this post was submitted on 09 Jul 2024

619 points (98.0% liked)

Stolen from Facebook

340 readers

1 users here now

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

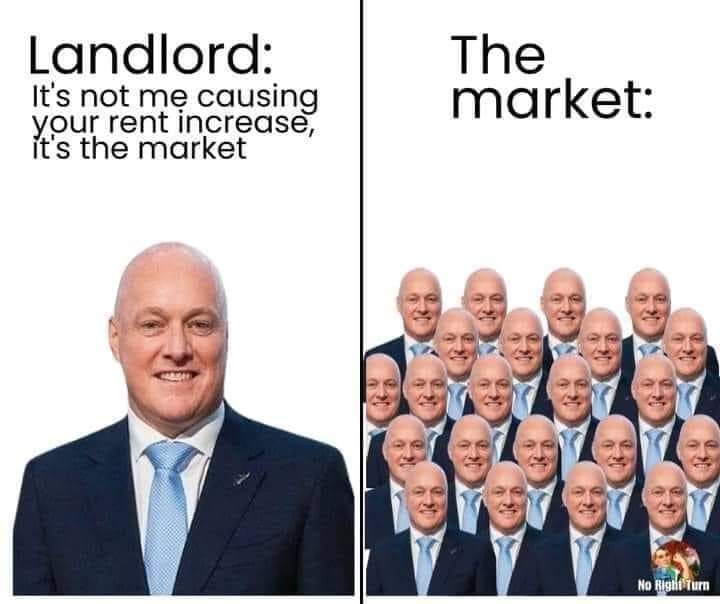

Fuck landlords. There should be a 100% tax on the value of land

What does land mean in this context does it mean property? How am I supposed to be 100% tax on property that does not generate money because it's a house? Is the property value drops then I'm losing money under this scheme.

You would not be taxed on any improvements, only on the value of the land underneath it. Building improvements is a good thing and you shouldn't be punished for that. A 100% tax on land value would make ownership of that land essentially worthless, so you would only be taxed the amount that land could produce in rent.

So if I buy a house that's already been built then I'm not doing improvements to the land am I? I'm simply purchasing property.

But I'm not a rich person it took almost my entire life savings to buy this house why should I not pass it on to my children?

You bring up a valid point, any change that is implemented should have exceptions to avoid screwing ordinary people out of the fruits of their labor that were legitimately invested under the prevailing system. The longer answer is that house itself is an improvement even if you didn't build it and it should not be taxed, and you should be able to pass it on to your children without interference from anyone, but the land underneath it is a different matter. What if the value of the land has increased from $100,000 to $1,000,000 during the time someone owns it, even though they have made no improvements to it? Where does that increase in value come from? It comes from the work of the surrounding community. Is it right for one person to be able to capture a percentage of that? The goal of a land value tax is not to punish anyone, it is only to prevent landowners from either charging rent without adding value or realizing large capital gains, all at the expense of everyone else.

No the idea is that it is very distinct from property. It is just the value of the land. Any "improvement", be it a house, a factory, or an apartment building is untaxed.

For people who don't live on their land right?

For everyone. Why should one generation enrich itself at the expense of the next while producing nothing? Land speculation is purely extractive.

I just want one small parcel of land to live on and not pay rent to a landlord. Why should I be taxed 100% for that?

Because the earth is finite and you having that land means it's denied to everyone else. You shouldn't have to pay rent to a landlord just because his great great grandfather was a Marquis, but you should compensate everyone else for excluding them from something they have as much right to as you do. The idea of the land value tax is not to punish you, but to prevent you from profiting from the work of others that increases the value of your land without you having to do anything. Henry George explained all of this better than I can.

How would this account for people who do put work into increasing the value of their land? If you decide to permanently settle down somewhere, naturally you'd want to make improvements to your home and the surrounding areas to improve your quality of life.

You're right, technically a land value tax should be not on the total value of the land but rather on the unimproved value, so even improvements made to the land itself would still be exempt from taxation.