this post was submitted on 22 Apr 2024

1034 points (81.4% liked)

A Boring Dystopia

10311 readers

1469 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

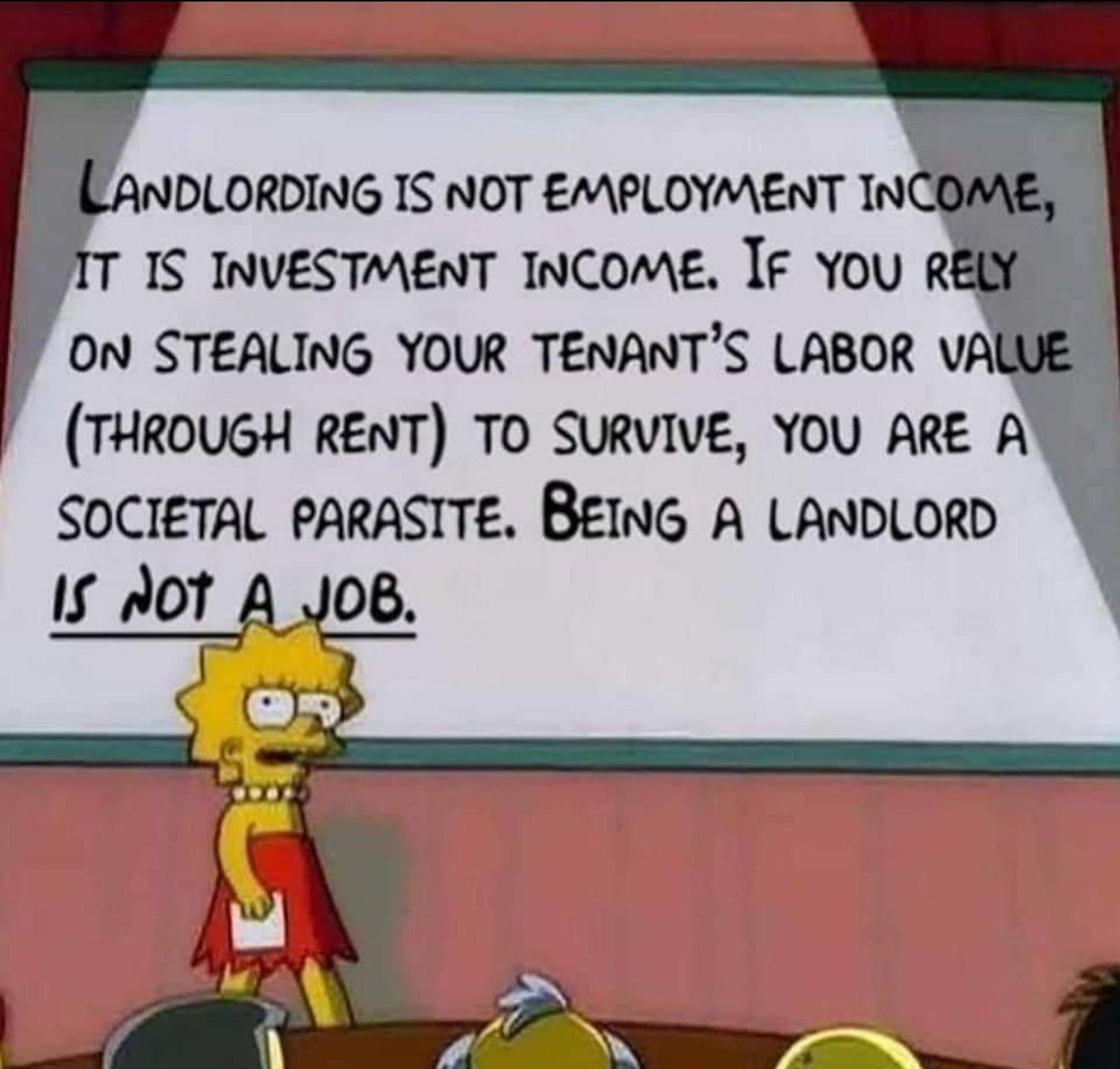

Depends on how the income is structured. You can own shares in a REIT that manages properties and count the dividends paid out as investment income.

We had interest rates as low as 2.8% APY within the last three years. States have been lowering property taxes steadily for the last decade, as prices skyrocketed. Depreciation doesn't lower the land-value, which is where most of the price inflation has occurred since the first big real estate booms of the 90s. And "renter interactions"? I don't even know what this is attempting to imply. Is cashing the checks costing you money?

Some of the biggest investments hedge funds have made since the COVID crisis have been in residential real estate. This, in a market where The Magnificent Seven stocks have performed 20-30%/year for several years. Someone who works for Warren Buffet clearly sees a windfall in landlord-ism that you're not seeing.

(In the US) divedends are taxed as ordinary income. REITs are required to disburse their profits to the shareholders as divedends.

Only buy-low, sell high appreciation is taxed as capital-gains.