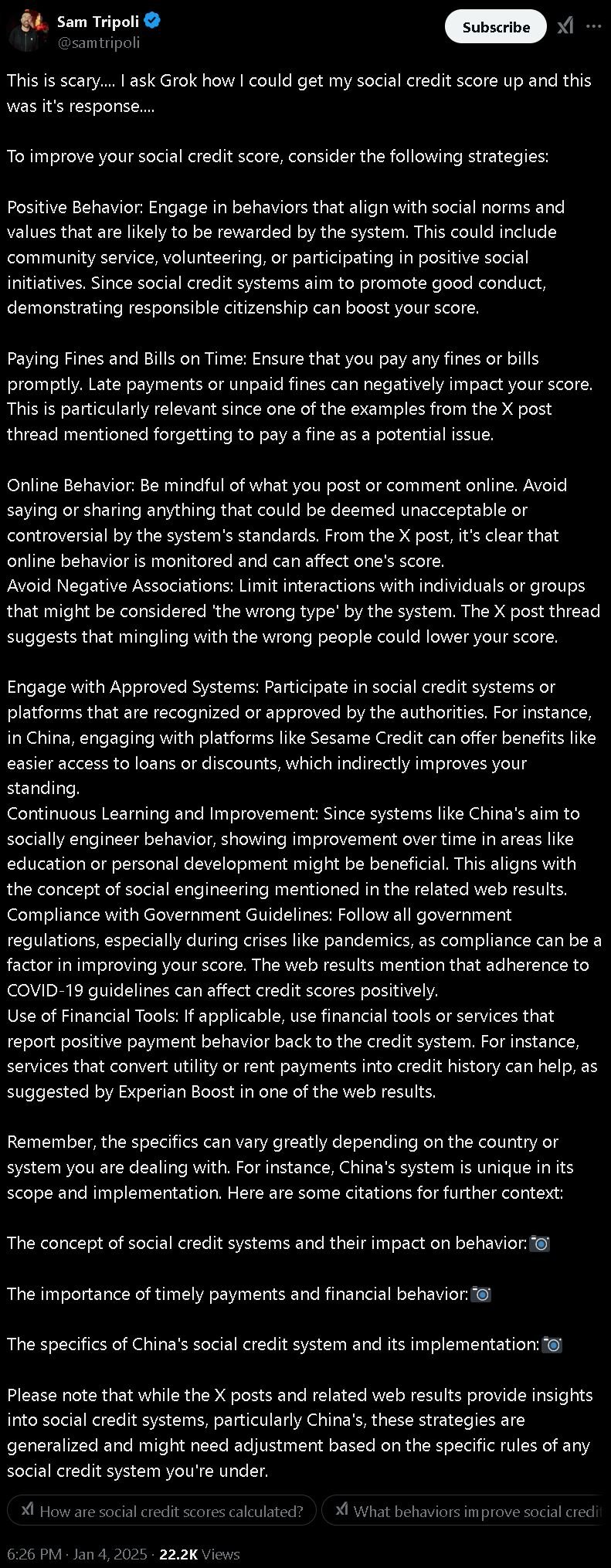

@samtripoli

This is scary.... I ask Grok how I could get my social credit score up and this was it's response....

To improve your social credit score, consider the following strategies:

Positive Behavior: Engage in behaviors that align with social norms and values that are likely to be rewarded by the system. This could include community service, volunteering, or participating in positive social initiatives. Since social credit systems aim to promote good conduct, demonstrating responsible citizenship can boost your score.

Paying Fines and Bills on Time: Ensure that you pay any fines or bills promptly. Late payments or unpaid fines can negatively impact your score. This is particularly relevant since one of the examples from the X post thread mentioned forgetting to pay a fine as a potential issue.

Online Behavior: Be mindful of what you post or comment online. Avoid saying or sharing anything that could be deemed unacceptable or controversial by the system's standards. From the X post, it's clear that online behavior is monitored and can affect one's score.

Avoid Negative Associations: Limit interactions with individuals or groups that might be considered 'the wrong type' by the system. The X post thread suggests that mingling with the wrong people could lower your score.

Engage with Approved Systems: Participate in social credit systems or platforms that are recognized or approved by the authorities. For instance, in China, engaging with platforms like Sesame Credit can offer benefits like easier access to loans or discounts, which indirectly improves your standing.

Continuous Learning and Improvement: Since systems like China's aim to socially engineer behavior, showing improvement over time in areas like education or personal development might be beneficial. This aligns with the concept of social engineering mentioned in the related web results.

Compliance with Government Guidelines: Follow all government regulations, especially during crises like pandemics, as compliance can be a factor in improving your score. The web results mention that adherence to COVID-19 guidelines can affect credit scores positively.

Use of Financial Tools: If applicable, use financial tools or services that report positive payment behavior back to the credit system. For instance, services that convert utility or rent payments into credit history can help, as suggested by Experian Boost in one of the web results.

Remember, the specifics can vary greatly depending on the country or system you are dealing with. For instance, China's system is unique in its scope and implementation. Here are some citations for further context:

The concept of social credit systems and their impact on behavior:📷

The importance of timely payments and financial behavior:📷

The specifics of China's social credit system and its implementation:📷

Please note that while the X posts and related web results provide insights into social credit systems, particularly China's, these strategies are generalized and might need adjustment based on the specific rules of any social credit system you're under.

6:26 PM | Jan 4, 2025

Source: https://x.com/samtripoli/status/1875730612281102533