this post was submitted on 12 May 2024

53 points (86.3% liked)

Housing Bubble 2: Return of the Ugly

380 readers

1 users here now

A community for discussing and documenting the second great housing bubble.

founded 9 months ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

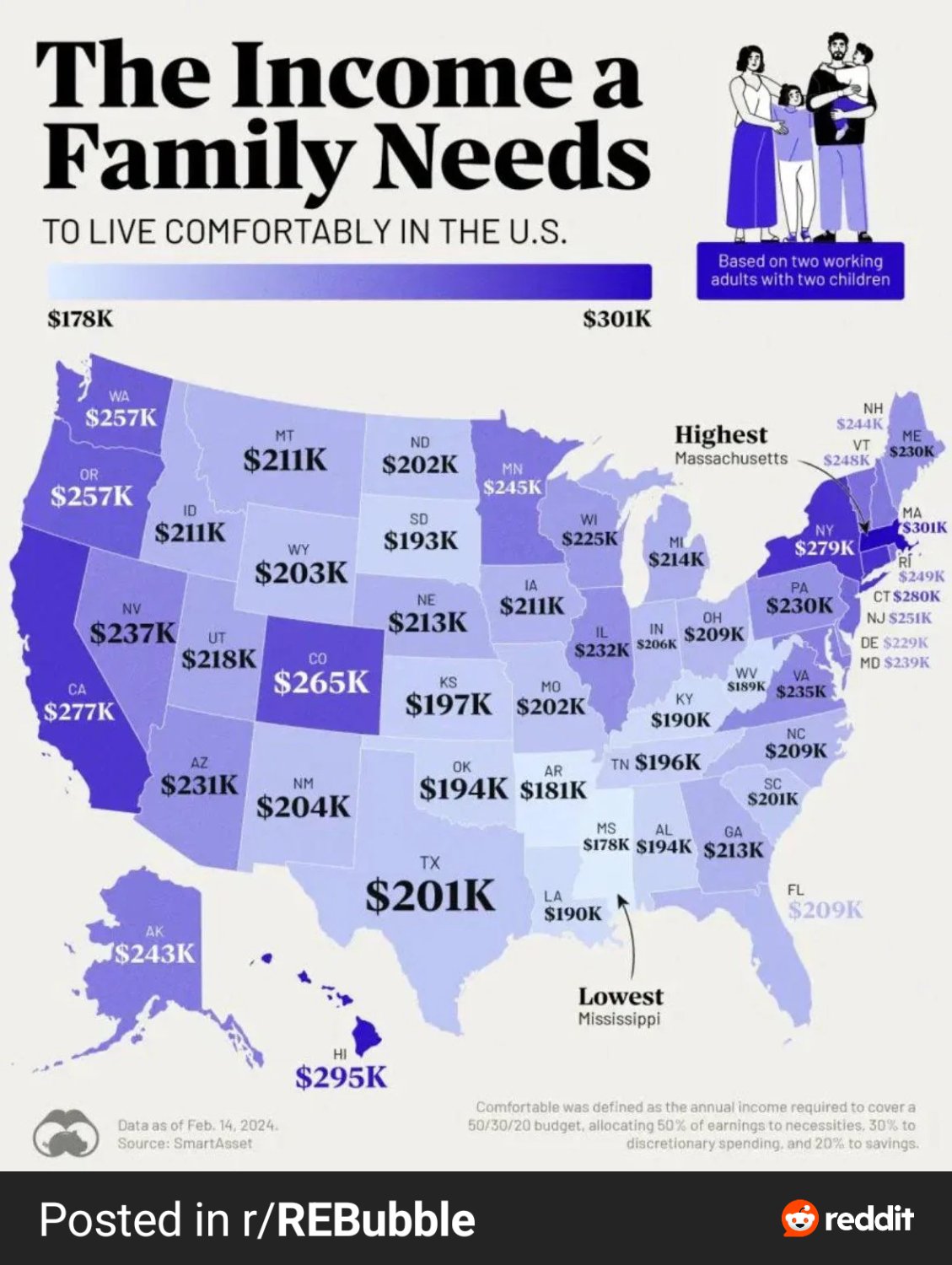

I don’t know how they defined “comfortably”, but you could live pretty well below that. Massachusetts seems awfully high, but we also have a lot of well paying jobs. As a software engineer, I’ve been able to providing well for my family with much less than that and despite living near Boston. Maybe I’m biased as the demographic that already owns a house, and that’s much harder to do now, I don’t know.

However, yeah, if you marry someone in your field, the household income of two software engineers is above that and you’ll be quite comfortable. This puts into perspective how so many co-workers can afford daycare, while for us it was cheaper for my ex to stay home

Yeah, housing is a huge factor. I managed to buy a house in a lower-cost area about a decade ago. It's the only reason my family can survive on one income.

They are saying like $19k per month in my state, that is over 5x the median income. That is absolute financial security level of comfort, the only financial strain you would have is because of income creep and/or trying to keep up with the Joneses.

Their definition of "comfortable" is in the lower right corner. It is a 50/30/20 budget. 50% on necessities, 30% on discretionary spending on 20% on savings.

Wow, 20% savings! Yeah, that’s pretty comfortable, I don’t think I’ve ever known anyone to do that on a regular basis. Of course, as you earn more that quickly becomes lifestyle creep

those numbers are radically different if they are 50K vs 500K. and generally that rule is only for those of us on the lower end of the spectrum.

if you're pulling in 500K a year you and spend 70% on necessities you still have 150K in disposable income.