this post was submitted on 20 Jan 2025

389 points (95.8% liked)

Funny: Home of the Haha

6256 readers

356 users here now

Welcome to /c/funny, a place for all your humorous and amusing content.

Looking for mods! Send an application to Stamets!

Our Rules:

-

Keep it civil. We're all people here. Be respectful to one another.

-

No sexism, racism, homophobia, transphobia or any other flavor of bigotry. I should not need to explain this one.

-

Try not to repost anything posted within the past month. Beyond that, go for it. Not everyone is on every site all the time.

Other Communities:

-

/c/[email protected] - Star Trek chat, memes and shitposts

-

/c/[email protected] - General memes

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

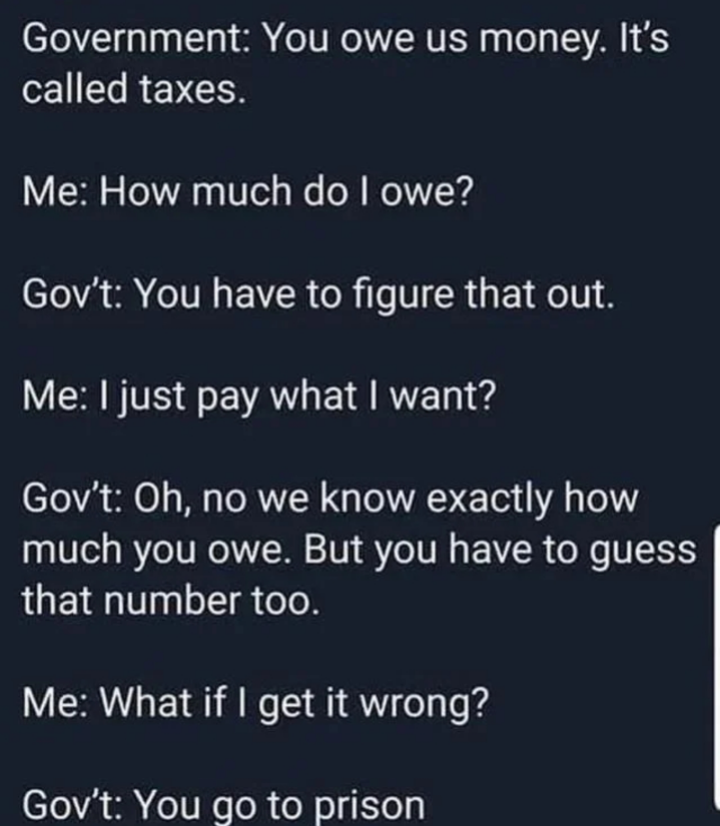

Scottish here. Apart from a brief time being self employed I have never needed to look at how much I have paid in taxes, it all gets done automatically by my employer and I get a yearly update through them.

No idea how you all do them.

It's incredibly stressful. I get about 3-4 months to do them, depending on how quickly I get all the necessary forms. If I don't pay in time the IRS fines me 25% of my taxes as a late payment.

Figure I typically put in about 40 hours per year to do my taxes, AND I HAVE TAX SOFTWARE!

Wow, your situation must be complicated. With TurboTax or FreeTax it doesn't take me more than a couple hours - and I've never used the short form.

We even have this in Ukraine. I guess our quality of life is still higher than the US.

What we generally do is pay for other people or programs to do it for us.

It's done automatically in the US too, as far as it can be. Income tax is withheld from our paychecks based on a form we fill out, where we say if we're single or married and how many dependents we have. But the formula used to figure out how much to withhold for tax can't anticipate things we do during the year that change our taxes - for example, charity donations, investment income, or using our own cars for work purposes. So we have to do a final figuring.

Also Scottish. I recently came into an inheritance that I had to pay some tax on. It was a wild ride working out how much. After a good long while in a phone queue I was directed to the correct online form, gathered all the relevant documents etc and just worked my way through it. It turned out I owed a lot less than I thought, hurrah! Everyone I spoke to was lovely and helpful, and although it was difficult (I'm crap at maths) it was a weirdly positive experience.