Late Stage Capitalism

A place for for news, discussion, memes, and links criticizing capitalism and advancing viewpoints that challenge liberal capitalist ideology. That means any support for any liberal capitalist political party (like the Democrats) is strictly prohibited.

A zero-tolerance policy for bigotry of any kind. Failure to respect this will result in a ban.

RULES:

1 Understand the left starts at anti-capitalism.

2 No Trolling

3 No capitalist apologia, anti-socialism, or liberalism, liberalism is in direct conflict with the left. Support for capitalism or for the parties or ideologies that uphold it are not welcome or tolerated.

4 No imperialism, conservatism, reactionism or Zionism, lessor evil rhetoric. Dismissing 3rd party votes or 'wasted votes on 3rd party' is lessor evil rhetoric.

5 No bigotry, no racism, sexism, antisemitism, homophobia, transphobia, ableism, or any type of prejudice.

6 Be civil in comments and no accusations of being a bot, 'paid by Putin,' Tankie, etc.

view the rest of the comments

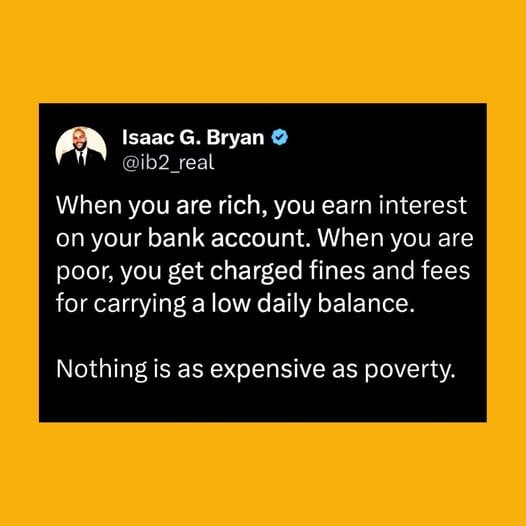

Yes. Now can you explain how it's not penalizing the poor? Like explain the difference between "giving a benefit only to the rich" and "punishing the poor"

Because I'm tired of people saying that this shit isn't fucking intentional.

The rich do not benefit at all. Banks make a profit by using money from the accounts of the rich. Charging a fee for a low account balance was only done to encourage customers to keep money in the account so that banks could profit from it.

Except for the $12 billion in overdraft fees alone per year. They don't benefit except for that, you mean, right? And the other fees related to low balance. And the fact that they use your own money to lobby against your rights..?

They don't benefit at all. Nope. Nuh uh.

https://www.consumerfinance.gov/data-research/research-reports/data-spotlight-overdraft-nsf-revenue-in-2023-down-more-than-50-versus-pre-pandemic-levels-saving-consumers-over-6-billion-annually/

They do benefit though - they gain liquidity. If they'd keep all their money in direct investments, they wouldn't be able to use it - so they have to keep some of it in a form they can utilize. Doing it in a bank account allows them to still get some revenue (not as much as an investment firm would give them, but still more than zero)

Both sides of an arrangement can benefit from it. I don't understand what this concept is so alien so some people, and I don't see the point of focusing on this aspect of the post instead of the more interesting one - they poor getting charged fees for not having enough money.

You made a point that the bank loses money on low balance accounts, which seems reasonable (the bank does enjoy the economy of scale, but there are still minimum costs for dealing with each customer as an individual) as long as you stress out that this is before the bank takes these fees.

So, the real questions is why should a poor person even have a bank account? The main purpose of a bank is to provide liquidity while still investing they money - but the poor don't have enough money to invest, and cash is just a liquid and doesn't incur low balance fees. Is there something systematic that forces them to use a system they only lose from?