this post was submitted on 30 Mar 2024

846 points (97.5% liked)

Memes

8267 readers

577 users here now

Post memes here.

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.

An Internet meme or meme, is a cultural item that is spread via the Internet, often through social media platforms. The name is by the concept of memes proposed by Richard Dawkins in 1972. Internet memes can take various forms, such as images, videos, GIFs, and various other viral sensations.

- Wait at least 2 months before reposting

- No explicitly political content (about political figures, political events, elections and so on), [email protected] can be better place for that

- Use NSFW marking accordingly

Laittakaa meemejä tänne.

- Odota ainakin 2 kuukautta ennen meemin postaamista uudelleen

- Ei selkeän poliittista sisältöä (poliitikoista, poliittisista tapahtumista, vaaleista jne) parempi paikka esim. [email protected]

- Merkitse K18-sisältö tarpeen mukaan

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

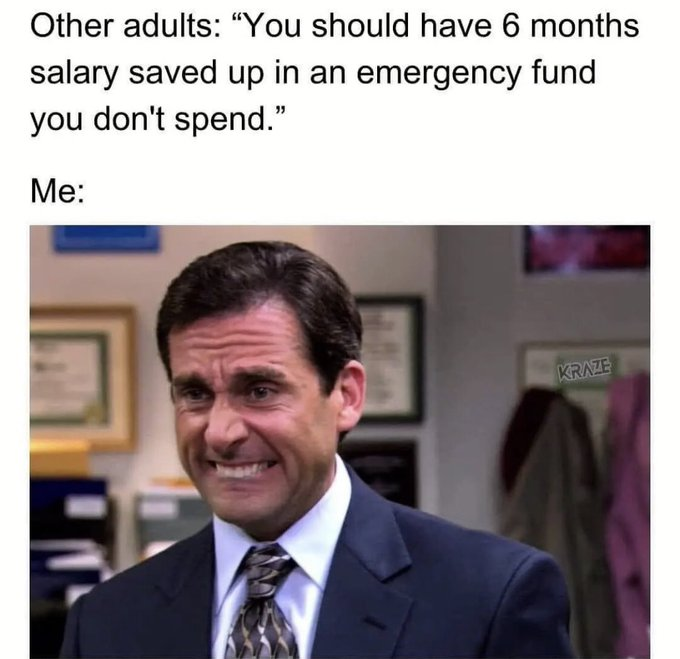

If they're able to and understand that it's important, yeah. If you can't afford to save (ie can't pay basic expenses with money left over for savings), then no.

If you're spending everything you earn, then if you miss a paycheck/get fired you're screwed. If there's nothing you can cut back on to start to save money and there's not a sufficient government safety net - then that's a really dangerous spot to be in.

The first priority when it comes to financial planning is having enough saved so that if you have an unexpected expense or get fired you won't be out on the streets.

There is not a hard and fast rule for how big your emergency fund should be but there are definitely a lot of folks in the personal finance community who have at least 6 months in some type of readily available account that's not tied up in 401k or other investment funds which have early withdrawal penalties.

How much you save comes down to the individuals ability to do so and how much risk they are at if they were to suddenly lose a source of steady income and how much debt they currently have. For people with a lot of ongoing expenses, it'd be smart to try and pad up some safety net so they don't have their life completely fall apart if they somehow lost their job. This also might vary if you are single income or multiple streams for the household.

6 months is probably on the higher side since there's the opportunity cost of not investing surplus money somewhere that could have a higher rate of returns. Usually money that is in emergency funds have lower interest rates as a tradeoff. And if you have upwards of 4 months or more, you can use that time to draw from other accounts for more money if you see that the emergency fund isn't enough.

Good point about opportunity cost of cash savings vs investing - could always put it in a high yield savings account and/or some of it in short term bonds to mitigate that effect. I have about 3/6 mos of my emergency fund in HYS and maybe like 2 more in matured I Bonds (would just be giving up last 3mos interest if I withdrew it and could have the money in less than a week)