this post was submitted on 26 Nov 2023

1374 points (94.5% liked)

A Boring Dystopia

10315 readers

1734 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

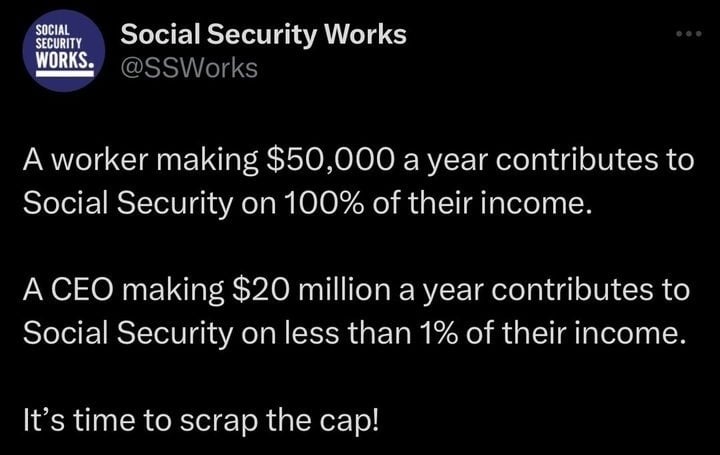

How about OP provides sources to their claim first.

On one hand: fair. If you're not versed in elements of tax law this bit of data can seem arcane.

On the other: this is a matter of policy - not one of research. The definitive answer can be found with relative ease via a Google search. Here's a link to a Social Security Administration page on the topic: https://www.ssa.gov/OACT/COLA/cbb.html

By the math set out at the above link, one can calculate that, at a maximum income of $168,600 and a SS Contribution rate of 6.2%, the most any individual would contribute to social security in a year would be $10,453.20.

$10,453.20 would represent 0.052266% of the income of someone making $20 millions per year. Even doubling that amount (as some conservatives do) to count the employer's contributions to Social Security would leave you with just over 0.1% of net income.

So yeah, even if Social Security isn't going bankrupt, it's an anemic system that barely provides livable circumstances for those who depend on it. Raising or removing that "max income for contributions" limit would go a long way to seeing the system be able to actually support people who need it while only burdening those most able to bear the burden.

Ninjaedit: grammar