this post was submitted on 27 Nov 2023

1101 points (98.8% liked)

Work Reform

10436 readers

536 users here now

A place to discuss positive changes that can make work more equitable, and to vent about current practices. We are NOT against work; we just want the fruits of our labor to be recognized better.

Our Philosophies:

- All workers must be paid a living wage for their labor.

- Income inequality is the main cause of lower living standards.

- Workers must join together and fight back for what is rightfully theirs.

- We must not be divided and conquered. Workers gain the most when they focus on unifying issues.

Our Goals

- Higher wages for underpaid workers.

- Better worker representation, including but not limited to unions.

- Better and fewer working hours.

- Stimulating a massive wave of worker organizing in the United States and beyond.

- Organizing and supporting political causes and campaigns that put workers first.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Compared to zero, yes, but employers can, and I know some that actually do, match up to 100%.

Edit: looks like there are a few that match 200%

Oh I thought it meant they matched 100% up to 10% of your paycheck. That's how my work does it but only up to like 3% and then 50% for another 3%

Say I have a 50% contribution match from my employer. For every $2 I contribute into my 401k my employer will add their own $1.

Some employers will force you to contribute a percentage of your paycheck towards your 401k, others will allow you to contribute up to a percentage of your paycheck, not all employers match though and not at the same rate. I believe my employer allows me to contribute up to 60% of my paycheck if I wanted (until the annual IRS limit is reached) but they will only match 50% of whatever dollar amount I send to the 401k account.

IRS will only let a person add $22,500 in 2023, which means if I max out my contribution my employer will add $11,250 for a total annual contribution of $33,750.

The IRS will only allow me and my employer combined to contribute $66,000 in 2023 to my 401k. I am unable to hit that $66,000 limit because my employer doesn’t match 293% of my contribution.

That's cool that it's uncapped for you. Lots of free money if you can make it work with your budget

I got lucky in certain areas and I try not to forget that.

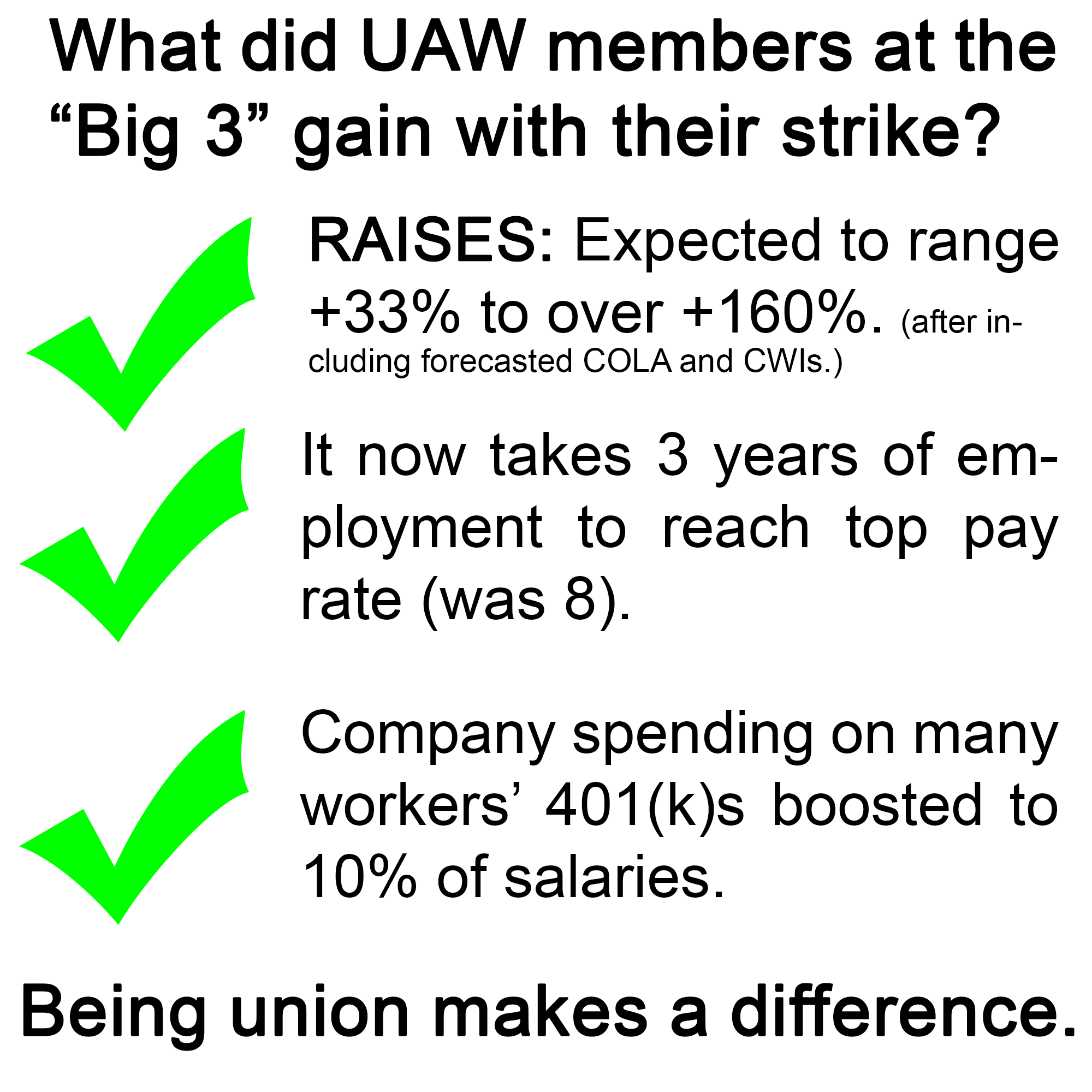

Either way if it’s a contribution match limit or a paycheck limit, it has a green check mark next to it, so it’s gotta be an improvement on where they were. I’m all for bringing everyone up and I’m happy for them.

Amin

Based on what someone else said, this isn't a match but a straight up contribution. So if that is to be believed, it's even better...

From the supplemental agreement regarding the personal savings plan (exhibit G, available at uaw.org/gm2023)

"The Company shall increase its contribution to an Eligible Employee's Account from 6.4% to 10% of each such Employee's Eligible Weekly Earnings with such increase to be implemented by December 31 2023, with contributions made retroactive to October 23, 2023"

Well that’s sure neat. Thanks for clearing that up