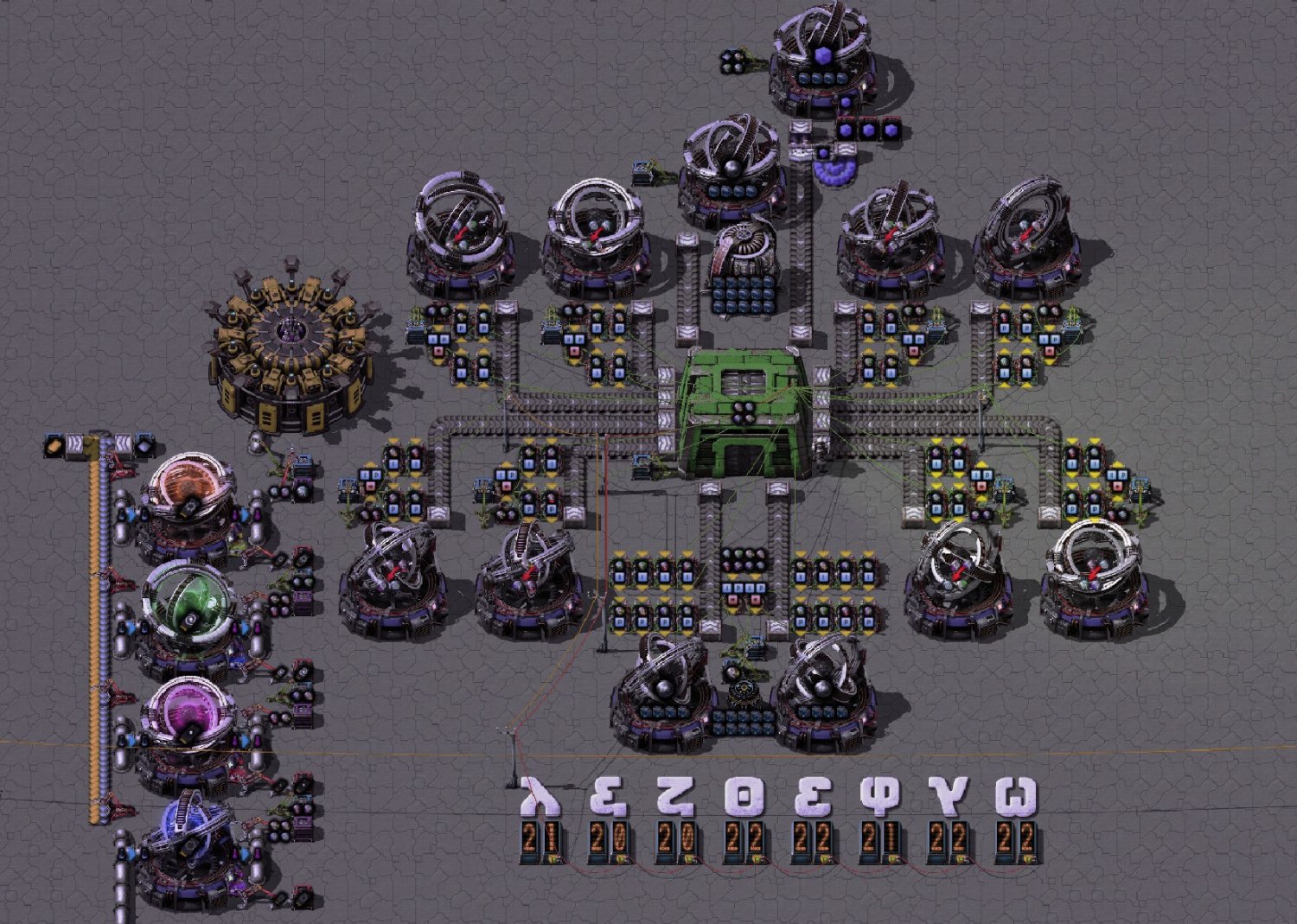

I've just set up arcosphere balancing in my K2SE playthrough.

My set up is relatively simple, though it uses a lot of combinators!

I'm taking the inputs for a recipe as signal I and the products as signal P.

If I > P then I request the inputs for that particular recipe.

I then added a slight tweak to multiply the products by 1.1, so the inputs need to exceed products by 10% before the request comes through.

Initially, it never reached equilibrium and the gravimetrics facilities would keep churning away.

With the extra 10% buffer, it settles down a lot more easily and kicks in only when things start to become more unbalanced.

I've been producing naquium tesseracts and DSS3 data cards for a while now and it seems to be hanging together.

I had a hiccup early on when I ended up really unbalanced due to the length of time bots were in the air with arcospheres leading to the balancing running amok.

My fix for now has been to move DSS3 and tesseracts close to the balancing area, but not sure this is going to be sustainable. Let's see!

That’s dedication. Where are you up to now?