this post was submitted on 10 Jul 2023

8 points (90.0% liked)

Investing

856 readers

2 users here now

A community for discussing investing news.

Rules:

- No bigotry: Including racism, sexism, homophobia, transphobia, or xenophobia. Code of Conduct.

- Be respectful. Everyone should feel welcome here.

- No NSFW content.

- No Ads / Spamming.

- Be thoughtful and helpful: even with ‘stupid’ questions. The world won’t be made better or worse by snarky comments schooling naive newcomers on Lemmy.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

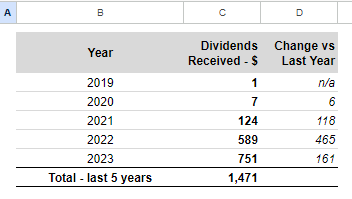

The list of things I've bought and sold is pretty extensive with a good balance of Dividend staple stocks as well as a tiny tiny amount of a few funds. I heavily simplified it in the last year or so and have created a nifty little setup that hits all of my investing itches. It's a simplified 45%, 45%, 5%, 5% that has the entire possibility of going completely to shit on me but also has worked out so far. As it stands right now it's 45% QYLD, 45% TQQQ, 5% SCHD, and 5% O.

It's not for the weak of stomach to say the least. O covers retail real estate while SCHD provides good growth with dividend return. QYLD forms the base so that every month SOMETHING goes in even if my checks were a little short. The TQQQ provides exponential growth. I don't sell to rebalance just buy more of the lower of the four when ever I buy or get my monthly payouts. I cannot stress how much I do not recommend doing this volatile nonsense but damn is it fun to watch 60% portfolio growth YTD.