this post was submitted on 24 Nov 2024

-5 points (39.1% liked)

cryptocurrency

179 readers

1 users here now

cryptocurrency

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

It looks like he could've dodged this by not making a lot of the decisions he made. It was definitely a bad move for him to wire crypto to bank accounts tied to businesses. It also looks like this became a big issue when he decided to go through expatriation, which required him to report and pay taxes for the capital gains. A law firm allegedly told him to "pretend" that he sold almost everything, leading him to not report any Bitcoin for both his assets and taxes, which seems like the 'law firm' was literally telling him to do fraud; he still went through with that despite how fishy it sounds? Can't help but feel like any legal firm telling you to "pretend" anything is a scam... It seems like he brought a lot of this on himself, but it also shows how deeply the IRS will dig their claws into you if they smell a couple million dollars.

Indictment PDF: https://www.justice.gov/opa/media/1350116/dl?inline

https://www.justice.gov/opa/pr/early-bitcoin-investor-charged-tax-fraud

https://www.justice.gov/usao-cdca/pr/early-bitcoin-investor-known-bitcoin-jesus-indicted-allegedly-committing-tax-fraud-and

This is not about the IRS smelling millions, if it was they would have gone after him years ago. This is political, the established order are terrified of the information he is spreading and activism he is engaged in.

Right after he released his very popular book called Hijacking Bitcoin on how BTC was taken over by banker interests and it's technology crippled so it could not be used as a payment system which is far superior to banker controlled legacy currency, they pounced on him. The IRS is a criminal mafia organization, and the "income tax" is slavery by definition.

This is must see information for anyone who thinks they know something about Bitcoin, your face will melt when you find out the truth.

Hijacking Bitcoin: by Roger Ver https://odysee.com/@Pantera:f/HijackingBitcoin:7

Right, it's not about the IRS smelling millions, it's about him wiring crypto to businesses he owned and him not reporting it on his taxes during expatriation. It's all in the indictment papers. Pretty bog-standard tax fraud, nothing really out of the ordinary or exciting.

Again if it was simple "tax fraud" they would had engaged him about it in less than a year after the fact. This was 10 years ago. The criminal state is using the IRS mafia and trying to retaliate against someone threatening their criminal enterprise.

Tax issues are not criminal offences, you cannot exact violence against someone because you believe they owe you money. Scumbags do this, hence the state is a scumbag cabal.

Yeah, on the one hand I agree with your sentiment, but on the other hand it's not that simple. Nothing in the government ever moves quick, and the IRS loves to give you plenty of time to dig your own grave as deep as you want.

https://www.taxnotes.com/featured-analysis/immaculate-expatriation-bitcoin-jesus-and-exit-tax/2024/05/10/7jhlf

The article above goes into more analysis about this situation, and includes a great quote that rings to what I previously mentioned:

"Here’s a useful trick for highly affluent readers who are desperate to avoid the exit tax: Live wherever you want, but don’t renounce citizenship. The constructive sale of assets and resulting taxable gains probably aren’t worth the trouble. Above all, don't paint yourself into a corner by renouncing your citizenship and then calculating what your exit tax will be. The benefit of performing the calculation first is that it can influence your decision as to whether renunciation is worth it."

That is good info and advice but people have to start pointing out that the US is run by criminal thugs and they have designed an oppressive system to keep you from escaping, with immensely complex rules to make sure they can execute violence against you at a later date if they please.

Roger Ver mattered for Bitcoin adoption over a decade ago. He hasn't mattered since the bcash scam.

Sound like some religious maxi sentiment. Objectively Bitcoin Cash is a much better coin than BTC.

BCH upgrades have blown past BTC, BTC is now looking like the scam - https://minisatoshi.cash/upgrade-history

Do you remember saying "the market will decide" in the years before the split? This conversation makes me nostalgic.

The market decision is currently based on censorship and propaganda. Don't be a lemming be a market maker.

It's a good thing that these adversaries willing to lose infinity money to trick you aren't paying your miners to do anything bad.

The miners are just waiting for BCH to recover and they will jump over to it ASAP. The future of BTC is shaky because it will require crazy price increases to be sustainable due to the sabotaging of the tech rendering it useless as a currency. BCH can process millions of transactions per day which will sustain miners in the long term.

What evidence would make you think BCH has failed and you might be wrong about something? Fewer than [some number] on-chain transactions per year?

As long as BCH upholds the original design of Bitcoin, which is peer to peer decentralized e-cash then it has not failed. BTC has already failed in that purpose. When will you admit this?

Still works fine on my machine, and it's gotten a lot more popular, so saying that it's failed sounds pretty outlandish at this point.

Since I'm arguing that market evidence is useful, I would admit BTC has failed once BCH/BTC >> 1 for a few months.

BTC fees shoot up every couple months and it becomes completely unusable and you just have to wait a week for it to clear out, this is a currency that has failed. The price mania is fueled by people who have never sent a bitcoin transaction, they just hit the buy button on an exchange, they do not yet realize what they are buying is a fake. Eventually reality will set in when BCH dominates the transaction volume and it becomes obvious that BTC is fool's gold.

Not really, no. I use my phone and cold storage all the time.

You were saying...?

On the Electrum client on my phone, it's $0.53 for on-chain and basically free for LN.

and sometimes it's $5, then there is a requirement to wait for confirmations which BCH does not have thus makes payments instant as Bitcoin was designed to have. The point is BTC is crippled on purpose to be unusable as a reliable payment system as not to threaten the bankers monopoly over currency.

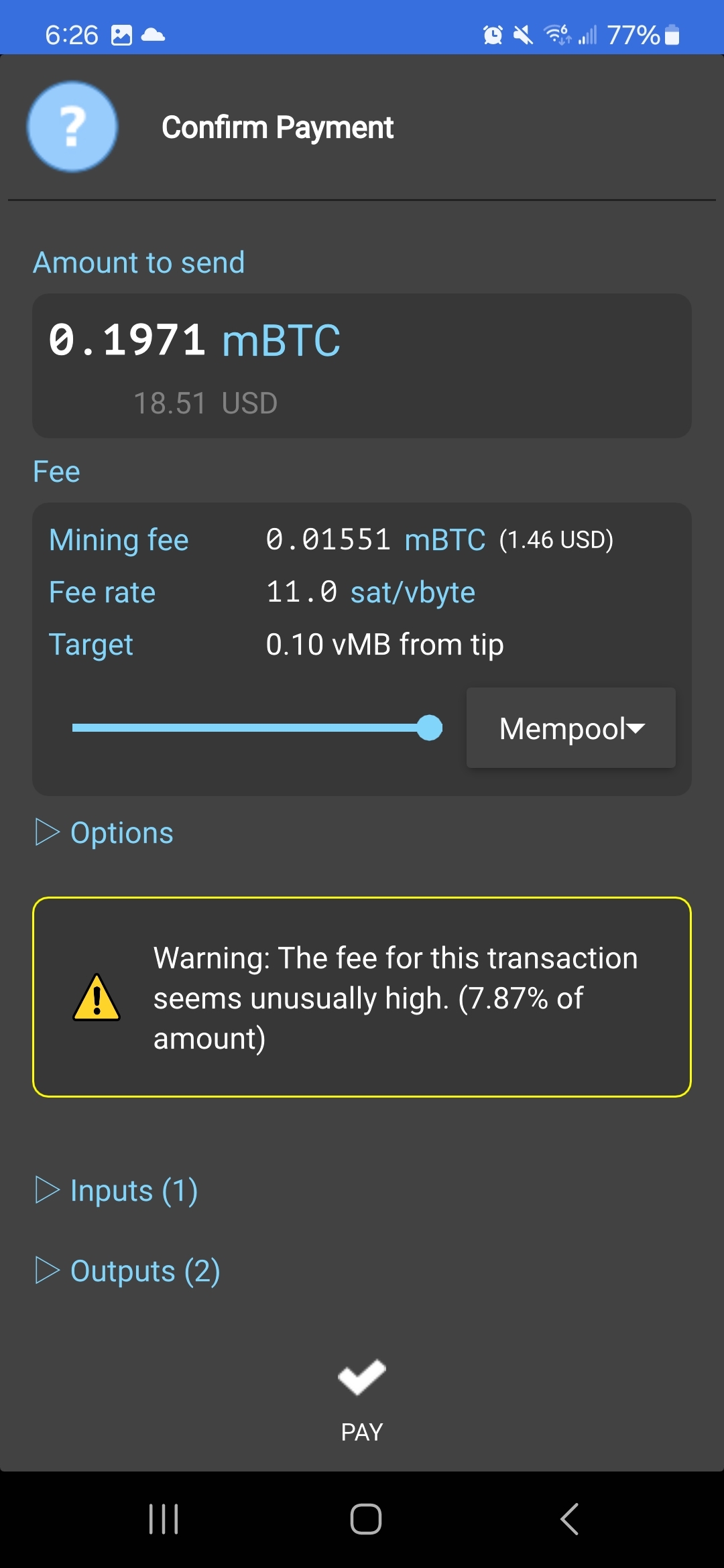

No it's not. I've never paid $5 for a transaction in all these years because that is not how the mempool works. Here's a screenshot from literally right now with it cranked up all the way to next block. Whoever is saying $7 above is deliberately misleading you.

Whoever is saying $7 above is deliberately misleading you.

0-conf was never secure; you guys just declared it so because you have no L2.

Bro. It's nearly a decade later. All time high. LN is working. Gresham's Law still exists. It sucks to get scammed but we'd love to have you back. You don't have to do this to yourself.

LN is total trash and does not work 50% of the time and will be fully centralized, which is the only way it can work 100% of the time. 0-conf is fully secure on Bitcoin Cash use it all the time with no issue.

No need to check mempool when using the real bitcoin, you just send and it works 100% of the time with minuscule fees.

The BTC narrative is falling apart as people who can still think see the chain going nowhere in innovation. Price is pumping because ignorant fools are pilling in at ATH.

I would recommend converting some of your BTC for real Bitcoin ahead of the inversion.

It's extremely improbable that I've won that many 50% coin flips in a row - you're telling me about a UX that I just haven't gotten. I check the mempool when someone tells me I've been paying $7. Have the economics behind 0-conf/"first seen" changed on your end since the split?

It's just bizarre that you keep telling me it's more expensive than what I've been paying, and less reliable than I've experienced, as opposed to theoretical concerns ahead of time. FWIW I sold all my BCH immediately after the split. I listened to all these claims before they had been demonstrated false within the first year.

If you believe in the rationality of markets at all, how many years would it take to convince you that you were wrong?

My point is LN is not being used on a wide scale. If it were to be all the problems would be glaring. You have to be online to receive payments and you need money to receive money, just these two alone are a non-starter for 99% of people. Not to mention you have to run a BTC node and an LN node to open a channel, if LN is ever used it will be fully custodial. The LN whitepaper even says the base chain would need >100MB blocks for LN to work on a wide scale. It is a dead end and a stall tactic.

BTC has been diverted from the original plan of making it a p2p e-cash into "digital gold", every decision and advancement BCH has made improves the e-cash use case. I am of the opinion that bitcoin needs to have instant ant extremely cheap transactions that is why I am in BCH.

BCH has been under constant attack for years following the split, because BTC has been favored by the banking cartel with their unlimited resources, and had to split two times again because of bad actors, about 3 years ago things have settled and the tech has rocketed ahead, it is vastly superior to BTC. It will take some time but people that are in BTC who believe Bitcoin should be like cash will switch to BCH, especially as they see no real adoption and the failure of LN become obvious.

Once transactions are instant and near free on BTC then I will admit I was wrong.