this post was submitted on 20 Jan 2025

389 points (95.8% liked)

Funny: Home of the Haha

6256 readers

285 users here now

Welcome to /c/funny, a place for all your humorous and amusing content.

Looking for mods! Send an application to Stamets!

Our Rules:

-

Keep it civil. We're all people here. Be respectful to one another.

-

No sexism, racism, homophobia, transphobia or any other flavor of bigotry. I should not need to explain this one.

-

Try not to repost anything posted within the past month. Beyond that, go for it. Not everyone is on every site all the time.

Other Communities:

-

/c/[email protected] - Star Trek chat, memes and shitposts

-

/c/[email protected] - General memes

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

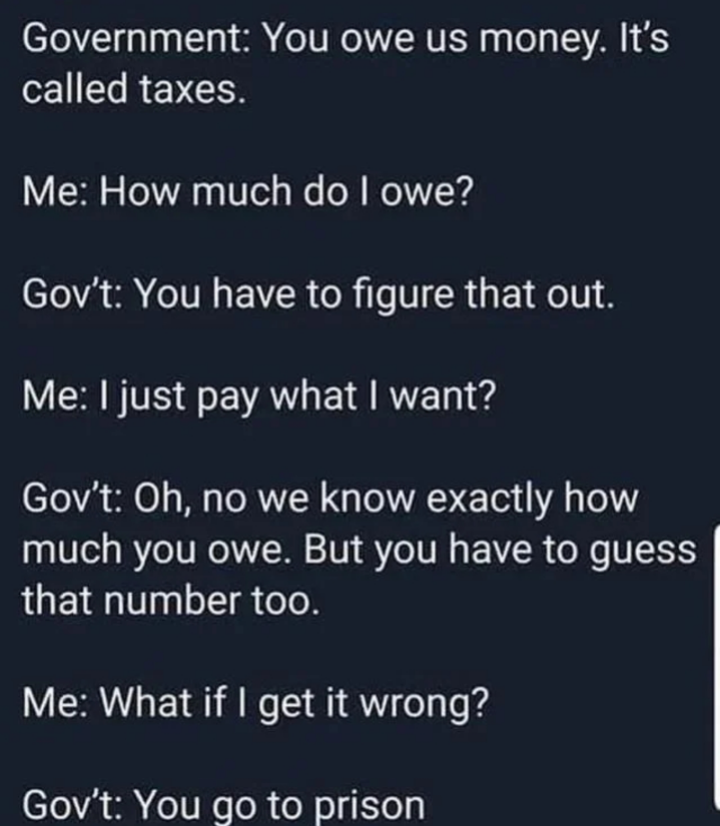

The IRS does not know how much you owe. They can figure it out. This is what an audit is. They assume most people are honest and most people are. They use statistics to decide who to audit.

Do not get me wrong it is a stupid system. But there is no need to exaggerate how stupid it is.

Why don’t they?

It's underfunded. That's why they also don't audit rich people as much, because they can't afford to.

Lots of income can be under the table and aren't on the books. It's up to you to come clean.

They do know how much you owe, or can at least figure it out if you only work for one employer (who pays taxes) and you don't own any property. The tax setup is different if you're self-employed (there is no tax withheld automatically if your income is from your customers), or if you're self-employed AND work for one or more employers, or own properties (and what you do with those properties), or any combination of those things.

You can see how many possible scenarios there can be, so there's not really a one-size-fits-all solution. They can't possibly keep track of all of everyone's income streams and properties and all the other rules they have created, so they have to rely on individuals to self-report.