this post was submitted on 24 Nov 2024

1119 points (95.5% liked)

Comic Strips

13842 readers

3548 users here now

Comic Strips is a community for those who love comic stories.

The rules are simple:

- The post can be a single image, an image gallery, or a link to a specific comic hosted on another site (the author's website, for instance).

- The comic must be a complete story.

- If it is an external link, it must be to a specific story, not to the root of the site.

- You may post comics from others or your own.

- If you are posting a comic of your own, a maximum of one per week is allowed (I know, your comics are great, but this rule helps avoid spam).

- The comic can be in any language, but if it's not in English, OP must include an English translation in the post's 'body' field (note: you don't need to select a specific language when posting a comic).

- Politeness.

- Adult content is not allowed. This community aims to be fun for people of all ages.

Web of links

- [email protected]: "I use Arch btw"

- [email protected]: memes (you don't say!)

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

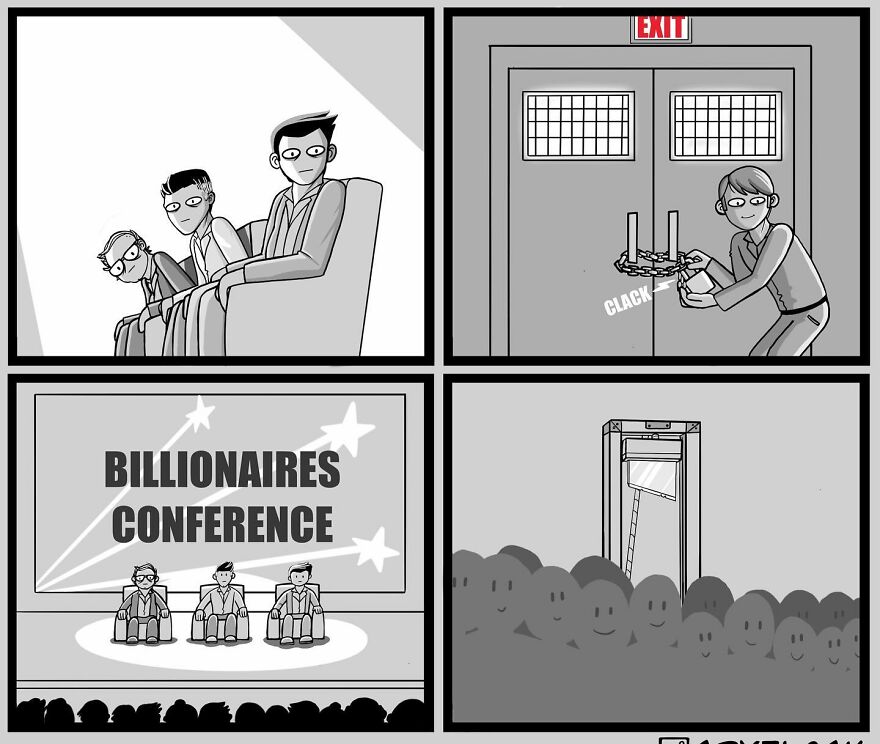

This would be ideal but I'm skeptical that it's actually possible. Bribes are cheaper than taxes, so I think they'd likely just prevent the taxes from happening by greasing the correct palms.

Well yeah, that’s exactly what’s happened for at least the past 50 years. In 1968 corporations were paying 53% of their profits in taxes, and billionaires were paying 94% around that time! Btw, if you’re making billions, paying 94% still leaves you richer than most…

Contrast that to today, where the system is so obviously broken during a time when Amazon is paying less in total taxes than a fry cook at McDonald’s.

It would need to be done with actually no loopholes, and meaningful enforcement of consequences for those who would try to cheat (perhaps the guillotine).

one big issue is everyone goes "you can't tax stocks!" and then billionaires take a loan against the stocks with the unrealized gains as collateral. So we'd need to start classifying a loan as a realized gain of the collateral against this, with an exception for mortgages on primary domiciles, maybe also a "first million dollars are exempt," calculated on the full debt of the borrower, not per loan. I can't imagine anyone taking out more than $1M in debt against a properly they don't live in is not the rich we need to be taxing.

Yeah. Virtually anything with an exception for the first million dollars will both lose almost no tax revenue (as a percentage), and never ever touch the rest of us temporarily embarrassed not-quite-yet-billionaires.

That’s an insightful point, and honestly taxing those loans as realized gains sounds entirely reasonable. It’s good for the lenders because of reduced risk, it’s good for the rich because it keeps them honest, and it’s good for the public because we gain increased tax revenue from those who can most afford it. Nice!

Wait.....by percentage, or by dollar amount?

Mostly by percentage, but I wouldn't be surprised for the other one.

Dollar amount for some markets and some years - big corps do accounting magic and end up net negative, which they can calculate against profits in another fiscal year under some circumstances, paying 0% tax

Don't they already just avoid paying taxes by not having a salary and just using bank loans or something? So they have no actual money in the bank