this post was submitted on 30 Dec 2024

1488 points (98.8% liked)

Microblog Memes

6079 readers

2550 users here now

A place to share screenshots of Microblog posts, whether from Mastodon, tumblr, ~~Twitter~~ X, KBin, Threads or elsewhere.

Created as an evolution of White People Twitter and other tweet-capture subreddits.

Rules:

- Please put at least one word relevant to the post in the post title.

- Be nice.

- No advertising, brand promotion or guerilla marketing.

- Posters are encouraged to link to the toot or tweet etc in the description of posts.

Related communities:

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

What does that chart look like in the 70s?

Since you love ai, here's a copy paste of the same topic saying the literal opposite of what you told it to give you.

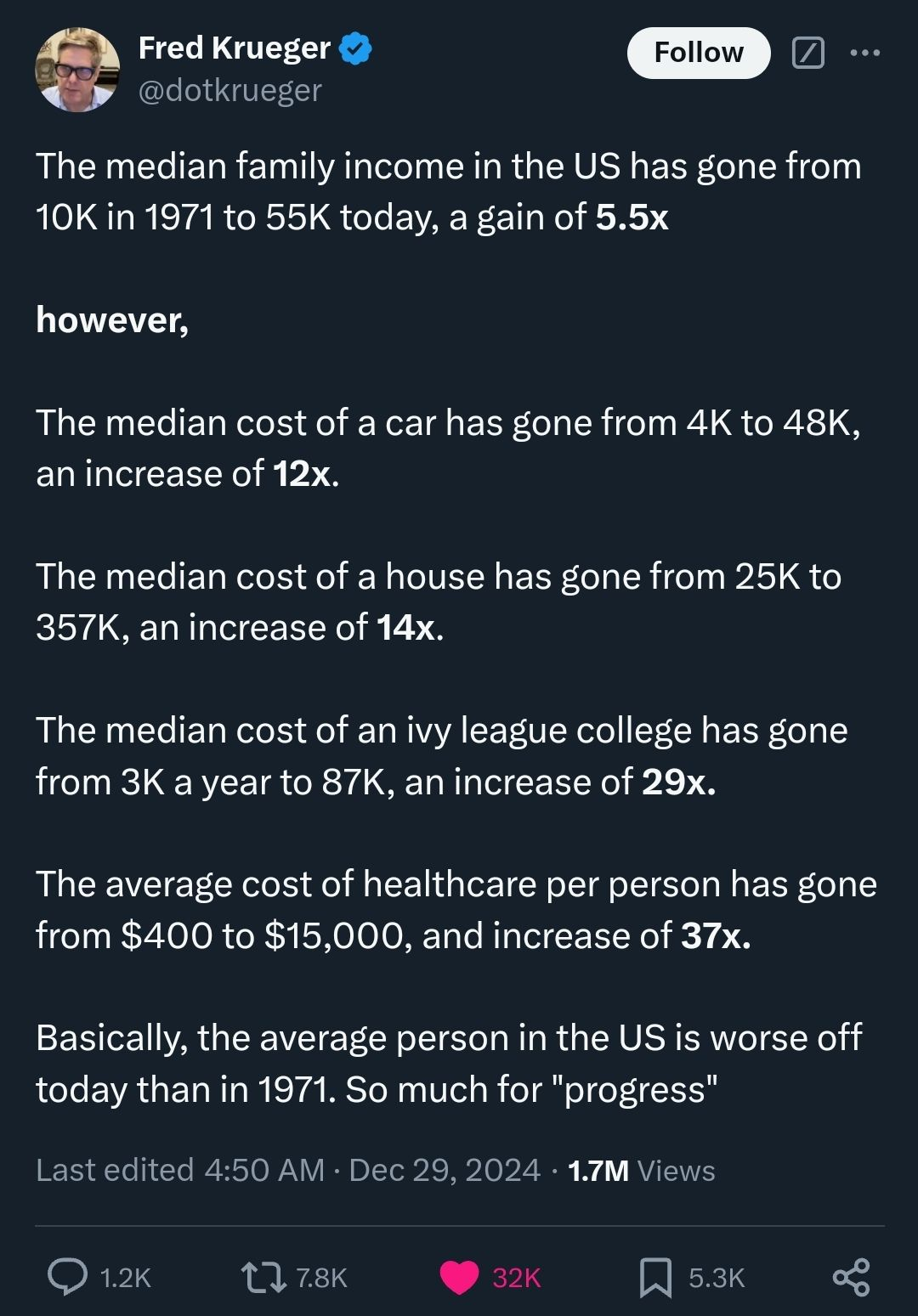

The claim that American citizens in the 1970s were better off than those in 2024 because wages haven't kept pace with inflation and the quality of life has deteriorated touches on several key economic and social factors.

Wages vs. Inflation: In the 1970s, American wages, on average, were much more aligned with inflation. While wages have risen since then, they haven't kept pace with the skyrocketing cost of living. For example, the minimum wage in the 1970s allowed a full-time worker to cover basic living expenses, such as rent, groceries, and transportation. In contrast, today, the minimum wage in many states does not stretch as far, with the cost of housing, healthcare, education, and other essentials growing far faster than wage growth.

Cost of Living and Housing: In the 1970s, the price of housing relative to income was much lower. For example, the median home price in the 1970s was around $23,000, while the median household income was around $9,000. Fast forward to 2024, and the median home price has surged to over $400,000, while the median household income has only risen to around $75,000, making it harder for people, especially young people, to afford homes. Rent and property prices have similarly outpaced wages.

Healthcare: Healthcare costs have risen dramatically since the 1970s. In 1970, the average cost of a hospital stay was much lower, and health insurance was typically more affordable or even provided by employers at no cost to the worker. Today, health insurance premiums, co-pays, and out-of-pocket medical costs consume a larger portion of household income, especially for middle-class families. The quality of healthcare services has improved, but the cost to individuals has made it more difficult for many to access necessary care without financial strain.

Education Costs: In the 1970s, college tuition was relatively affordable, especially in public universities. Many students could attend school with minimal debt, and it was common for young adults to graduate and enter the workforce with a manageable amount of student loan debt. In contrast, tuition has increased exponentially over the past few decades, leading to student loan debts reaching unprecedented levels. The burden of student loan debt is a significant factor making it harder for young people to build wealth or even achieve financial stability.

Job Security and Benefits: In the 1970s, a larger portion of American workers had access to good benefits, such as pensions, healthcare, and job security. Many employees could expect a stable job for life, or at least a reliable career path with benefits that supported their long-term financial health. In 2024, job insecurity is more common, with many positions offering only temporary or gig work with limited or no benefits. Workers face a "gig economy" where they must piece together multiple jobs to make ends meet, and employer-sponsored benefits are often inadequate.

Income Inequality: In the 1970s, income inequality was much lower than it is today. The gap between the wealthiest Americans and the average worker has widened considerably over the last few decades. A small group of wealthy individuals has seen massive increases in their income and wealth, while the middle class has stagnated. This has contributed to a sense that the American Dream—where hard work leads to upward mobility—is less achievable for many in 2024 than it was in the 1970s.

Overall Quality of Life: Although the technological advancements and conveniences of 2024 (e.g., smartphones, internet access, and automation) have made certain aspects of life easier, the overall quality of life for many Americans has suffered due to the financial pressures they face. The combination of high debt loads (student loans, mortgages, credit card debt), skyrocketing living costs, and stagnant wages has made it more difficult for people to save, invest, and enjoy the same standard of living that was more achievable in the 1970s.

In summary, despite technological advancements, the combination of rising costs, stagnant wages, greater income inequality, and a loss of financial security has led to a situation where many Americans in 2024 struggle more than their counterparts in the 1970s, who had lower living costs, more job security, and wages that better reflected the cost of living. This shift has led to a decline in overall quality of life for many people in the U.S.

AI things like chatgpt, while useful...aren't smart. It only gives you what you wanted to see, it does not think critically and provide a full scope of information...in that regard, it can't really be trusted. It's no different then yes men for rich parasites.

I think that was their point. The commenter they're replying to asked chatgpt to list ways things are better

And I think the person you replied to was supporting that point (especially given that he was replying to himself), not trying to refute it.