this post was submitted on 21 Jul 2023

2124 points (98.9% liked)

Mildly Interesting

17912 readers

16 users here now

This is for strictly mildly interesting material. If it's too interesting, it doesn't belong. If it's not interesting, it doesn't belong.

This is obviously an objective criteria, so the mods are always right. Or maybe mildly right? Ahh.. what do we know?

Just post some stuff and don't spam.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

In the UK tax is deducted 'at source' by your employer for anybody employed. You have a personal tax code, which tells your employer how much tax to deduct and pay on you behalf.

You then have a number of allowances you can claim against if you are eligible, to reduce your tax, which issues you an updated tax code.

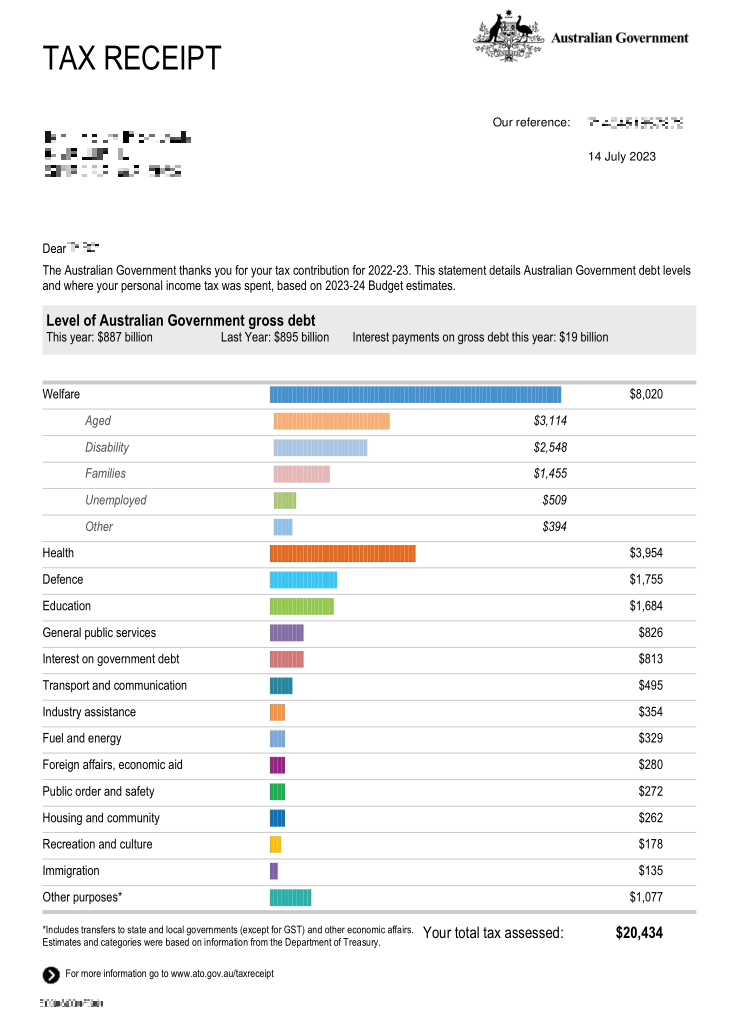

It is a very similar system in Australia. Must employees have their tax taken out when they are paid.

You can then claim deductions on certain things, and also make sure if you have multiple jobs you paid the correct tax.

Most people get some money back every year