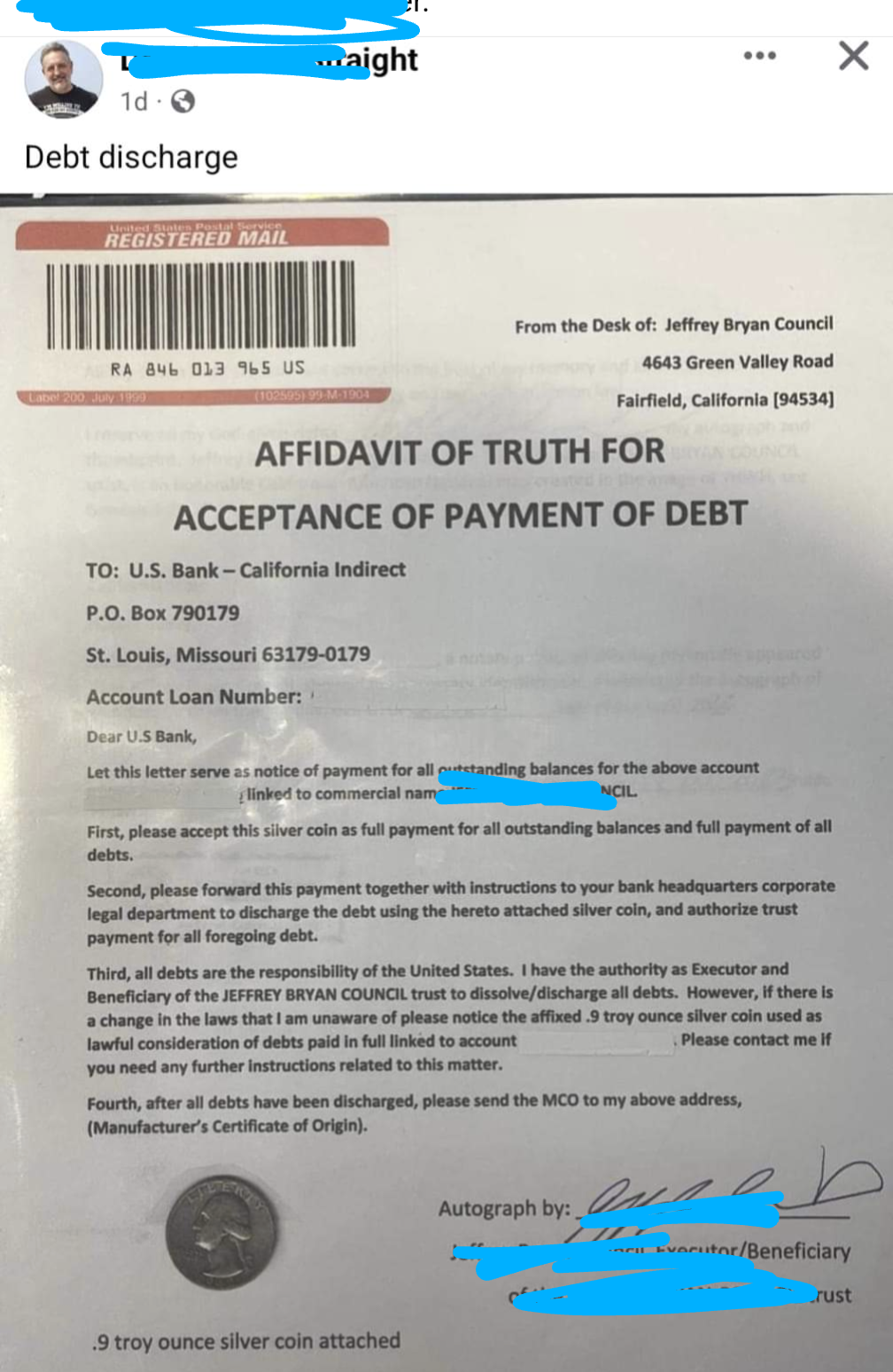

What this dude is trying to do is from the UCC chapter 3 on negotiable instruments, which are checks and drafts. What most people know as checks are called drafts.

Accord and satisfaction: it's funny, because is one of the rare times in law when the magic words have to be exact, and the phrase is "tendered in full satisfaction" or in full satisfaction. If the check says that in the memo line (if check is to you) or under an endorsement (if it was signed over to you), and you cash it after, you have liquidated the debt subject to certain limitations; i.e., if the organization tenders repayment back to you, the underlying promissory obligation is unpaused.

https://www.law.cornell.edu/ucc/3/3-311

Usually a draft have to be a naked order, directed to your bank, to pay the bearer or assignee, and nothing more. But this is one of the few exceptions to what you can write on a check and have the check still be valid.