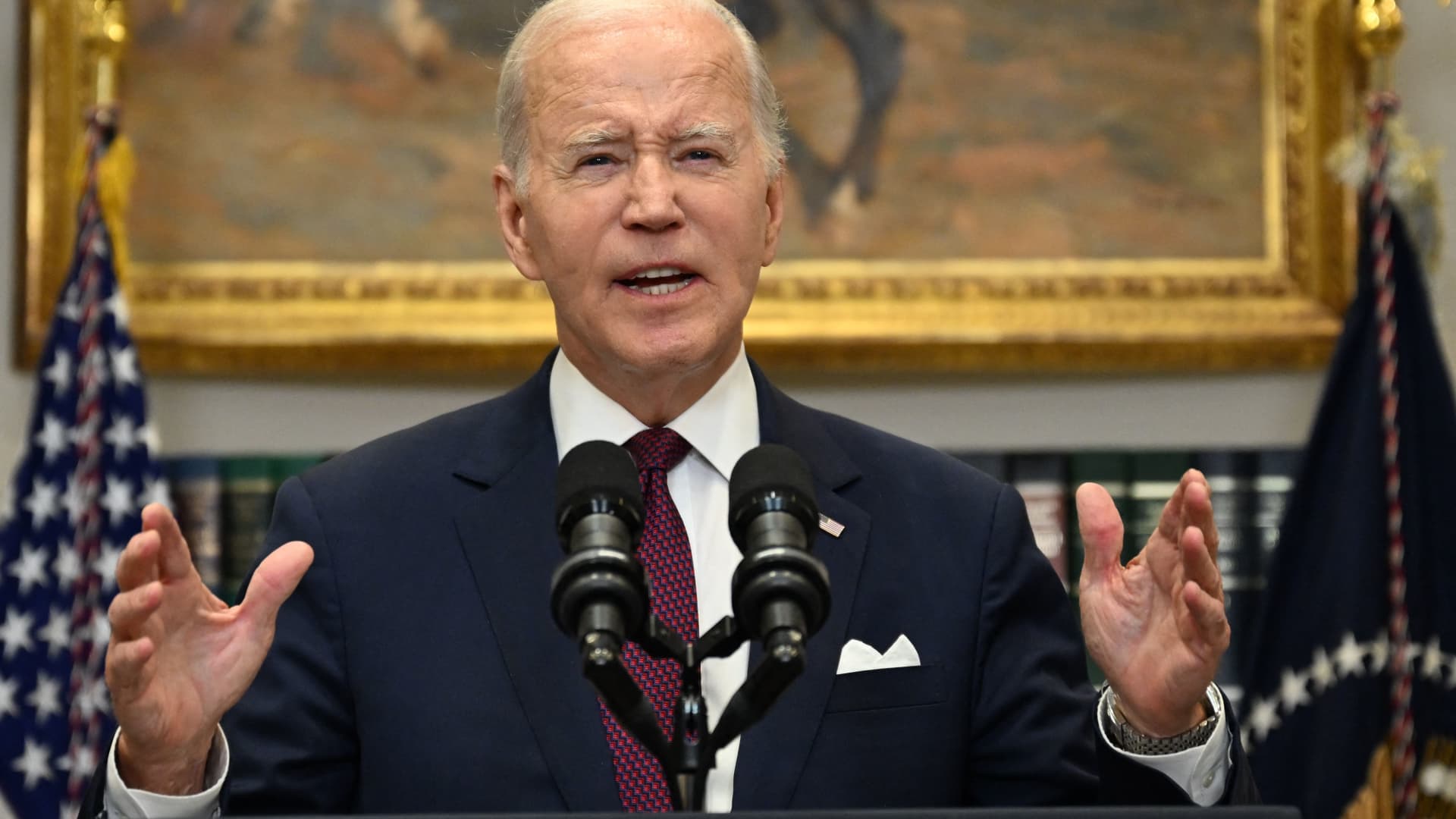

WASHINGTON — President Joe Biden said Friday he’ll give a second go at his student debt relief plan, rooting it in the Higher Education Act, after the U.S. Supreme Court ruled against his initial plan to forgive up to $20,000 per borrower.

“I believe the court’s decision was a mistake, it was wrong,” Biden said, speaking from the White House. “We need to find a new way and we’re moving as fast as we can.”

The Supreme Court ruled Friday in a 6-3 decision against Biden‘s plan to cancel up to student loan debt for an estimated 40 million Americans. The venture would have forgiven more than $400 billion in student loan debt, making it one of the most expensive executive actions in history.

Biden pointed to the greenlighting of the Paycheck Protection Program under former President Donald Trump, which cost an estimated $760 billion.

“The hypocrisy is stunning,” Biden said. “You can’t help a family making $75,000 a year but you can help a billionaire and have your debt forgiven? My plan would not only have been life changing for millions of Americans, it would have been good for the American economy.”

Biden said Friday he also has directed the U.S. Department of Education to institute a 12-month “on-ramp” period that would grant borrowers struggling to adjust to repayments after the three-year pause forgiveness for missing initial payments.

Biden stressed it is not an extension of the pause as payments will still be due and interest will accrue, but the Department of Education would not report failure to make payments to credit agencies for the first year.

Last summer, Biden announced his plan to cancel $10,000 in student debt for borrowers earning less than $125,000, or married couples earning under $250,000. Pell grant recipients were eligible for up to $20,000 in forgiveness under the proposal.

The Supreme Court ruling Friday places millions of student loan borrowers back at square one as the payments pause instituted at the beginning of the Covid-19 pandemic comes to a close in October. During the pause, implemented under the Trump administration, borrowers did not have to make payments on their loans nor did the loans accrue interest. source

Student loan interest is 0,25% here. The US has absurd interest and it is a system that should be broken. They prey on human frality