this post was submitted on 11 Jan 2024

1115 points (93.3% liked)

memes

10482 readers

5032 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Oh yes, it costs me $7k a year for the pleasure of managing a property, responding to all the tenants needs, the risk of paying for major future repairs, trusting the tenant to pay on time and in full (collections is practically impossible to enforce), dealing with vacancies while I still pay the mortgage, paying real estate agent fees which amounts to a month's rent every time I get a new tenant. And that's all for a house that I am not able to live in, and that I have locked up 20% of the house's value for a down payment. It's much more profitable just to let that money sit in the stock market instead.

But please tell me more about how you know better and that's it's all sunshine and rainbows for a non-corporate landlord.

You get a building that is worth more than you paid for, so that's your payment.

On 25 years, you pay a fifth of the building price for it. And that is not accounting for the equity that the house gains over the years like we've seen during covid.

Here, let me play you the sad song on the smallest violin of the world.

So does every other home owner. That benefit is not for just landlords.

I don't understand the hatred for the risk return of being a landlord. Let's assume you can double your money in the stock market every 7 years.

Compare real estate and stock ownership for 20k (100k house). In the market, 20k becomes 40k in 7 and 80k in 14, 160k in 21, and so on. That's 215 total over 25 years. As long as appreciation is close to 3% it's almost a wash after 25 years. The difference is as a landlord you have the risk of capital expenses requiring you to hold cash and the value of your time to run a rental.

If you want to assume you'll double your money somewhere else, sell up and do it.

The fact is you've borrowed against an asset, the bank took the initial risk on your ability to pay but it's secured against the asset.

The tenant is in a position they pay more per month than your mortgage payment simply based on a deposit around 20% of the property value.

You get to take on 20% of the risk of buying a house, the bank 80% of the risk, and the tenant pays you both for it.

I'm going to assume the average landlord, just as you assume average returns. Sod all work and maintenance done, no time spent. A property initially bought in good condition coasting on for 10 years with little input required.

Then sold on at a profit after the tenant has paid rent, paid into the landlords mortgage and their equity. Just before the rental value starts to reflect poor condition.

It's bought by a house flipper in poor cosmetic condition, tenants kicked out, renovations done to the lowest standard to last about 10 years. House sold on for a small additional premium as ready to rent to a buy to let landlord.

I really hope the buy to let landlords end up at a wash or worse. The tenant pays into equity, the house flipper adds value by actually working on the property.

The landlord in between just acts as an easy risk for the bank to charge their interest against while taking the tenants money. The bank makes a healthy profit and the landlord gets a cut of the tenants earnings too, simply for reducing the banks net risk to near zero by putting in their 20%.

Without the landlords banks would have to lend to the tenant directly or not at all. The lower number of actual buyers would lower the price, so they'd actually probably end up lending the same amount against the asset. But they'd have to do more work to ensure the value of the property.

Economically a passive landlord's main function is to assess value and bet on the right property for the bank. Without landlords the postcode algorithm would be all that's left as home owners tend to overvalue their potential home. And it's not enough information.

Landlords could be replaced by banks employing decent surveyors allowing them to offer that 100% mortgage without crashing the market. But they don't because landlords give them an out.

If, in the current system, real estate investment wasn't profitable, no company or landlord would buy to let.

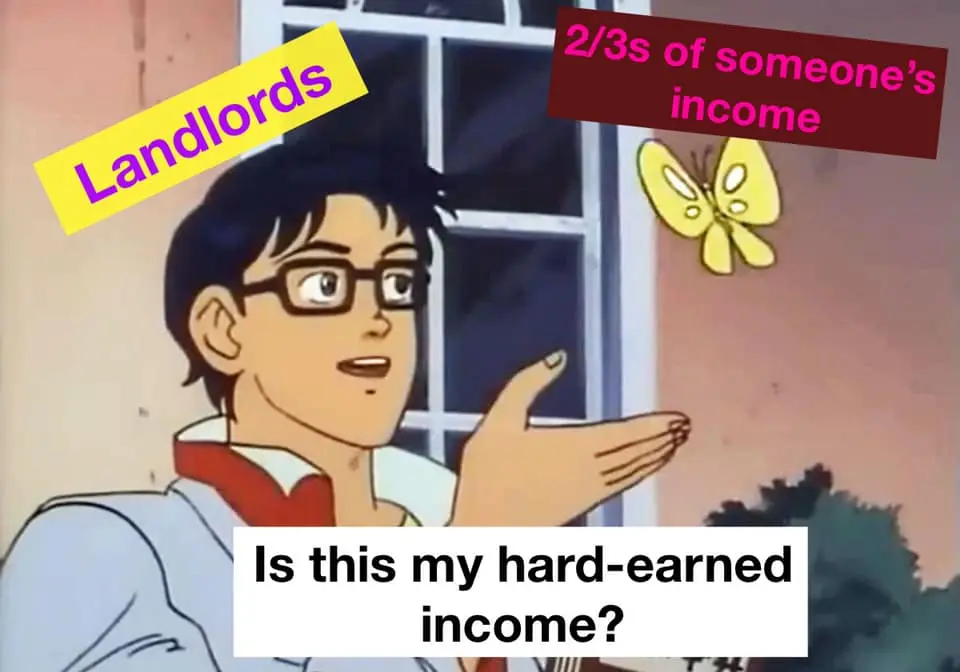

The problem is that there is a housing crisis right now where rent is through the roof, buying is out of reach for a big chunk of the population and its getting worse.

The commodification of housing fucked us over.

And then, you have people like the OP I was replying to, that whines because he has to pay the fifth of the value of the building, while the tenant pays his mortgage+ taxes minus 100$ and then get pissy when he gets called out.

Again, the saddest song in the world with the smallest.of.the violin.

So why don't you? What motivates you to not take that money to the stock market or start a business, if it's oh so hard being a landlord?

The risk of being a landlord is exactly why I don't do it, and invest elsewhere.

Myself, I don't. Being a landlord has quite a bit of risk from awful tenants as well as quite a bit of effort to make it work well. I have a job, don't want another, and don't want the additional risk; my investments are thus elsewhere.

For us, it's because work required that we temporarily relocate. But we plan to move back in a couple years and we really like our house.

For others it usually has to do with the fact that selling a home costs 10% of the home's value after all fees are accounted for.

Then there is the other set of people who genuinely think the equity in a property is more lucrative than money in the stock market (depending on the market and timing, it could be, but it's ultimately a bet).

But I could ask the same question of every single person bemoaning the existence of landlords. If it's oh so easy to be a landlord, why don't they just become a landlord?

Probably because they don't have the capital necessary to become a landlord in the first place. If you have enough money, being a landlord requires literally no work at all.

I guess getting that initial capital required no work at all either.

Why don't they just get that initial capital if it's so easy.

Unless someone was born with money, the argument against non-corporate landlords (97.5% of single family homes are owned by non-institutional investors) is nonsensical, because those owners had to work for the initial capital.

At the end of the day they're still using that capital to exploit people by being landlords. Even if they earned that initial capital through hard work, the moment they invest some of it into a down payment on a house and begin to extract profit/equity via someone else's labor, it becomes exploitation.

For single family homes, I disagree. Property management is around 10% and you're not going to build wealth quickly by giving that much off the top if you only operate a couple rentals.

"If you're homeless, just buy yourself a home"

Sounds like you should sell that house, dude...