this post was submitted on 09 Aug 2024

50 points (98.1% liked)

InsanePeopleFacebook

2695 readers

149 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

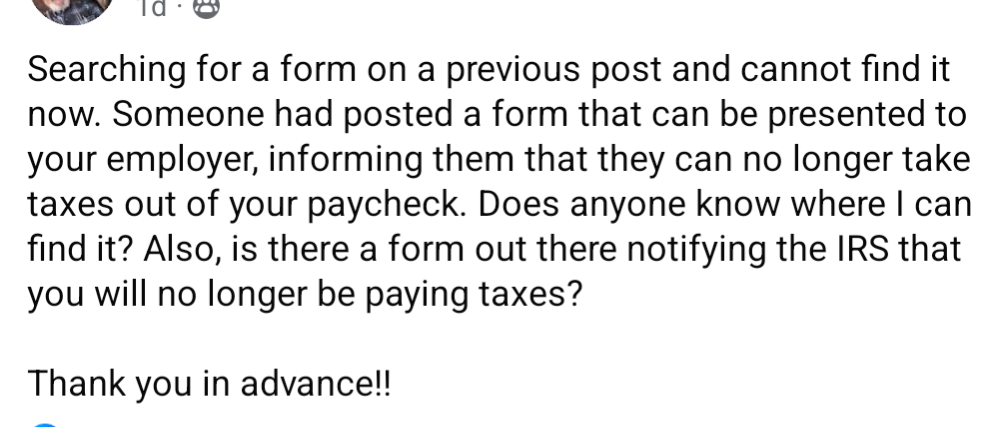

Isn’t that the exemption thing anyone can do with their employer’s payroll system? Doesn’t mean you don’t have to pay taxes, just that your employer won’t withhold it and you have to pay it yourself before the tax deadline. I mistakenly did that when I moved and first worked here and was shocked by the amount I owed when I did my taxes. lol

I’m not sure about exemption, but I know you can put as many dependents as you’d like on your W-4, reducing the amount withheld. Just like you said, this affects withholding only and has no bearing on the taxes you’ll owe in April.

It’s a good idea to adjust your withholdings so you break even in April. Big refunds seem nice until you realize you gave the government an interest free loan with money you could’ve put to work for you.

Right up front here - I am not suggesting that sovcits are in any way correct in their weird opinions on how anything works.

But --

You can have your employer not withhold taxes; your taxes are your responsibility. But many employer payroll departments will balk at that and tell you "they can't do that," probably because it's such an unusual thing for people to want to do that they don't want to deal with the hassle of it.

Of course, doing so is likely to raise a flag with the IRS. Pay your taxes.

No, you’re missing the part where you get to play by a different set of rules. /s

That used to be common when bank accounts were giving high interest rates. You could save money by paying taxes quarterly (at the minimum amount so you wouldn't get a fine) and keep that money earning.

You can still do it today with a money market account.