Summary:

Extending Trump’s Tax Cuts and Jobs Act will have painful trade-offs for the U.S. economy and most Americans.

Key Findings:

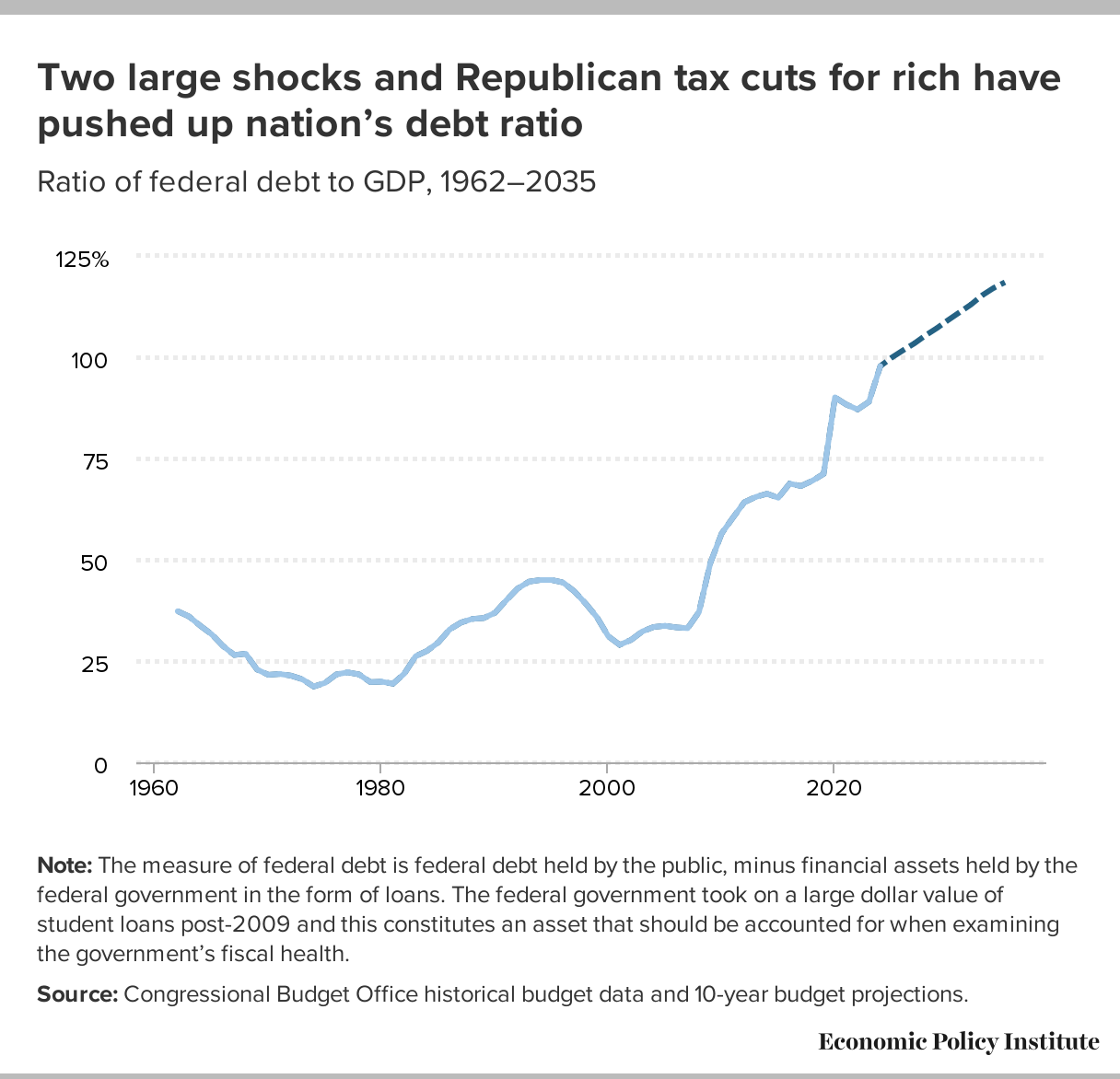

The U.S. “fiscal gap”—how much taxes need to be raised or spending cut to keep public debt stable as a share of gross domestic product—was entirely created by the Republican tax cuts of 2001, 2003, and 2017.

The “tax gap”—the amount of taxes owed but not paid each year—is currently larger than the overall fiscal gap. It is driven by the richest U.S. households and businesses cheating the law and underpaying taxes.

Extending the expiring provisions of the 2017 Tax Cuts and Jobs Act (TCJA) would increase the fiscal gap by nearly 50%, from 2.1% to 3.3%.

No matter how these tax cuts are financed, the result will hurt most working families, especially low-income households. The most damaging way to finance TCJA extensions would be with spending cuts for programs like SNAP or Medicaid.

Given today’s historically low unemployment rate, deficit-financed tax cuts are more likely to put a drag on growth going forward.

Why this matters

If these tax cuts for the rich are financed by large spending cuts, this would greatly damage current incomes and future opportunities for the most vulnerable families in the U.S. Cuts this large would also, all else equal, drag sharply on economy-wide spending, reducing it by roughly $600 billion, or around 2% of overall GDP. This drag would be large enough to force the Federal Reserve to cut interest rates essentially back to zero to avoid a recession, giving the Fed no further room to cushion the economy against other shocks.

How to fix it

Expanding public investment and raising federal revenue via taxes that mostly come from high-income households is the most optimal way to close fiscal gap, boost economic productivity, and produce a fairer economy. If TCJA expansions for the rich are inevitable, this leaves three options: running deficits, increasing regressive taxes (in the form of tariffs, for example), or spending cuts. While none of these options is ideal, running deficits has the potential to be less harmful for American families, whereas regressive taxation and spending cuts will categorically cause the most harm.

Charting the problem

The more they consolidate wealth the less complicated the inevitable redistribution will be.