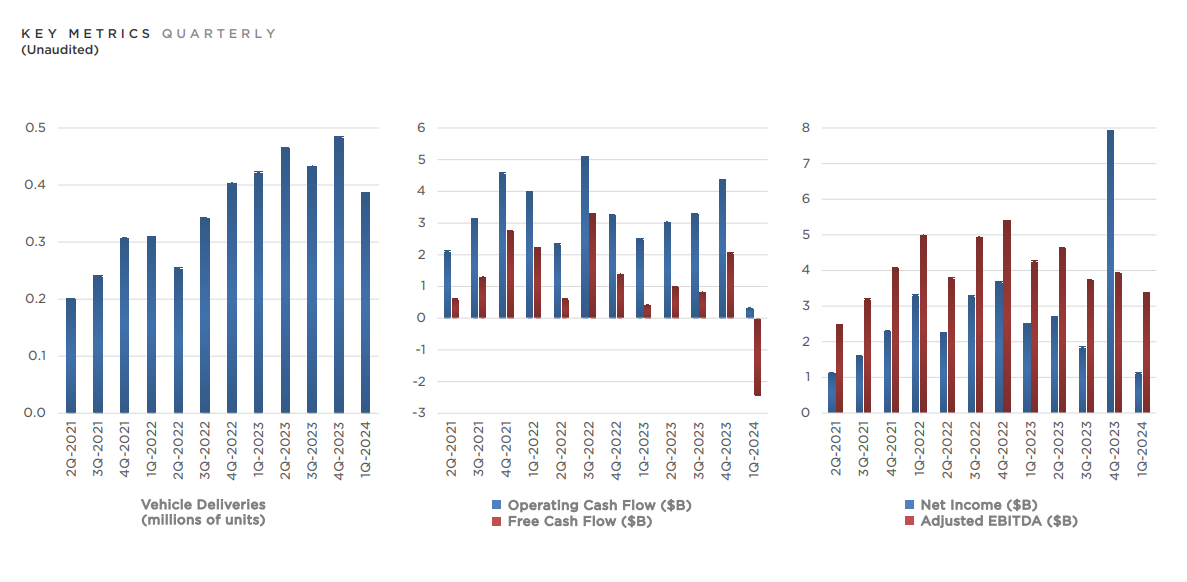

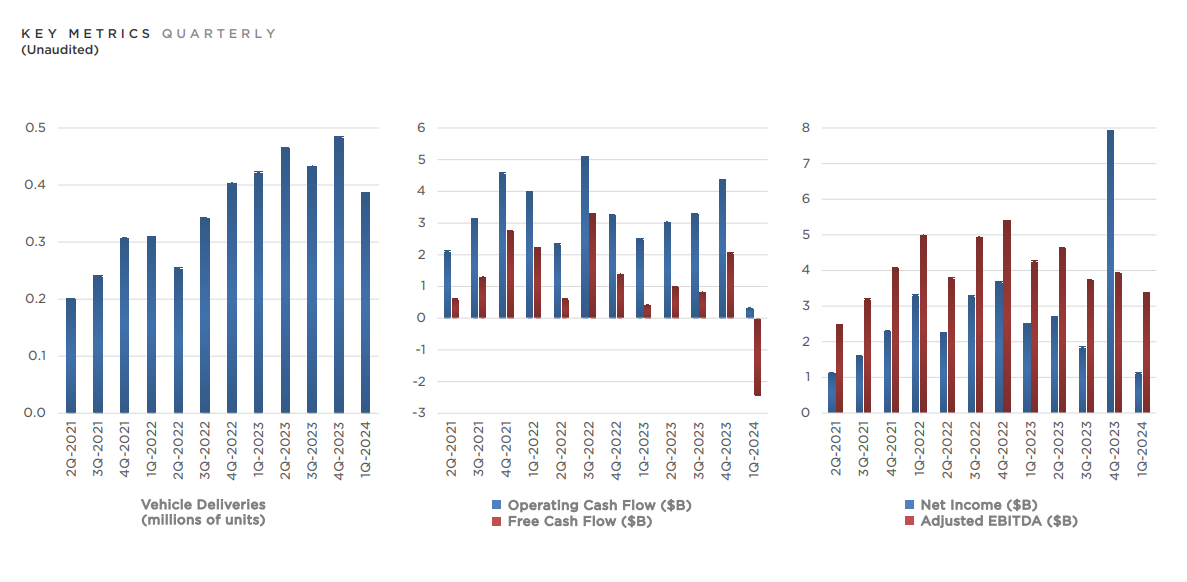

Page 22 shows ~-$2.3 Billion in Free Cash Flow for 1Q 2024. That sounds problematic, but I do admit that I forget what FCF means and I'm using Google to figure out FCF vs other metrics again, lol.

Page 22 shows ~-$2.3 Billion in Free Cash Flow for 1Q 2024. That sounds problematic, but I do admit that I forget what FCF means and I'm using Google to figure out FCF vs other metrics again, lol.

FCF is "spending money". Cash you don't need to spend on rent, paychecks, or capital purchases.

Having it be in the red means you're borrowing money to keep daily operations going. But that could be a result of a very large capital purchase (a big factory, for example), so it's not automatically bad.

The difference between FCF and net income is in capital goods. Net income includes depreciations, so if I wear out one BigMachine every 10 years, my net income will show 1/10th of the machine every year, while my FCF will show a BigMachine sized dip every decade.

FCF dropped by $2.3ish Billion because ~45,000 Teslas were made that couldn't be sold last quarter.

At ~$50,000 per Tesla, that's perfectly in line with the ~$2.3 Billion FCF loss.

Its not a "loss" yet because Tesla likely hasn't written down the vehicle's values yet (accounting for the lower prices they have to go to try and sell these vehicles). As they account for the losses and reduce their production lines, it will lead to worse operating margins, and eventually a net-loss.

But for now, they are building up extra cars and holding them in inventory somewhere. That's cash intensive.

Earnings call is clear that Elon Musk is focused on Optimus, Dojo, and Robotaxis. He seems to more tersely talk about Cybertruck, Model 2, 4680, and other such car news. Just my opinion on that matter though.