this post was submitted on 25 Jan 2024

947 points (99.1% liked)

People Twitter

5283 readers

2187 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a tweet or similar

- No bullying or international politcs

- Be excellent to each other.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

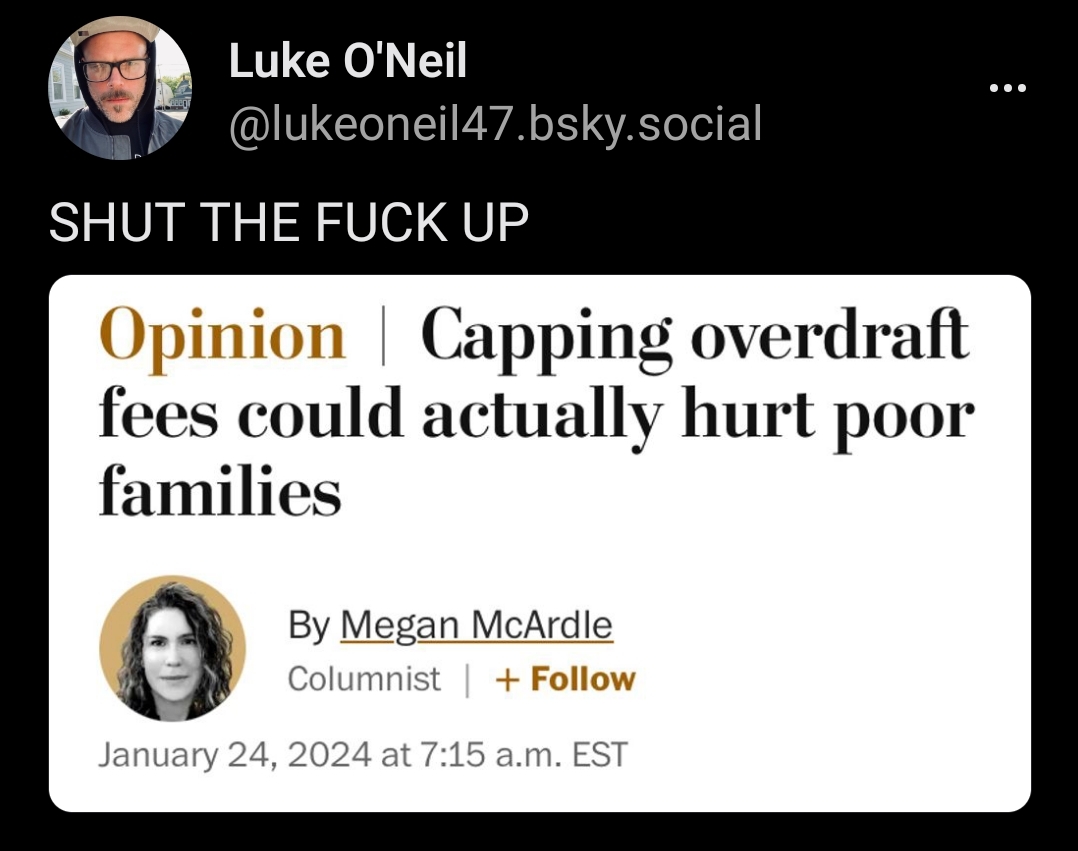

Fucking how? What strange form of logic does this idiot use?

I didn’t read the article, but I can chime in with this little anecdote.

I had a friend who took those stupid expensive payday loans forever. I told him I’d pay it if he swore to never take one again. I paid it, he stopped taking the loans.

Later he discovered that near the end of the month he could take 200 bucks out of the ATM and overdraft his account for 35 bucks and as soon as his check deposited he was in the clear. He literally survived like that forever. He was disabled, fell from a roof and shattered his legs. He didn’t have much money. It would have been better if he had been able to get ahead, but he couldn’t. The bank gave him 30 days to get his account in order.

I would imagine she goes on about that kind of thing in the article. It could actually be better for poor people who survive that way if the fees are capped, but I would imagine that the banks will find a way to make their money anyway. I’d say some people are worried that accounts that don’t have a lot of money just won’t be allowed to overdraft anymore, but I doubt that. Banks currently make a lot of money making poor people poorer, that’s for sure.

Shit. If there were only these communication devices we all had on us that could let us know if we go over any time it happens.

Reminds me of the dude on Lemmy the other day defending Comcast early termination fees

I have definitely avoided much bigger late fees via overdraft when I was younger. There's a middle ground here between predatory fees and getting fucked over a few pennies imo. Let people run a negative balance and then defer the fees if the account goes positive again within a certain timeframe.

What the hell does avoiding a late fee for non-payment have to do with capping the maximum overdraft fee? If anything, a lower overdraft fee is even more beneficial in your scenario cuz instead of the $20 overdraft fee, you're only being charged $3 while still avoiding late fees.