this post was submitted on 28 Jan 2024

160 points (96.5% liked)

InsanePeopleFacebook

2526 readers

310 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

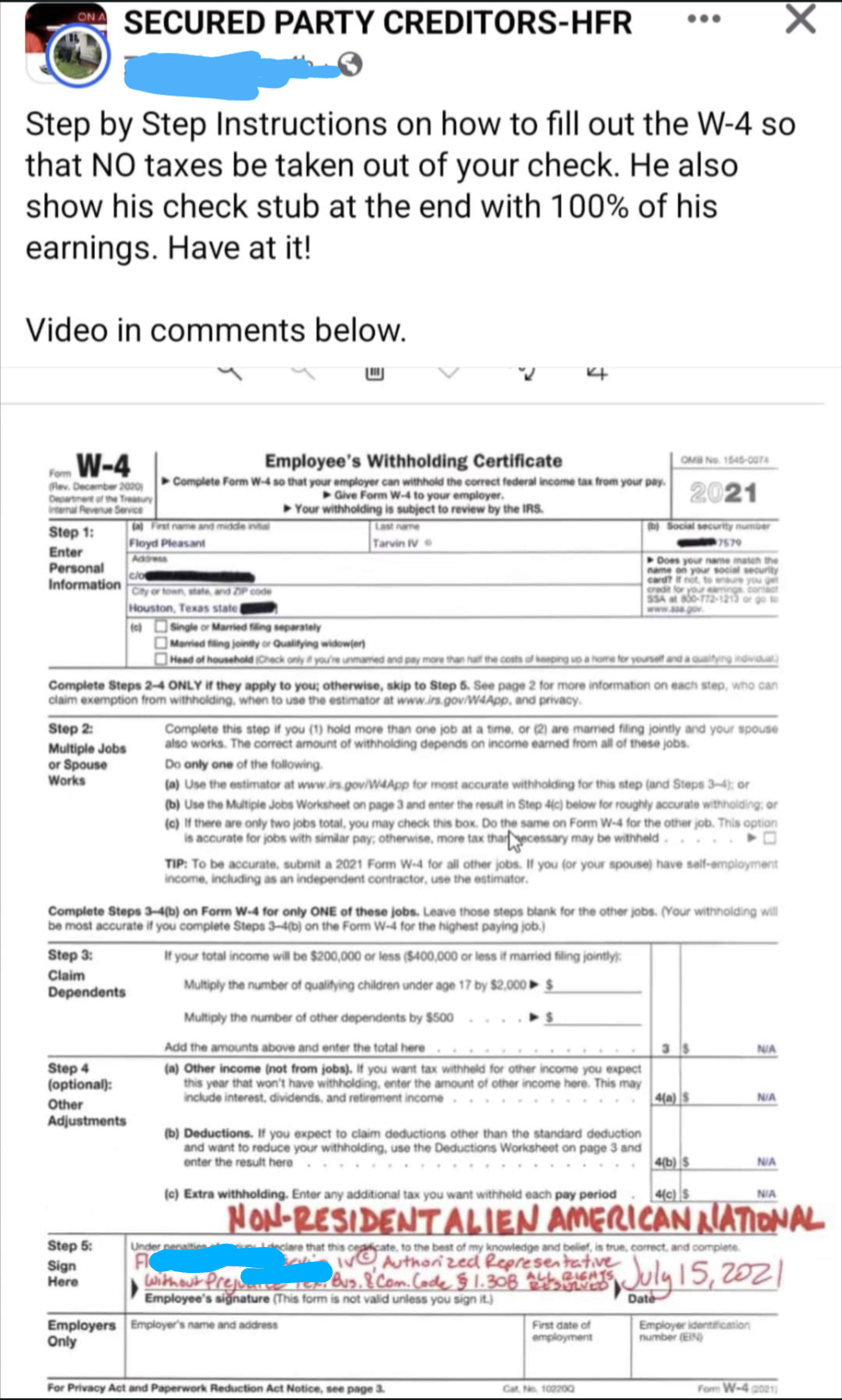

Yeah, it's called claiming ~~0 (zero)~~ exempt.

Not paying, but with the right information, seems a lot less risky (legally) than lying on IRS forms.

In fact, I'm pretty sure there's a bunch of fine print on those exact documents explaining how lying on them will "fuck yo shit right up".

Note: Exempt obviously doesn't mean you won't owe taxes, just that they won't be withheld automatically on your paychecks. It's also not uncommon in sales to go exempt for single large commission check, or bonus.

Edit: Mixed up max withholding and no withholding. Fixed now, my bad.

Isn’t it the other way around? Claiming zero means they take the maximum amount in taxes out. For every dependent you claim, they reduce the amount they take out. I’m sure there’s a cap but they guy probably thinks he can claim 99 and then not fill out his taxes.

FWIW the post-2020 Form W4 did away with picking a number of allowances. Now you write in a dollar figure comprised of multiples of $2000 and $500 as Step 4 states.

Seeing a low single-digit "number of allowances" written in Step 4 spotlights who read the instructions on the form and who didn't.