this post was submitted on 14 Jun 2023

328 points (93.9% liked)

Socialism

5413 readers

2 users here now

Rules TBD.

founded 5 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

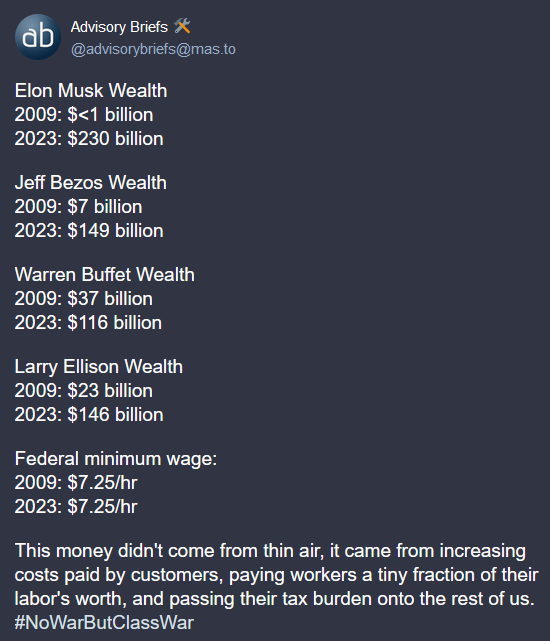

You do a structured sale overtime and those do take place even in the billions of dollars without destroying the value of the stock. Also, they can borrow against the value of the stock, usually for extremely low interest rates, to quickly infuse cash. This argument is nonsense. The best recent example is elon buying Twitter. Yes it hurt tesla stock in the short term but it is almost back to the presale value with little impact on his overall networth. The wealth in stocks is very real.

Edit: The elon case isn't even a good example because he was forced to sell the stock much faster than normal.

Also it's not like most people's wealth (if they even have any) is liquid either. Most is probably tied up in retirement accounts, real estate, or funds for unforseen circumstances that you wouldn't touch for ordinary needs.

Elon buying Twitter is really an outlier to begin with, since otherwise there are basically no single expenses that would require that amount of funds to be liquid.

Especially with the mentioned loans, there really is more than enough liquidity available to buy anything you'd ever want.