this post was submitted on 05 Mar 2025

488 points (98.0% liked)

memes

12310 readers

3900 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

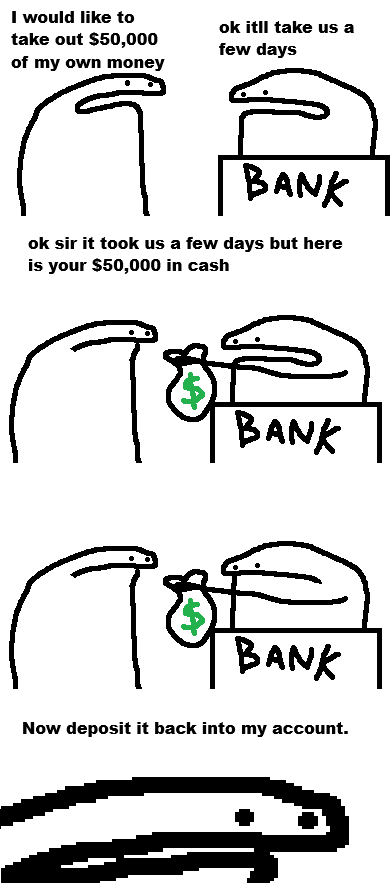

I struggle to understand what modern insurance companies actually exist for, apart from money people donating money to them for nothing in return.

Insurance prevents people from hoarding money that they would need in case of a (personal) disaster to rebuild/repair/re-purchase their losses. If you know insurance will cover your house if it ever burns down, you spend the money, which helps the economy.

Huh? Most people don't have enough cash to pay off their home, let alone save up enough to be able to buy a backup home. That's what insurance is for- it protects you from expenses that would be ruinous if you had to pay them out of pocket. The insurance company takes in more than it pays out, but it's worth it for home insurance (and health insurance in the good old US of A). It's why buying insurance on some $100 tech thing is always a ripoff.

Even if someone worked very diligently to save money, it would take a whole lot to save enough to be able to afford an entire second house.

Some are mandated, like auto insurance. Some are because your relative loss from buying insurance is waaaaaaaay less than your loss from an actual disaster. I for one don't mind paying (and this is an example, lol, like I can afford a home in my area) $200k over 40 years when the cost to rebuild my home after a fire, flood, hurricane, tornado, earthquake, or godzilla would be >$400k.

Health insurance is the real head scratcher. It's almost a guarantee that you'll need it at some point. Pet insurance falls under this as well. A friend was telling me that it was a no brainer unless you're the type to shoot the dog as soon as it gets mildly sick. It's something along the lines of $40 a month, which means you're paying $480 a year, or maybe $4,800-$9,600 over the 10-20 year lifespan of the dog (it's a dog in this example because my fingers like the d more than the c). You know how much a single emergency with a dog can cost? Probably the entire amount you'd pay over a 10 year life span. If it is a longer problem, it balloons even more. And, importantly, right now pet insurance is where health insurance was at years ago, where they didn't scratch out your eyeballs over every payment. It may take that turn here soon, once the industry is more established. That's what my buddy actually wants to do, is review cases for pet insurance companies. I might have to toss him out of the car one day if it gets to the point of our human health insurance.

Just take him for a walk...

His spouse might have a problem with that, or I'd already have the leash ready.

Come again?

See, if I liked the c more than the d, I would be using a cat as an example. You know... typing? My fingers like the d, which is on the home keys, more than the c, which is a downwards reach.

This isn't one you can dig yourself out of.

Yeah, let's throw this poor person a bone already so that they do not have to dig their buried one up.

This stopped me in my tracks also lmao. I was wondering how you get vet bills from playing red rocket.

It is reverse gambling.

Except when you need the insurance it is gambling whether you get it.