This is that certainty that businesses love that Republicans provide, right? On investment, trade, taxes? I'm sure the lost business volume will be made up in their tax refunds the government will surely provide them for all the services cut, right...?

Economics

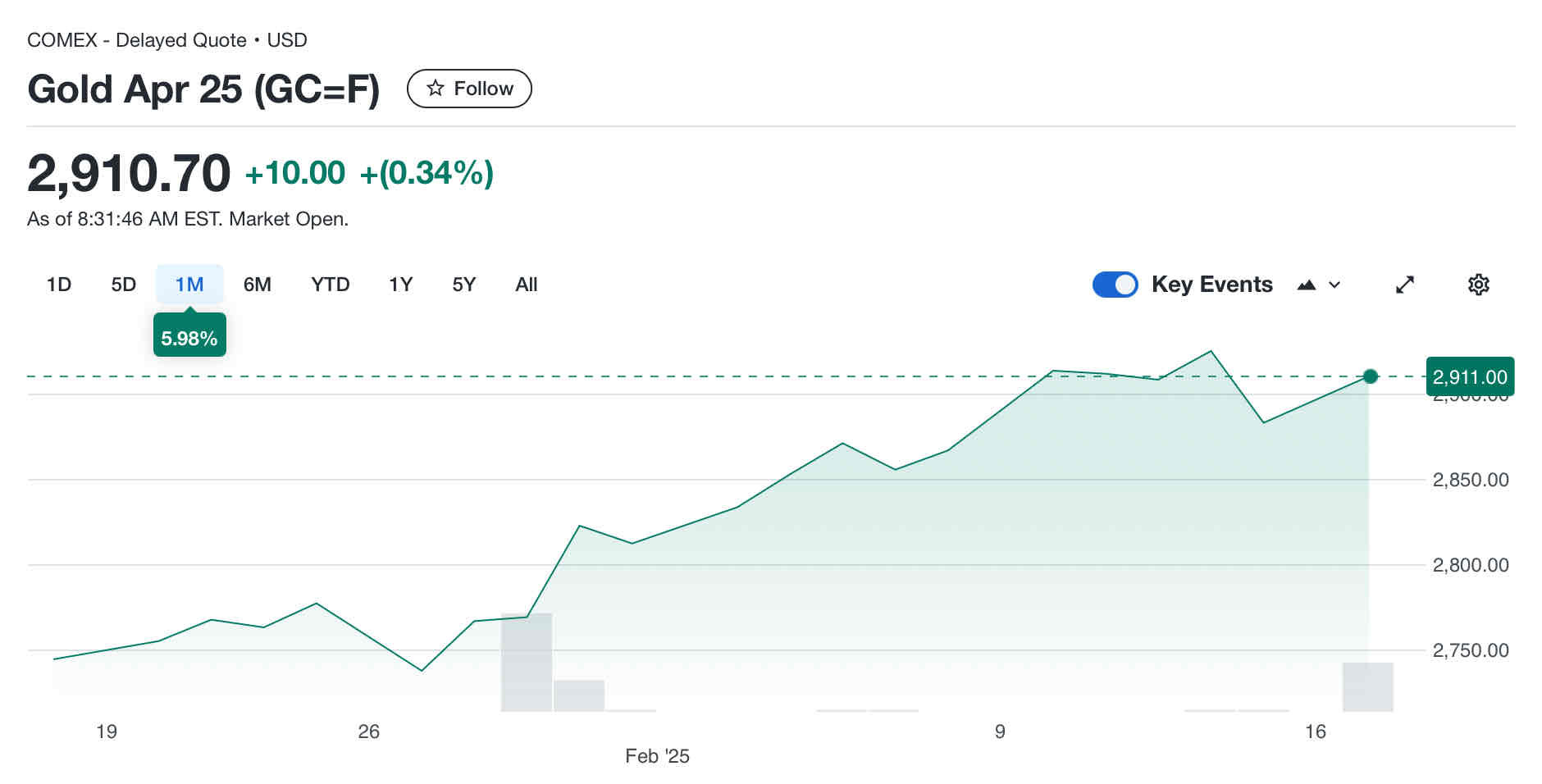

So it’s not a good sign when the Dow and NASDAQ stagnate while gold climbs? What about JP Morgan taking a $4B gold shipment?

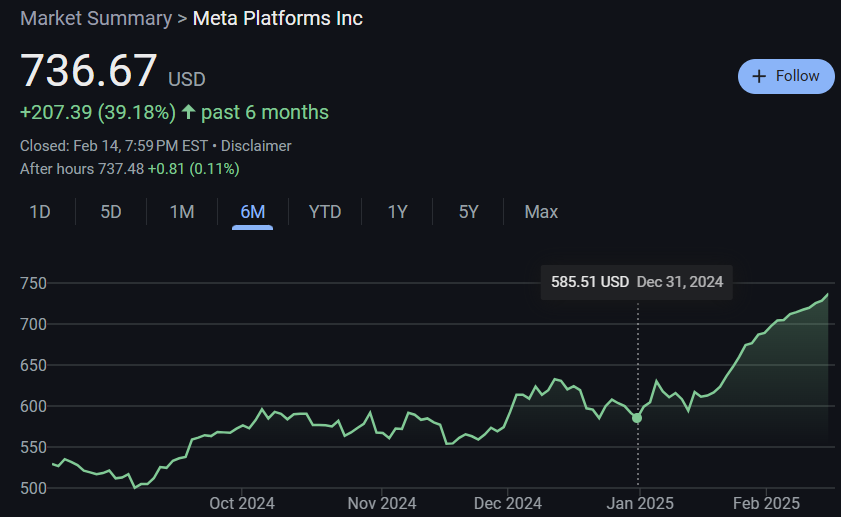

YTD for Google and Tesla is down, but Meta is up, so it's looking too early to see how the current goes with the new oligarchs.

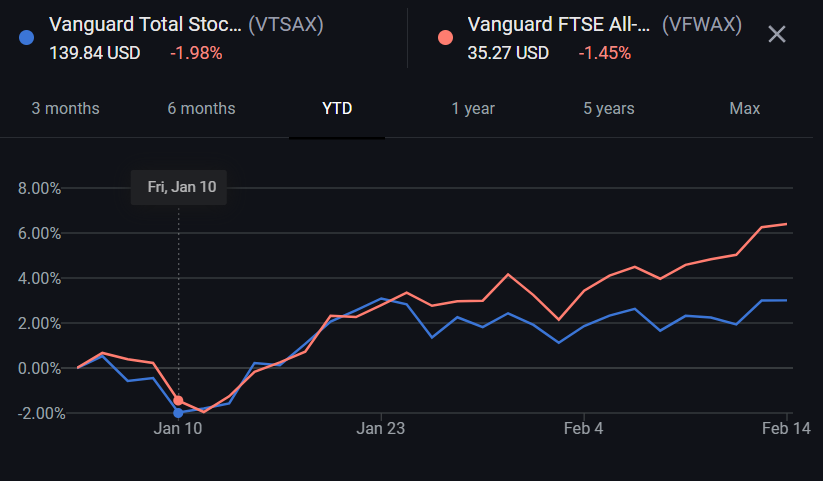

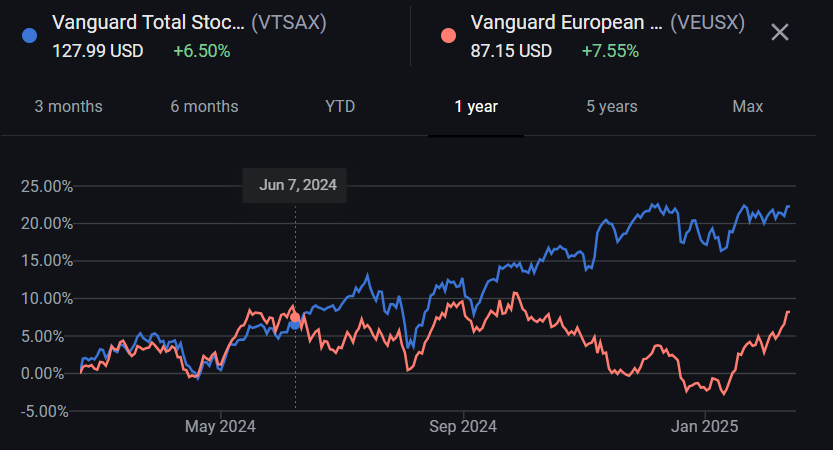

For the big picture, while the US is still killing the rest of the world broadly on returns, the YTD is another story.

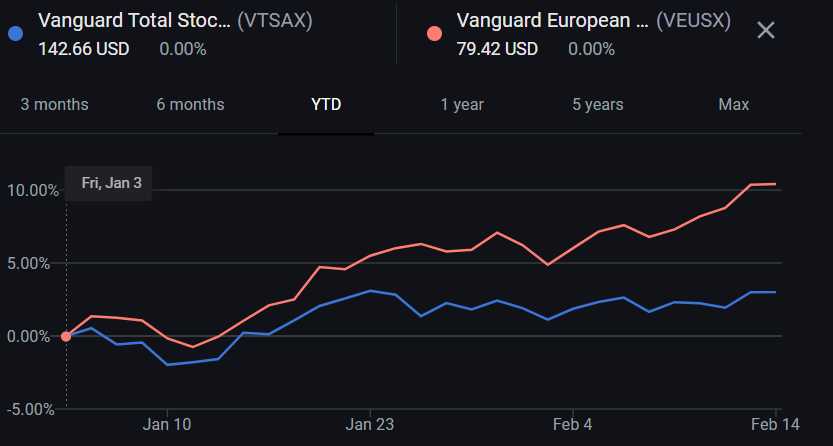

Gold doesn't interest me for my needs, but US vs non-US is going to be worth keeping an eye on. I've been 100% US so far and have not regretted it, but this intentional sabotage of trade has me questioning having all my eggs in one basket now that certain people are punching holes in that basket.

Oh I’m not referring to money-making opportunities so much as market volatility. Investors flock to gold in times of instability.

Gotcha. I'm used to gold people being a little sketchy. My response is 50/50 money making vs stability, though for the same reasons. I felt it would take something cataclysmic to dethrone the US as the prime market force as a whole in my lifetime, and, well, it seems I may have been right, but I really didn't want to be. If we're due for stagflation or inflation, I need to ramp up my savings and growth, so it's got me looking if now is the time to spread out to ex-US investments. I'm no stock bro, I just got to look out for the future happiness and medical expenses for me and my wife. 😐

Nah, as long as "GDP is good", everyone is ok. We won't have poor people anymore. We will end homelessness and no one will ever go bankrupt from medical bills. The power of "high GDP" ya know.

Tap for spoiler

/s