this post was submitted on 16 Apr 2024

54 points (98.2% liked)

Denver

1204 readers

2 users here now

A place for discussions about Denver, CO.

Rules:

- No bigotry: Including racism, sexism, homophobia, transphobia, or xenophobia. Code of Conduct.

- Be respectful. Everyone should feel welcome here.

- No NSFW content.

- No Ads / Spamming.

- Be thoughtful and helpful: even with ‘stupid’ questions. The world won’t be made better or worse by snarky comments schooling naive newcomers on Lemmy.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

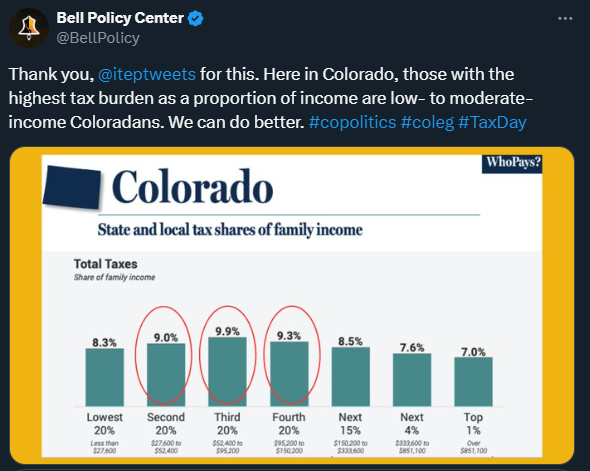

Edit: I have since realized that I am unsure on the calculation of tax burden is calculated for the chart.

I am skeptical of the representation of the data. My sense for ways to skew data is set off when making statements of segments of population when the segments are not comparable.

I would need a better understanding of the calculation of the values reported to be able to justify that the top 20% are split into smaller groups than they’re being compared to.

You can easily lump them together again and see that it would add up to 8.2% for the top 20% incomes. I think they’ve made subdivisions to highlight that it’s skewed even within that group, with the richer people having a lower tax burden.