this post was submitted on 23 Apr 2024

970 points (98.1% liked)

Comic Strips

14113 readers

3197 users here now

Comic Strips is a community for those who love comic stories.

The rules are simple:

- The post can be a single image, an image gallery, or a link to a specific comic hosted on another site (the author's website, for instance).

- The comic must be a complete story.

- If it is an external link, it must be to a specific story, not to the root of the site.

- You may post comics from others or your own.

- If you are posting a comic of your own, a maximum of one per week is allowed (I know, your comics are great, but this rule helps avoid spam).

- The comic can be in any language, but if it's not in English, OP must include an English translation in the post's 'body' field (note: you don't need to select a specific language when posting a comic).

- Politeness.

- Adult content is not allowed. This community aims to be fun for people of all ages.

Web of links

- [email protected]: "I use Arch btw"

- [email protected]: memes (you don't say!)

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

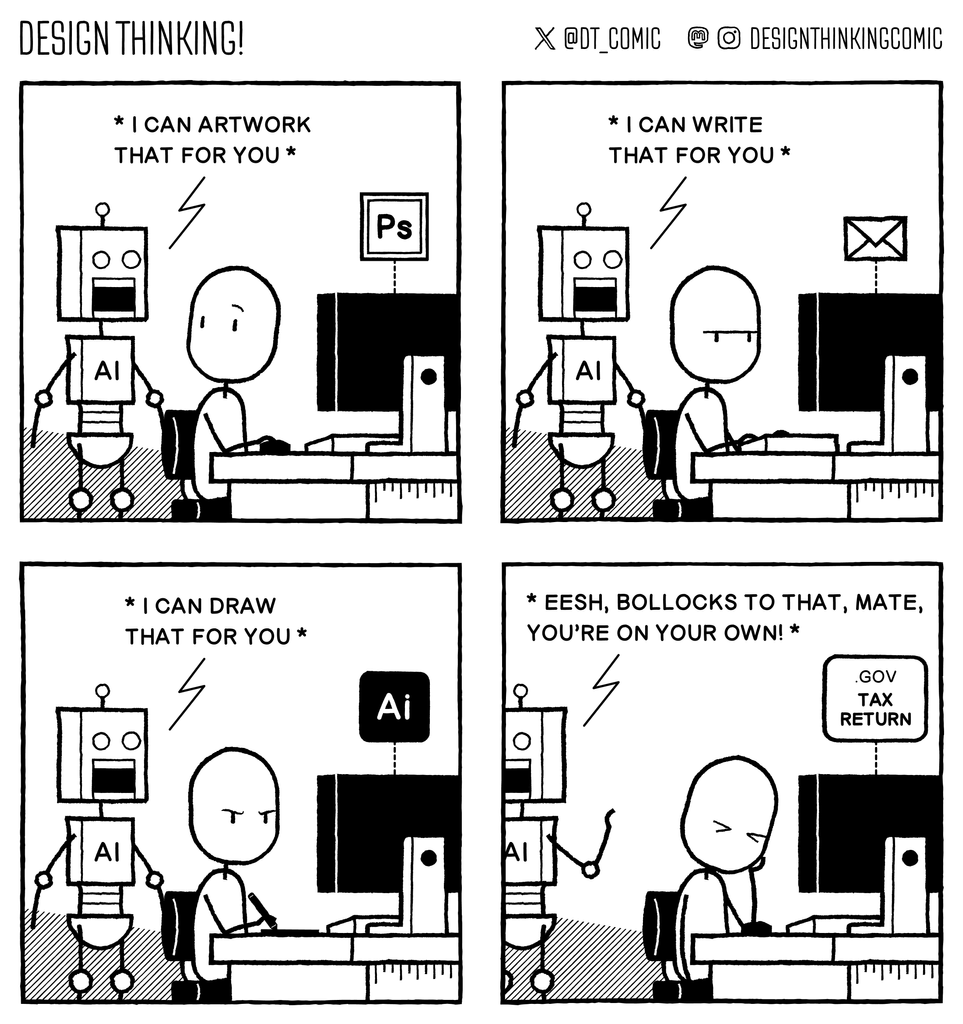

I agree with you but it's also a sorta. They don't know if you've done any under the table work that you need to report. With that said, they definitely could just have you log in securely with all your info already inputed and just have you double check and sign with the option to add more if needed. That's how the Australians do it iirc, just log in, check and sign.

“Under the table” sort of implies you won’t be reporting it. They know about 1099 type stuff, as well as getting reports from your brokerage and everywhere else.

90% of Americans the only real question is if you updated your w-4 or not to reflect recent changes as well as relevant deductions which probably should just go away. (I mean, seriously. I drive to work just factor in the average and call it good- don’t make me track mileage.)

If they don't know, they don't need to know.

Just send me the bill/refund according to what you know, IRS.

I agree with you. Could be way easier for us if it wasn't for lobbying.