this post was submitted on 25 Jan 2024

947 points (99.1% liked)

People Twitter

5959 readers

2893 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a pic of the tweet or similar. No direct links to the tweet.

- No bullying or international politcs

- Be excellent to each other.

- Provide an archived link to the tweet (or similar) being shown if it's a major figure or a politician.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

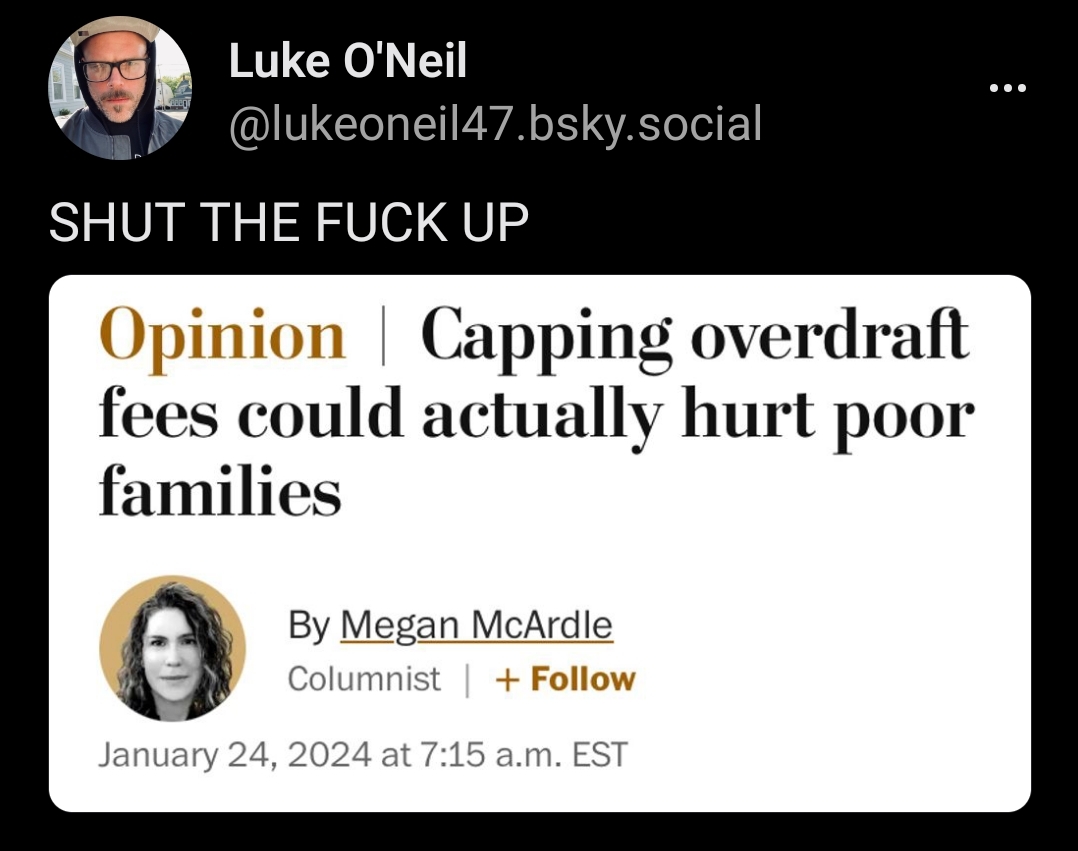

Crux of the argument?

Profit margins are very small on small personal bank accounts. If NSF fees are reduced, how ever will we profit from these tiny accounts?!

https://archive.is/ybfiw

One bank made only 49 billion profit last year, up from 48 billion in 2022. Why won't somebody think of the banks!?

Oh no, anyways credit unions exist and rarely have these issues

Credit unions would actually be impacted far more from this legislation than banks.

They don't have access to the same cash making options that large banks do, and credit unions are also non profit.

If their fee income was reduced, they would have to make up for it in other areas, such as higher lending rates, which affects more people than overdraft fees.

Personally, I'd rather deal with overdraft fees than have a higher rate for loans. If you learn to bank responsibly overdraft fees won't be an issue anyway.

Overdraft fees simply wouldnt be an issue if they didnt exist. Theres no reason a transaction shouldnt decline if there are insufficient funds. If you dont have the money then you dont have the money.

I’ll admit I’m ignorant to banking on a large scale, but the few banks I have used and worked for I’ve always had the option to just decline “overdraft protection” so indeed if I tried to make a $50 purchase and I had $45 in my account, it would just decline. Overdrafting has always been an optional service. Are there banks that force you to enable overdrafting?

Edit: now whether the choice is properly conveyed to people is another matter of course, I imagine many banks make it seem like a “good” thing or the default option.

You are correct it is optional but its defaulted to on then you have to listen to their spiel about how good it is for you before being able to turn it off. Even after you do so though it still doesn’t stop some recurring payments or charges so your account can still end in the negative and you typically get a charge for that if its in the negative enough (usually more than 5-10 dollars)

Yes, I agree that their spiels usually make opting out not seem like an option lol.

But I do what to point out this:

If you have not agreed to overdraft protection, they legally cannot charge you a fee if you end up overdrafting from automatic payments or another tricky one is gas pumps where some only charge $1 to initiate the pumping then later hard post the full amount. Now, I’m am sure there are institutions that go against this law but I try to spread the word that Reg E doesn’t allow that practice.