this post was submitted on 30 Oct 2024

62 points (95.6% liked)

InsanePeopleFacebook

2694 readers

272 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

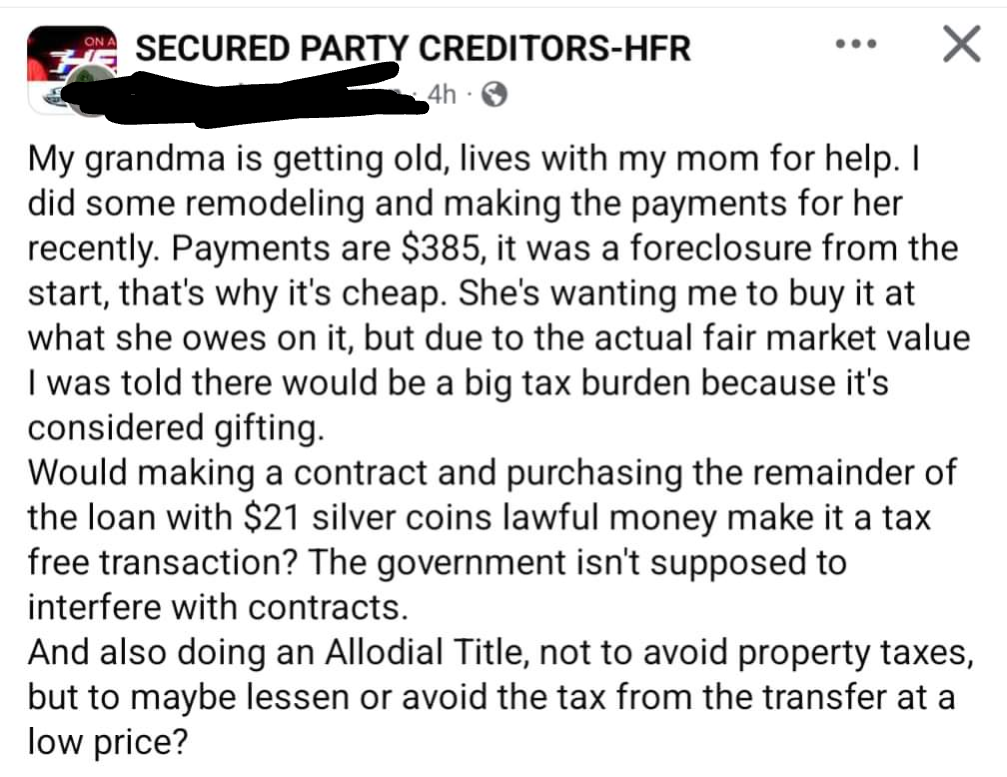

Basically, grandma bought a house, hasn't paid off the loan, and the house is foreclosed. He wants to buy the house (maybe with his Grandma's blessing) for the remainder of the loan amount. Because the "value" of the house, as determined by the market, is much higher than the amount remaining in the loan, he would have to pay taxes for acquiring a "gift" amount of the difference.

It's complicated because it gets into wealth transfer laws, and how taxes work in a particular system.

On one hand, generational wealth is a real problem because it lets the rich get richer down their lineage especially for the ultra wealthy, but on the other, if my parents want to give me a house that they paid for and own, why should the government be able to demand some 20k in taxes for my inheritance?

The funny thing is, the gift wouldn't be taxed anyway. It's certainly valued less than the multi-million-dollar federal lifetime gift tax exemption (and no state has an exemption under 1 million, either)

There's a yearly limit for gifts at $18k in 2024.

True, but anything over that just counts toward estate tax, which has the aforementioned exemptions.