this post was submitted on 23 Apr 2024

970 points (98.1% liked)

Comic Strips

12805 readers

5612 users here now

Comic Strips is a community for those who love comic stories.

The rules are simple:

- The post can be a single image, an image gallery, or a link to a specific comic hosted on another site (the author's website, for instance).

- The comic must be a complete story.

- If it is an external link, it must be to a specific story, not to the root of the site.

- You may post comics from others or your own.

- If you are posting a comic of your own, a maximum of one per week is allowed (I know, your comics are great, but this rule helps avoid spam).

- The comic can be in any language, but if it's not in English, OP must include an English translation in the post's 'body' field (note: you don't need to select a specific language when posting a comic).

- Politeness.

- Adult content is not allowed. This community aims to be fun for people of all ages.

Web of links

- [email protected]: "I use Arch btw"

- [email protected]: memes (you don't say!)

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

I don't understand why generative AI would be involved in a tax return? It's just data entry.

If your tax return needs creative assistance, maybe you should go to jail instead?

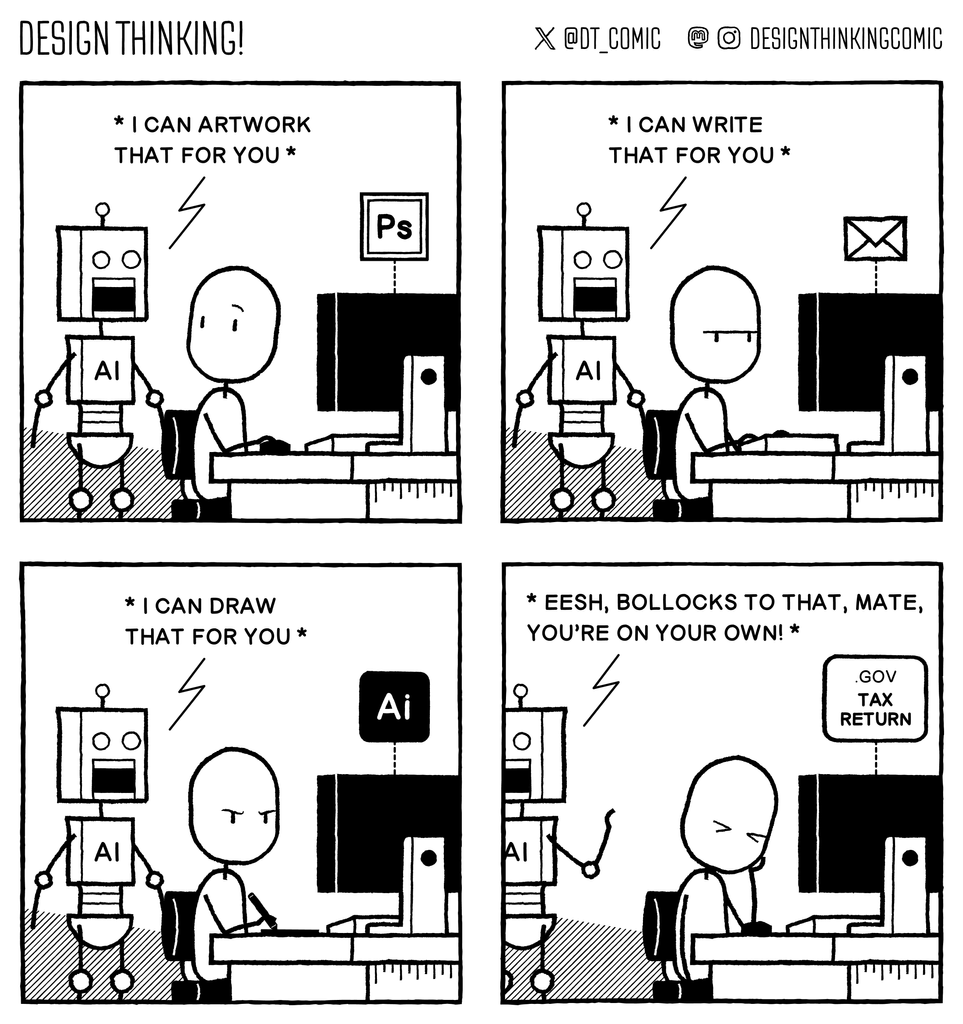

I think the point of this comic is that AI is doing all of the fun creative stuff for us but the jobs that we actually hate doing are beyond its capabilities.

Haven't most tax returns been automated since way before AI? Most methods can pull and auto-pop all the needed info. Usually after I give it my SSN or sometimes a number or two from the W2 it's done but for some clicking through review screens.

They have, yes. Doing math for your taxes is as simple a task as doing math that needs to be applied to your taxes in the correct order. There's no need for AI in that process at all.

The only potentially difficult part (massive "potentially" here) that doesn't involve math is probably having a UI that intuitively guides the user into selecting the right things that apply to them (if that data can't already be queried from somewhere else like a government site). But you don't really need AI for that either.

You don't understand, technology bad.

So what if people with no talent or money for commissions can get some joy seeing their imaginations rendered by a computer? You have to pay some artist or just have the ideas in your imagination.

Have you actually done a large, nuanced return by hand. What does X mean? Where is X in this form? (cuz they don't use the same name). And do I need a Form 1234-56-A for that?

Like I understand what all of the concepts, but confirming and digesting the rules and paperwork is non trivial. Paying 300/hr for accountants to do it is even more painful.

No, I'm only 40 so I've never had to do a tax return by hand, I've always used a program.

Which is exactly what Intuit and TurboTax want.

Taxes should not require a third party to complete.

It should be the government saying, "Based on the information we have available, you owe $x. If you believe that is incorrect, please submit Form 1A."

Yep, I used the new federal website this year rather than h&r's free service.

If you can do a 1040ez I did them by hand regularly until I married an accountant’s daughter and it wasn’t bad

The 1040ez is even worse! Everything in the 1040ez the government already has on you!

1040 with a schedule A I get. If you have some sort of situation where you need to deduct medical debt or something like that, something the government wouldn't already have.

But 1040ez...literally is you just sending the government the info on your W-2.

That's it.

And if you get it wrong, straight to jail.

If you just messed up, the penalty is... paying the tax you should have originally. Or receiving the refund you should have originally.

It's only if you are actually committing fraud (which requires intent) that you go to jail.

I don't understand why data entry is even required when the gov has the data. I mean, I do understand, but...

There's cases where the government doesn't have all the information they need to automatically generate them for you. That usually applies to businesses, though, since their accounting department is supposed to keep track of expenses and correct their tax filings before submitting them.

That's not a reason the government shouldn't make it automatic/easier for the vast majority of the population, though.

Sorry, I was being sarcastic. I live in Europe, where tax filing is automatic unless, yes, you're a business.

The government doesn’t have all the data. For example, if you pay a guy to install energy efficient windows, you will need to tell them so that you can get the credit.

Clearly you've never wanted to submit a seven-fingered hand as part of the return

What does the last sentence even mean? Let's just ignore that.

That being said, why do you think the vibe of "doing taxes is a chore" and the meme "they should teach taxes in school" come up regularly?

I can think of multiple ways in which "AI" could help in doing taxes. LLMs could rephrase a form request in multiple ways or easier language to help people understand what is being asked of them. Language models could provide examples and cross references. You could have image models scan and recognize your receipts. A model trained on tax datasets could validate inputs beyond simple syntax / value checking and e. g. ask a person if they really meant to enter that one weirdly high value.

Naturally, the final result needs to be checked by the person submitting it and the program can't be held liable, but please let's not ignore the fact that related technology could be employed in a useful manner, I'm tired of discussions where perfect is the enemy of good.

And let's not pretend doing taxes is incredibly easy for everyone. If you organize all your receipts perfectly all year round and always know what to put into every field of every form, good for you. Maybe there is someone else out there now suddenly having multiple jobs, or a single parent not knowing how and if to file some social benefits, both struggling with their taxes though. Maybe there are multiple countries with wildly varying tax processes, too, of which neither you or I may know anything.

Finally, AI does not always mean a process where a generative model hallucinates data.