this post was submitted on 27 Nov 2023

396 points (98.1% liked)

InsanePeopleFacebook

2748 readers

458 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

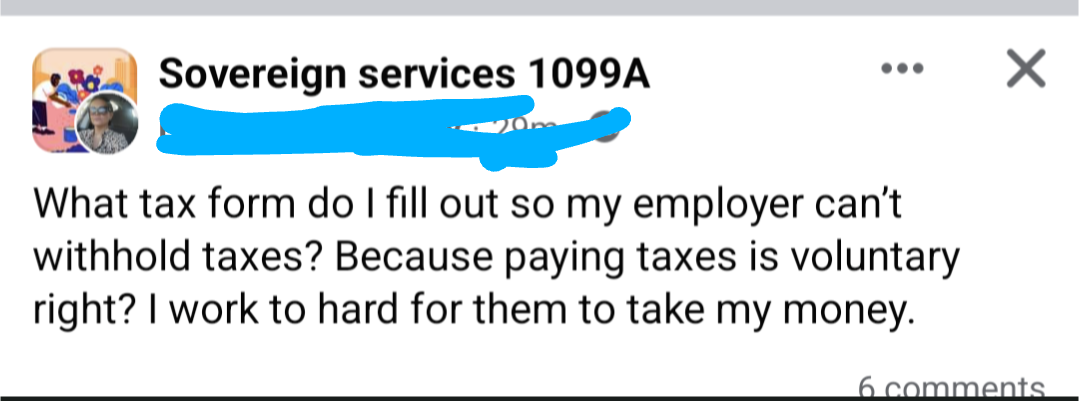

You write exempt in one of the boxes. They've hidden the part where it tells you which one. You can look it up, but its not stated clearly on the form anymore.

But you still have to pay taxes if you owe them, and you have to pay a penalty if they didn't withhold enough. But if you're poor enough you don't owe federal income taxes you can avoid giving the IRS an interest free loan if you file your form properly.

The US learned what happens if taxes are actually voluntary during the days of the articles of confederation. Results were predictable.

https://www.irs.gov/payments/underpayment-of-estimated-tax-by-individuals-penalty

I was looking into this a few years ago and also wondered what if I tried to just pay my taxes at the end of the year. I get why it exists but you gotta love the double standard... wish I could could get interest and penalty pay on any money they owe me over 1k.

Same especially now with high yield accounts at 5%