Repost from beginning of November.

Edit 2023-11-22: I might have missed something. Interestingly, in the new Teddy vol 2 TOYS is shown... might it actually be a trap for shorts?

Thx to wtfeweguys:

End edit.

Original title: Shorts R US - The Geoffrey Files Part 3 - The reports of Geoffreys nearing death might be actually true - Doug Cifu trades “nice” in September, only (a) month(s) in run way, death trigger in place, management with risk free compensation?!

I just went quickly through the annual report of TOYS R US (see https://wcsecure.weblink.com.au/pdf/TOY/02734815.pdf where all further references without additional link are for) and wow... this doesn't look good from a financial perspective. Wow... I have to share what I found.

Please remember, do your own due diligence. I am no financial adviser and this is not financial advice.

TL;DR: This company is borderline (a trap?), Doug Cifu trades “nice” in September, equity lowered by 96% or $32m, 1.7 months in run way (time till out of money) at the time of the annual report, debt increased and shifted to very short term debt, whole management receives mainly risk free compensation.

Topics:

- There is no float, Neo.

- Doug Cifu trades “nice” in September

- More debt, less equity

- Only (a) month(s) in run way (as of annual report)

- So, wen profitable?

- Who owns the debt? A death trigger?

- What about their US comeback?

- Execs with risk free compensation

There is no float, Neo.

Please check back on Part 1 (ppsub) and Part 2 (ppsub) if you haven’t. This also mixed with the info from the annual report that the top 20 holders own 72% of the shares.

(p. 89)

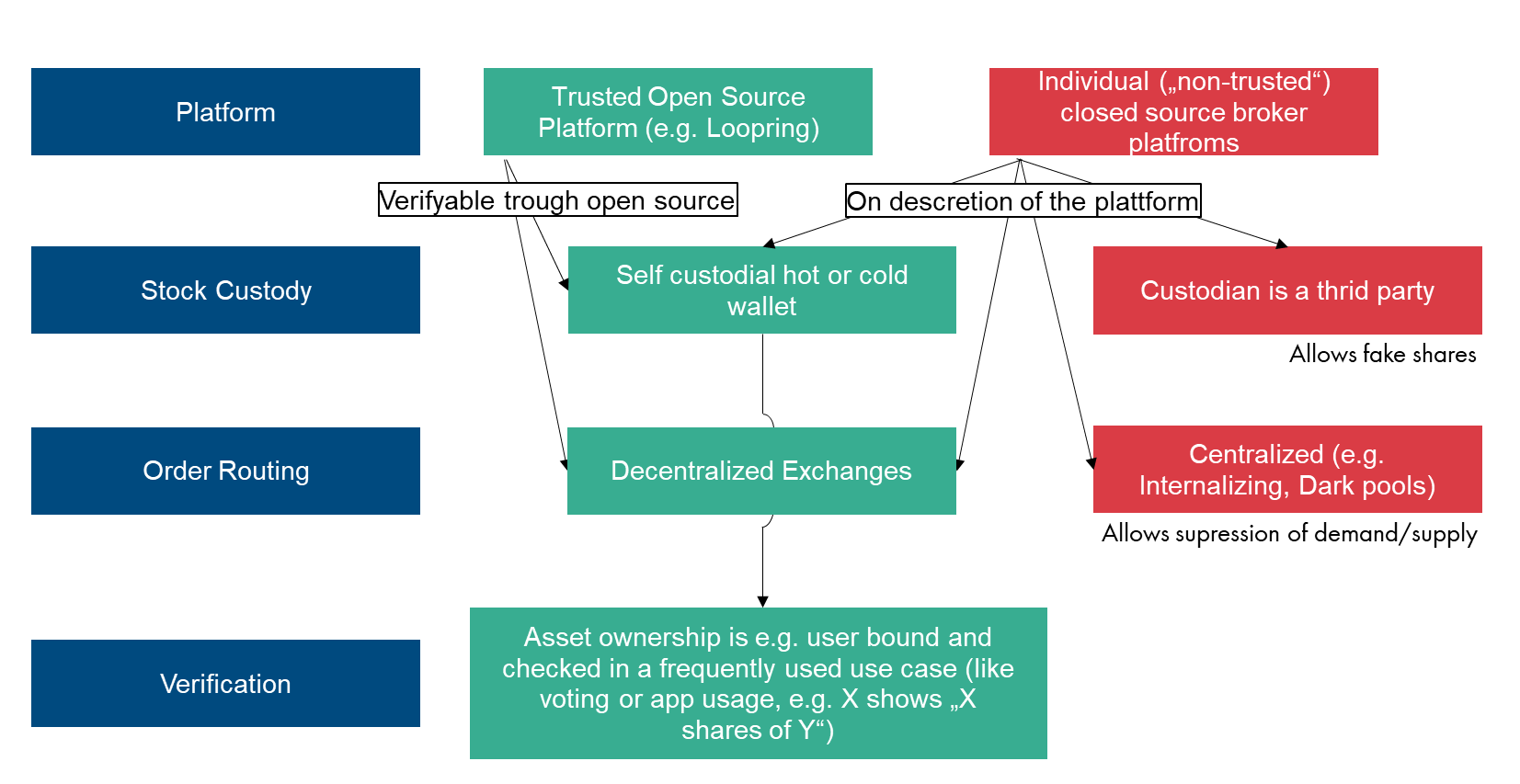

Okay, if this is all a sign of high short interest, is this a bullish sign? We know of certain activist investors that they like leaders to put their money where their mouth is, that risk free compensation probably will not lead to the best outcome for the company. And we know that shorts like to put a company to bankruptcy. So lets shortly go through some parts of the annual report and see how it looks like. Feel free to correct me and point out any important things I missed or got wrong.

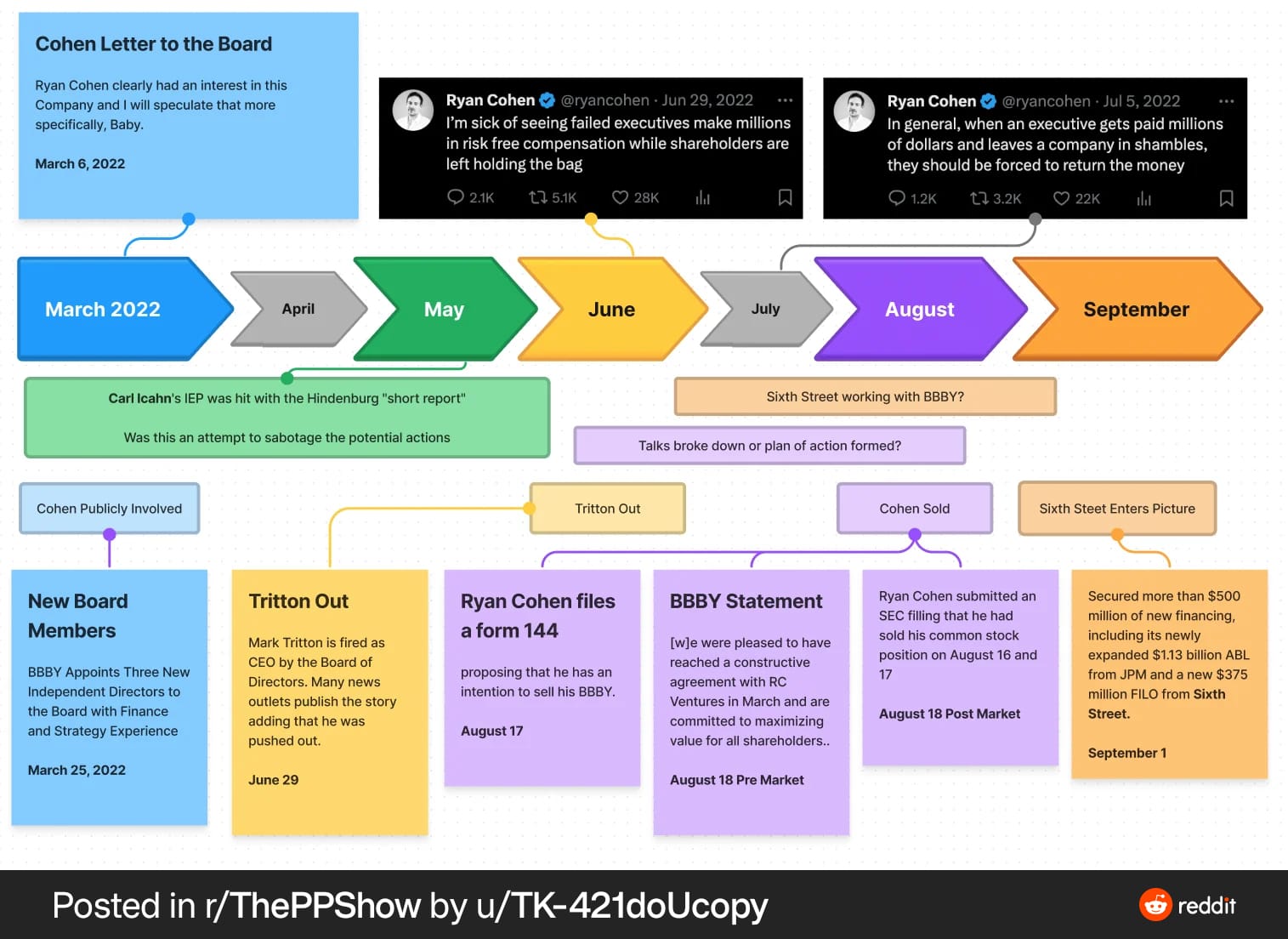

Also is there some way the debt could be turned to something good like supposedly in BBBY with the NOLs?

Doug Cifu trades “nice” in September

Market Statistics - Monthly Share Volume (finra.org)

Why should he do this? Ah, remember his meltdown on X? Maybe it’s rather the same impulse which lead him to do this… maybe not.

More debt, less equity

What blew my mind was on page 6. Leverage blew through the roof. From a moderate debt/equity ratio of 29% to 831% from FY22 to FY23

What did they do?

The balance sheet is a total mess… cash is gone, equity is nearly gone. Their borrowings went up.

(p. 28)

And it widened to $54m in two years.

(p. 29)

(p. 73)

Build up debt, scale down assets… the new key to success?

Also exchanging long term debt for higher interest rate short term debt, right?

(p. 76)

So they surely have massive countermeasures in place, right? They have massive countermeasures in place, right?

Oh nice… so during the course of one year the equity went down 96% or $32m while taking on $15.8m additional debt. Now their plan is to get rid of the UK business which will reduce loss by $6m, which brought in $5.3m. Wtf?

They are loosing roughly $1m/month (while operating activities might be seasonality).

Only (a) month(s) in run way (as of annual report)

So what is the financial runway left? (Total Capital ÷ Monthly Operating Expenses = Runway)

1,766 / (12,465 / 12) = 1.7 months

Wow.

So, wen profitable?

(p. 8)

(p. 2)

Breakeven by 2025? How do they want to survive with such high short-term debt, risk-free compensation and high burn rate?

Who owns the debt? A death trigger?

(p. 9)

(p. 63)

Ah, there is a death trigger.

The lender seems to be TRU Kids Inc (TRUK). See p. 71. If someone wants to dig in.

Losses as an asset?

(p. 63)

What about their US comeback?

In short... no.

(p. 68)

Execs with risk free compensation

(p. 18)

(https://wcsecure.weblink.com.au/pdf/TOY/02688802.pdf)

Edit: as of 17.11. Pen Cox got granted vested 14.5m shares. For a price of $0.011 AUD thats 160k AUD vested over the next years.

Well you could argue that the 40-80% variable Renumeration might be risk based, but there is no clear indication it will be.

There is no huge stock package with vested options and she gets roughly the same base as Matt Furlong got at GME for comparison.

This ends with: I would recommend for everyone to READ THE ANNUAL REPORT (https://wcsecure.weblink.com.au/pdf/TOY/02734815.pdf), dig into the available information.