It looks like he could've dodged this by not making a lot of the decisions he made. It was definitely a bad move for him to wire crypto to bank accounts tied to businesses. It also looks like this became a big issue when he decided to go through expatriation, which required him to report and pay taxes for the capital gains. A law firm allegedly told him to "pretend" that he sold almost everything, leading him to not report any Bitcoin for both his assets and taxes, which seems like the 'law firm' was literally telling him to do fraud; he still went through with that despite how fishy it sounds? Can't help but feel like any legal firm telling you to "pretend" anything is a scam... It seems like he brought a lot of this on himself, but it also shows how deeply the IRS will dig their claws into you if they smell a couple million dollars.

Indictment PDF: https://www.justice.gov/opa/media/1350116/dl?inline

https://www.justice.gov/opa/pr/early-bitcoin-investor-charged-tax-fraud

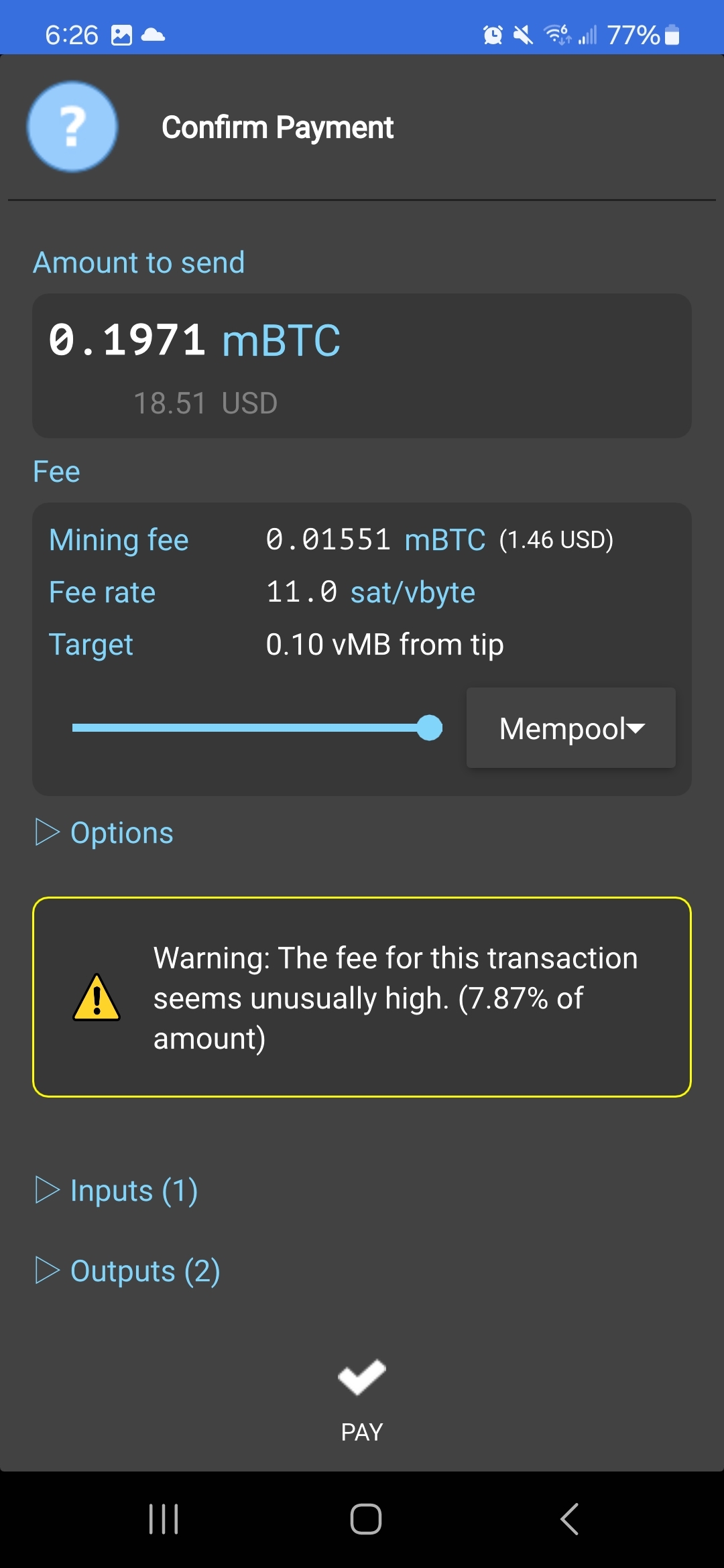

Whoever is saying $7 above is deliberately misleading you.

Whoever is saying $7 above is deliberately misleading you.