this post was submitted on 16 Apr 2024

786 points (97.8% liked)

Data is Beautiful

5329 readers

64 users here now

A place to share and discuss visual representations of data: Graphs, charts, maps, etc.

DataIsBeautiful is for visualizations that effectively convey information. Aesthetics are an important part of information visualization, but pretty pictures are not the sole aim of this subreddit.

A place to share and discuss visual representations of data: Graphs, charts, maps, etc.

A post must be (or contain) a qualifying data visualization.

Directly link to the original source article of the visualization

Original source article doesn't mean the original source image. Link to the full page of the source article as a link-type submission.

If you made the visualization yourself, tag it as [OC]

[OC] posts must state the data source(s) and tool(s) used in the first top-level comment on their submission.

DO NOT claim "[OC]" for diagrams that are not yours.

All diagrams must have at least one computer generated element.

No reposts of popular posts within 1 month.

Post titles must describe the data plainly without using sensationalized headlines. Clickbait posts will be removed.

Posts involving American Politics, or contentious topics in American media, are permissible only on Thursdays (ET).

Posts involving Personal Data are permissible only on Mondays (ET).

Please read through our FAQ if you are new to posting on DataIsBeautiful. Commenting Rules

Don't be intentionally rude, ever.

Comments should be constructive and related to the visual presented. Special attention is given to root-level comments.

Short comments and low effort replies are automatically removed.

Hate Speech and dogwhistling are not tolerated and will result in an immediate ban.

Personal attacks and rabble-rousing will be removed.

Moderators reserve discretion when issuing bans for inappropriate comments. Bans are also subject to you forfeiting all of your comments in this community.

Originally r/DataisBeautiful

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

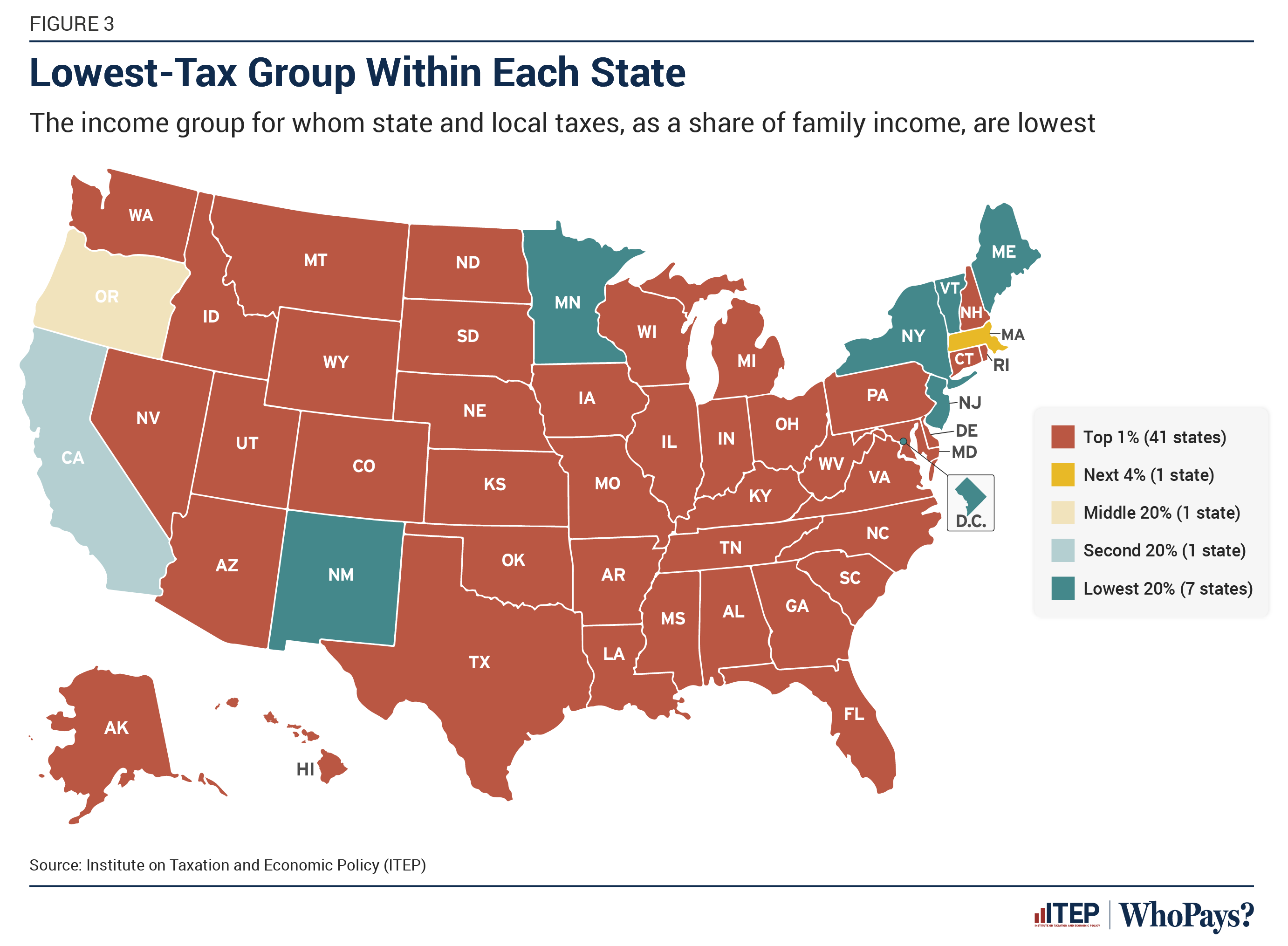

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming all have no state income tax. Am I missing something, or is this graph just misinformation?

The states that rely on sales taxes for most of their income are the most likely to tax the poor the most, since the poor spend more of their income.

As a proportion of their income maybe, but X% sale tax of one rich dude's glamour item(s) - expensive cars, boats jewelry, fashion, etc) could exceed the taxes from many many lower-income essentials.

Yes that's right. This graph is shate and local tax as a proportion of income, which is a much more relevant statistic than absolute dollars when concerned with the impact on the individual's quality of life. There might be other reasons to look at absolute dollars, and percentage of income doesn't tell the whole story when it comes to quality of life, but one is certainly more descriptive than the other for that concern.

I don't buy this, man. Groceries aren't taxxed, and I just don't see how a lower income individual could physically buy the same amount of taxed goods as a multimillionaire

Might be factoring in more than just state income tax. There's also sales tax, property tax, etc.

You are in fact just missing something because having no income tax doesn't mean that poor people aren't being taxed. Think of all the other taxes you pay

...sales tax? I don't believe that that would be higher for lower income individuals, seeing as higher income people would purchase more things that are taxeable than lower income people. The only other tax I can think of is property tax, which again, I would expect to disproportionately be played by higher income people as they are more likely to own property. I'm not saying that taxing the rich is bad, I'm just saying that there is positively no chance that rich people pay less taxes even if you exclude state income tax.

Tax burden is the amount of your income you pay as tax. Poor people spend a larger share of their income.

The cited article is for expenses unrelated to taxes. I would like to reiterate that I am not disagreeing that the system is busted, I'm just pointing out that saying that higher income people pay less taxes in literal tax havens is not possible. If they are only paying for sales tax and property tax, the only individuals who will be paying more taxes are property owners, which because of how fucked the system is, will practically be exclusively higher income individuals. Yes, renting costs more than property tax, but we are talking about taxes. The majority of your rent will not be going back to the government through taxes, but all of your property tax will.

Basic example to help you understand since it can be a little abstract: I make $1000 a week and buy a TV with $10 in sales tax. That comes out to 1% of my income on taxes. You make $2000 a week and buy the same TV. In your case you only pay .5% of your income for taxes on the same item.

Pretty well every state charges a combination of those to fund their state. Some have all 3, some rely on just 1. But they all combine to be part of a person’s tax burden.

Penny power bitches.

Looks like mods gay